Bulls dominate PSX as it closes at new high

Since the start of the new fiscal year, the Pakistan stock market has jumped by 13.8%

Haris Zamir

Business Editor

Experience of almost 33 years where started the journey of financial journalism from Business Recorder in 1992. From 2006 onwards attached with Television Media worked at Sun Tv, Dawn Tv, Geo Tv and Dunya Tv. During the period also worked as a stringer for Bloomberg for seven years and Dow Jones for five years. Also wrote articles for several highly acclaimed periodicals like the Newsline, Pakistan Gulf Economist and Money Matters (The News publications)

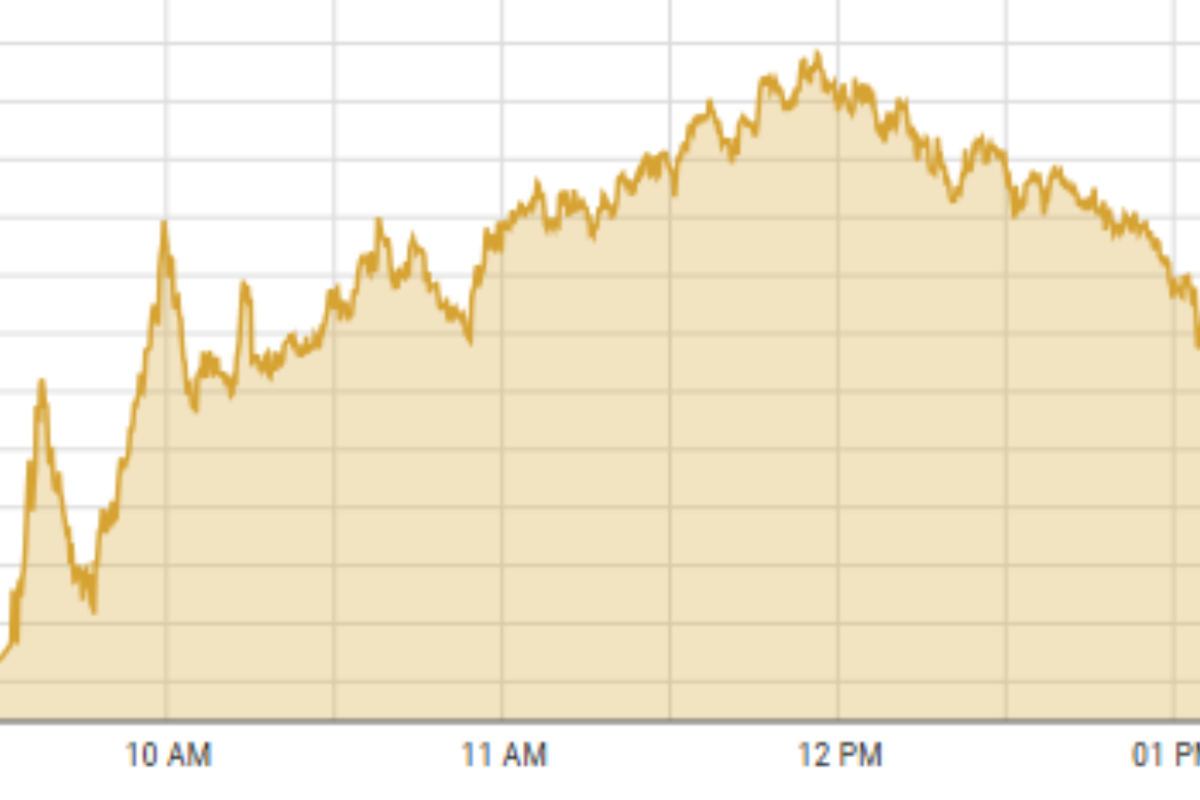

A snapshot of trading activity at the Pakistan Stock Exchange on Tuesday

PSX website

The Pakistan Stock Exchange achieved a new milestone on Tuesday, closing over the 143,000-points mark for the first time due to positive sentiment driven by improving economic indicators that led to investors hunting for high dividend-paying companies.

The benchmark KSE-100 index rose by 984 points or 0.7% to close at 143,037 points, the highest-ever level so far. Since the start of the new fiscal year, the index has jumped by 13.8%.

The market capitalization in terms of rupees has gone up by 10.6% or PKR 1,637 billion to reach PKR 17,109 billion. In dollar terms, the share value has risen by 11% to $60.5 billion.

Shahryar Butt, portfolio manager at Darson Securities, stated that the market has experienced a surge in liquidity, fuelling a bullish rally following a tweet by U.S. President Donald Trump indicating a reduction in tariffs—from 29% to 19%—and expressing interest in exploring opportunities in Pakistan's oil sector.

He noted that mutual funds and insurance companies have emerged as net buyers of domestic equities over the past few sessions, further supporting the market's upward momentum.

"Investors are actively rotating their positions," Butt said. "After realizing capital gains in the oil and gas sector, many have now shifted their focus to the fertilizer sector. Notably, gains in Fauji Fertilizer alone contributed over 200 points to the index."

According to an analyst from Topline Securities, investor confidence remained buoyant, fuelled by robust local and foreign inflows and broad-based sectoral rallies.

The sentiment further strengthened as Pakistan reported a nine-year low fiscal deficit of 5.38% in FY25, with 36% year-on-year revenue growth outpacing an 18% rise in expenditures, beating both the government and IMF's 5.6% GDP deficit forecast.

The market's upward trajectory reflects optimism over fiscal discipline, macroeconomic stability, and a stronger earnings outlook, setting the stage for sustained momentum in the sessions ahead.

Ali Nawaz, CEO Chase Securities, said that the KSE-100 gained momentum on the back of strong performance in the cement sector.

"Investor sentiment was buoyed by higher cement dispatches and optimism around upcoming corporate results, particularly in cyclical sectors," he said. "Improved expectations of earnings growth and continued macroeconomic stability contributed to broad-based buying, with volumes also trending higher. The index continues to reflect growing investor confidence amid signs of recovery in domestic demand," Nawaz said.

Major positive contributors included FFC, UBL, MCB, HUBC, and EFERT, which collectively added 679 points to the index. On the downside, PPL, BAHL, and HBL together shaved off 142 points.

Comments

See what people are discussing