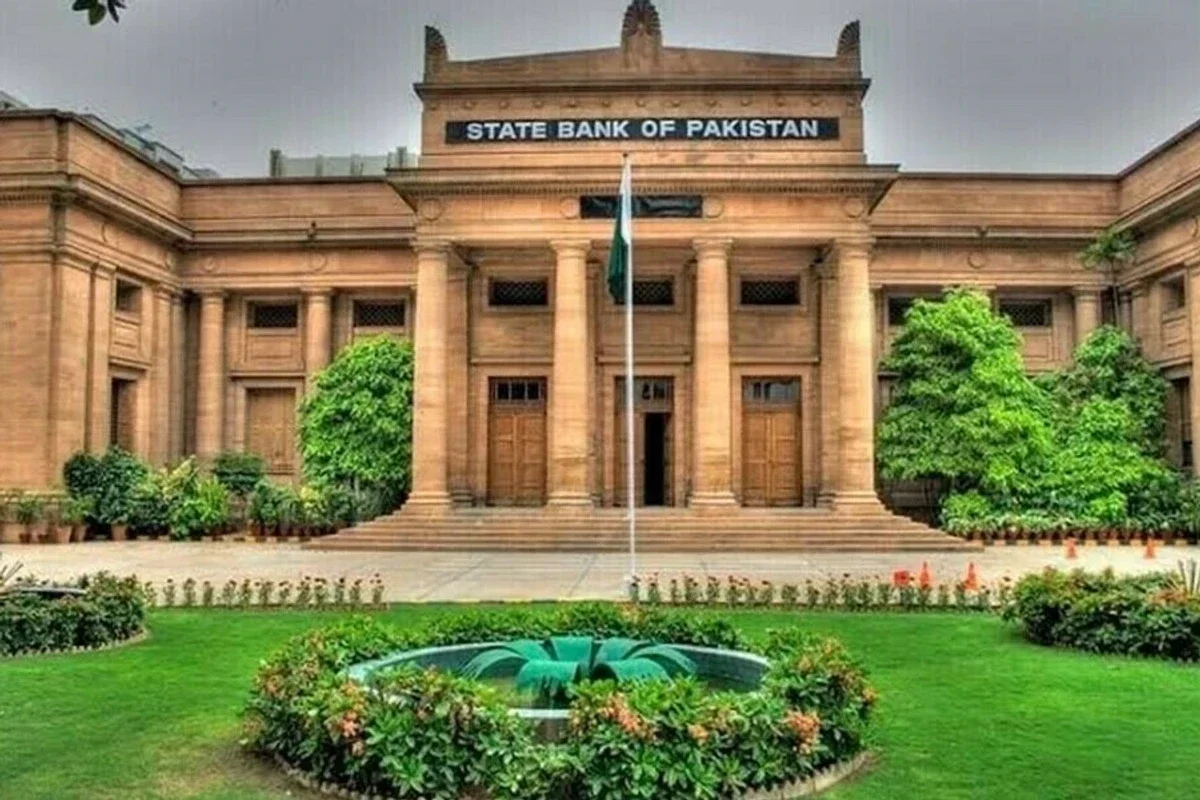

What are CDMs and why does SBP want banks to deploy them?

By 2028, at least 25% of each bank’s branch network must be equipped with CDMs, according to a circular issued by the State Bank of Pakistan

Haris Zamir

Business Editor

Experience of almost 33 years where started the journey of financial journalism from Business Recorder in 1992. From 2006 onwards attached with Television Media worked at Sun Tv, Dawn Tv, Geo Tv and Dunya Tv. During the period also worked as a stringer for Bloomberg for seven years and Dow Jones for five years. Also wrote articles for several highly acclaimed periodicals like the Newsline, Pakistan Gulf Economist and Money Matters (The News publications)

In a move to promote digital convenience and reduce reliance on over-the-counter transactions, the State Bank of Pakistan (SBP) has directed all commercial banks and microfinance banks (MFBs) to expand the deployment of Cash Deposit Machines (CDMs) across the country.

By 2028, at least 25% of each bank’s branch network must be equipped with CDMs, according to a circular issued by the SBP on Friday.

What are CDMs?

Cash Deposit Machines (CDMs) are self-service banking terminals that allow customers to deposit cash directly into their bank accounts without needing to interact with branch staff. Once a customer inserts the cash into the machine, the amount is instantly credited to the designated account, making the process fast, efficient, and available beyond regular banking hours.

These machines are increasingly seen as a vital part of digital banking infrastructure, particularly in high-cash demand areas and branches with large customer footfall.

Regulatory framework and requirements

Referring to PSD Circular No. 1 of 2021, the SBP reiterated its encouragement to banks and MFBs to roll out CDMs at high-traffic locations. The latest directive requires banks to submit a detailed implementation plan to the Payment Systems Policy & Oversight Department (PSP&OD) by November 30, outlining a year-wise deployment strategy to meet the 25% target.

Banks may choose from CDM and Cash Recycling Machine (CRM) models listed on the SBP website, or procure other machines. However, any new models not already approved by the central bank must undergo testing and clearance by the SBP Banking Services Corporation (BSC) in Karachi, as per FD Circular Letter No. 6 of 2023, under the SBP’s Currency Management Strategy.

Key Operational Mandates

To ensure secure and efficient operation of CDMs, the SBP has also outlined strict compliance and service standards:

- Instant credit: Deposited cash must be credited to the beneficiary’s account immediately.

- Biometric verification: Required for third-party transactions; customers may use biometric or debit/credit card authentication.

- Dispute resolution: Customer complaints related to CDM transactions must be resolved within three working days.

- Surveillance and safety: CDMs must be equipped with CCTV monitoring, and footage should be retained for a minimum of 60 days, or longer in case of unresolved disputes.

- Customer experience: Banks must ensure proper lighting, safety, privacy, and overall usability at CDM sites.

- Fee transparency: Any service fees must be clearly displayed on-screen before the transaction is finalized.

The SBP said this initiative is part of its broader goal to enhance financial inclusion and reduce pressure on physical branches, especially as digital banking adoption continues to rise. By making cash deposit services more accessible, faster, and available around the clock, the central bank aims to modernize Pakistan’s banking landscape and improve service delivery for millions of customers.Banks that fail to comply with the outlined targets and operational standards may face regulatory scrutiny, officials added.

Comments

See what people are discussing