Neem secures up to $4 million credit line from HBL to expand earned wage access in Pakistan

Strategic partnership aims to boost financial dignity and resilience for Pakistan’s salaried workforce

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

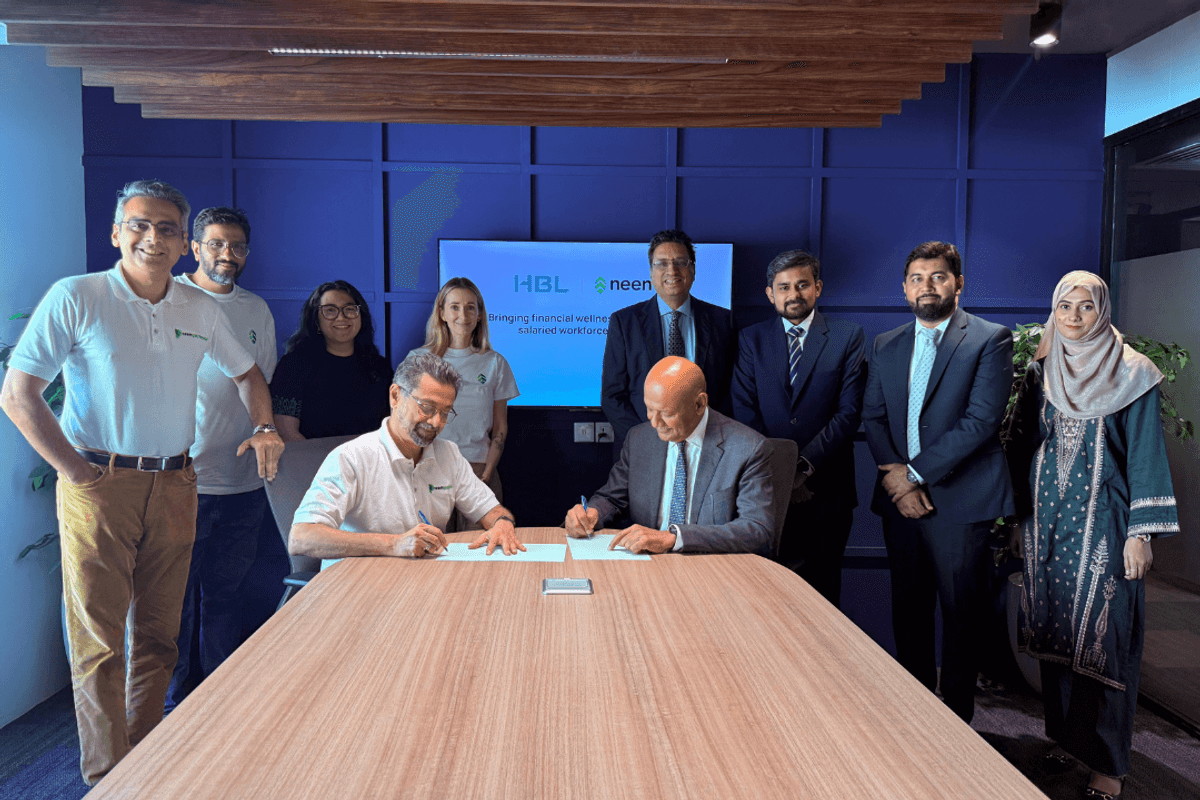

Officials from Neem and HBL sign the credit facility agreement

Neem

Neem, Pakistan’s leading embedded finance platform, has secured a credit facility of up to $4 million from HBL, Pakistan’s leading bank, beginning with an initial drawdown of PKR 100 million to expand its Shariah-compliant earned wage access (EWA) solution, Neem Paymenow. The move marks a strategic partnership aimed at advancing financial dignity and wellness for salaried Pakistanis, according to a press release issued by Neem on Tuesday.

The credit line, structured exclusively for employee wage advances, will help Neem scale access to on-demand salaries for thousands of employees across sectors such as retail, healthcare, logistics, and manufacturing, without the burden of hidden fees or debt traps.

“We are witnessing a fundamental shift in how Pakistan’s financial institutions view employee wellbeing,” said Naeem Zamindar, co-founder of Neem. “HBL’s backing validates our belief that financial wellness isn’t a luxury—it’s a necessity. We are not just advancing salaries; we are advancing dignity, stability, and hope for hardworking Pakistanis.”

“Our partnership with Neem underscores our belief in responsible fintech that empowers salaried individuals with dignified, Shariah-compliant access to their earned income,” said Faisal N. Lalani, group head financial institutions & member executive committee at HBL.

In a country where over 60 million people rely on fixed pay cycles, rising living costs and shrinking real incomes have made financial resilience increasingly difficult. Even small shocks—such as utility bills or medical emergencies—can drive households into financial distress. Neem Paymenow offers a transparent and timely alternative, allowing users to access already-earned wages without turning to loans or credit, the press release stated

Beyond early salary access, the platform also features in-app tools to promote long-term financial wellbeing. These include nudges for budgeting, saving, and building resilience, supporting everyday needs like rent, groceries, and bills while fostering financial control.

Comments

See what people are discussing