Pakistan stock market declines amid budget uncertainty and rupee instability

Investors remains cautious as fiscal uncertainty and falling oil prices weigh on trading

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

KSE-100 index shed 0.65%

PSX

The Pakistan Stock Exchange (PSX) ended in the red Thursday as investors grappled with uncertainty surrounding the federal budget for fiscal year 2026 and potential new tax measures tied to an ongoing International Monetary Fund (IMF) program.

Ahsan Mehanti of Arif Habib Corp said the market remained under pressure ahead of the budget announcement, with investor sentiment shaken by proposed tax reforms impacting the oil, fertilizer and auto sectors. “Security unrest, escalating tensions with India and rupee instability played a catalyst role in the bearish close,” Mehanti said.

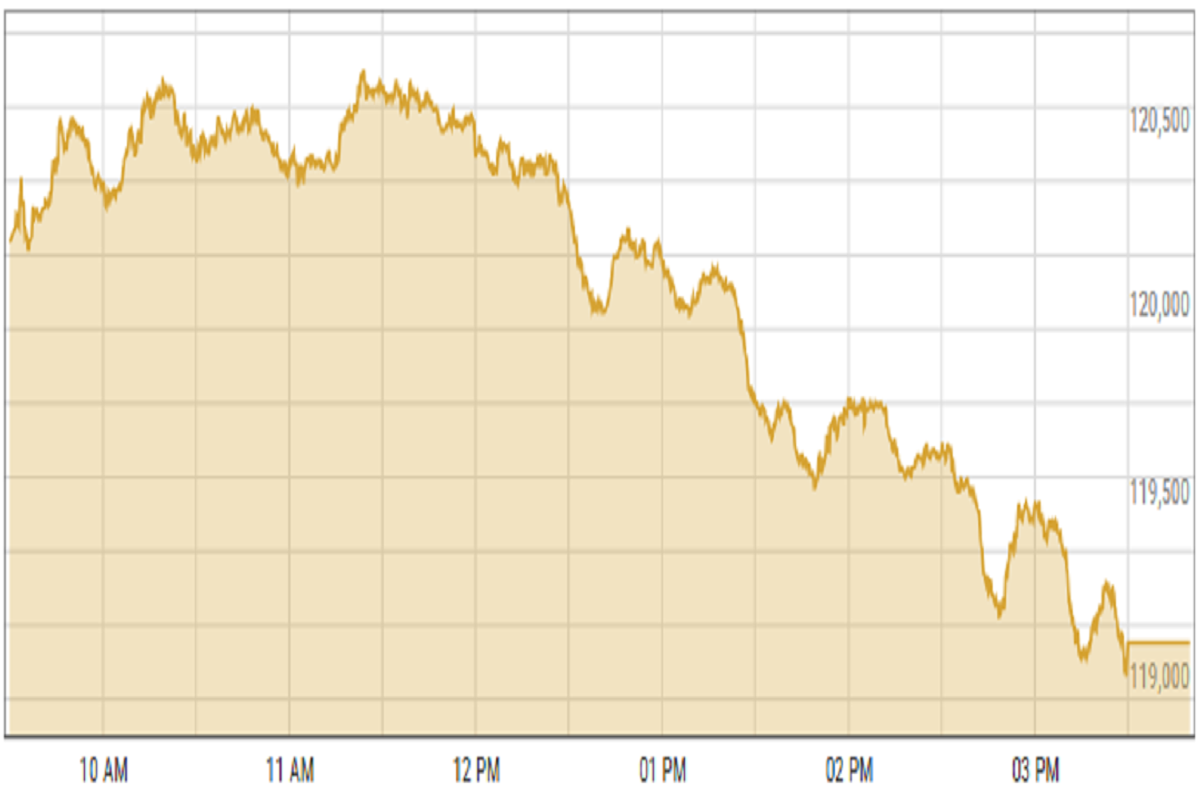

The benchmark KSE-100 index experienced volatility throughout the trading session, ultimately closing lower. Analysts at Ismail Iqbal Securities noted that investors engaged in portfolio adjustments as concerns over fiscal measures kept sentiment mixed. “Investors remained cautious and engaged in portfolio adjustments ahead of the FY26 budget,” an analyst said.

Meanwhile, Topline Securities analysts observed that the market stayed in consolidation mode, with the index fluctuating within a limited range. The downturn was primarily attributed to declining global oil prices, which weighed heavily on oil-related stocks.

The cement, oil and gas exploration, and banking sectors suffered the most losses in Thursday’s session, collectively dragging the index down by 528 points.

KSE-100 index shed 0.65% or 778.41 points to close at 119,153.04 points.

Currency

US dollar steadied against PKR in the inter-bank market. Pakistani currency shed 09 paisas to close at 282.06. In the open market USD was trading at PKR 283.8.

Indian Stocks

Indian stock markets dropped on Thursday, following the decline in U.S. markets due to weak economic sentiment.

Analysts say that, despite improvements in India's business activity and financial conditions in May, uncertainty around U.S.-India trade talks and ongoing global market instability could keep Indian stocks steady but not rising anytime soon.

BSE-100 index shed 0.71% or 184.93 points to close at 25,795.88 points.

DFM General Index gained 0.26% or 14.34 points to close at 5,452.76 points.

Crude Oil

Oil prices fell over 1% on Thursday after a report suggested OPEC+ might boost production in July. This raised worries that global supply could outpace demand.

OPEC+, a group of oil-producing nations, is reportedly considering increasing output at their June 1 meeting. One possible option is raising production by 411,000 barrels per day in July, but no final decision has been made yet.

Brent crude prices decreased by 0.2% to $65.41 per barrel.

Gold Prices

The price of gold continues to fall from its highest level in nearly two weeks, which it reached earlier on Thursday. During the first half of the European trading session, it drops to the lower end of its daily range.

This decline doesn't seem to be caused by any major event and is expected to stay limited due to certain supporting factors.

Investors believe that the U.S. Federal Reserve will reduce interest rates further in 2025, which could keep boosting gold prices since gold doesn't offer interest but remains a stable investment.

International gold prices decreased 0.66% to close at $3,292.59 per ounce. In the local market, gold prices declined PKR 1,900 to 347,500 per tola.

Comments

See what people are discussing