Pakistan Stock Exchange outperforms global peers over the past decade

Earnings of KSE-100 companies have shown a compound annual growth rate (CAGR) of 9.2% in USD terms

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

Over the past 10 years, the earnings of KSE-100 companies have shown a compound annual growth rate (CAGR) of 9.2% in USD terms

Shutterstock

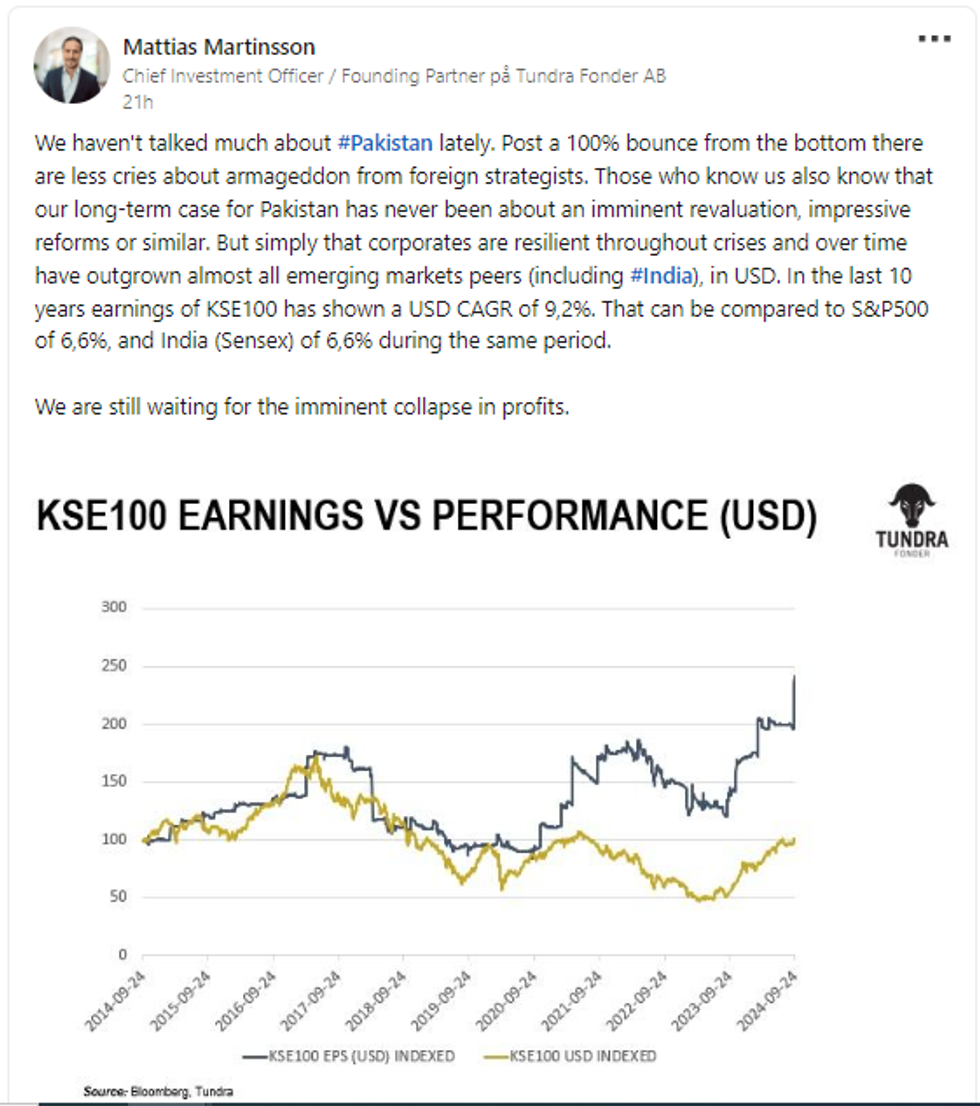

Pakistan Stock Exchange (PSX) has outperformed major global indices in USD terms over the past decade. Its benchmark KSE-100 index, representing the top companies in Pakistan, has shown superior earnings growth compared to the USA's S&P 500 and India's Bombay Stock Market Index.

Mattias Martinsson, founder of the foreign investment company Tundra Fonder, highlighted this achievement in a recent LinkedIn post. Martinsson, whose company has millions of dollars invested in Pakistan, pointed out that following a 100% rebound from market lows, there is now less pessimism from foreign strategists.

He emphasized that Tundra Fonder's long-term investment strategy in Pakistan has never relied on imminent revaluation or impressive reforms. Instead, it is based on the resilience of Pakistani corporates, which have consistently outperformed their emerging market peers, including India, in dollar terms.

Over the past 10 years, the earnings of KSE-100 companies have shown a compound annual growth rate (CAGR) of 9.2% in USD terms. This compares favorably to the S&P 500 and India's Sensex, both of which posted a CAGR of 6.6% during the same period.

In fiscal year 2023-24 (FY24), KSE-100 companies reported their highest-ever earnings of PKR 1.7 trillion, a 25% increase from PKR 1.3tr in FY23. In USD terms, profit after tax rose by 10% to $5.8 billion in FY24.This impressive growth was driven primarily by the banking sector, which saw a 35% increase, the fertilizer sector with a 75% rise, and the cement sector, which grew by 38% in FY24.

Additionally, KSE-100 companies announced cash dividends totaling PKR 666bn in FY24, a 30% increase from PKR 512bn in FY23. This translates to a 40% dividend payout ratio in FY24, up from 39% in FY23.

The exploration and production (E&P) sector's payout ratio increased to 27% in FY24 from 21% in FY23, thanks to improved cash recovery due to higher gas prices. The banking sector's payout ratio also rose from 42% in FY23 to 47% in FY24, driven by record profitability.

The banking sector remained the largest contributor to dividends, announcing PKR 278bn in FY24, followed by the E&P sector with PKR 118bn and the fertilizer sector with PKR 90bn.

Comments

See what people are discussing