Videos

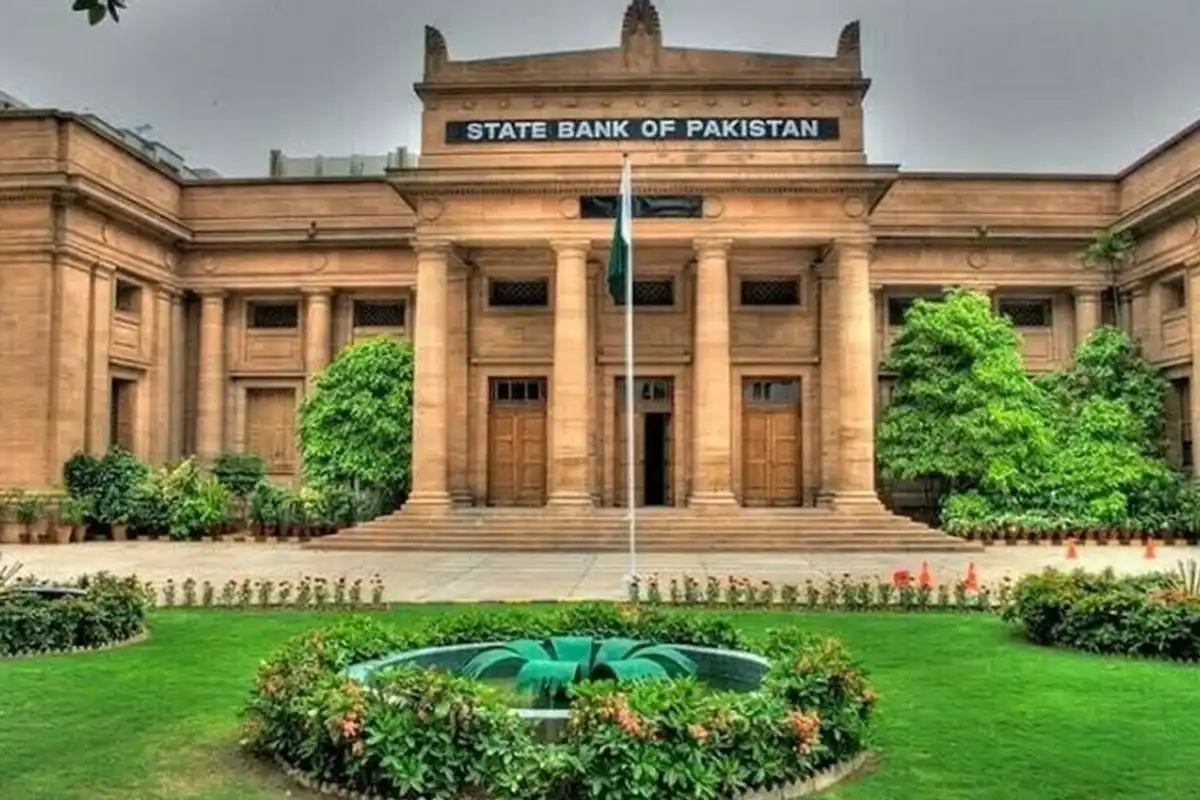

Islamic investing in focus: Expert explains returns, risks and market shifts

As Pakistan moves toward Islamic banking, an expert explains how Shariah-compliant funds, Sukuk yields and the KMI-All Share Index compare with conventional investments and what the shift means for individual investors

Feb 23, 2026

Feb 23, 2026