Pakistan stocks close positive, led by E&P sector

The benchmark KSE-100 index gained 0.38% to close at 93,648.33 points

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

KSE-100 index gained 0.38% to close at 93,648.33 points

PSX

Pakistan's stock market reached a new all-time high, mainly due to strong performances by blue-chip stocks, including exploration and production scrips.

The International Monetary Fund's (IMF) call for the privatization of state-owned enterprises (SOEs) and an increase in foreign interest after MSCI raised its standard index weight to 4.4% played key roles.

The rally was also driven by the State Bank of Pakistan's (SBP) recent decision to lower the policy rate by 2.5 percentage points, which improved market liquidity and signaled economic stability, boosting investor confidence.

KSE-100 index gained 356.64 points or 0.38% to close at 93,648.33 points.

Meanwhile, Indian stocks closed Monday's turbulent session on a flat note. Of the 50 constituent stocks, 30 ended in the red, with Asian Paints, Britannia, Apollo Hospitals, Cipla, and ONGC suffering losses of up to 8%.

On the brighter side, Power Grid Corporation, TCS, HCL Tech, Infosys, and Tech Mahindra were among the 19 stocks that finished in the green. Bajaj Auto, meanwhile, ended unchanged.

India’s BSE 100 Index lost 0.03% or 8.13 points to close at 25,495.51 points.

The Dubai Financial Market (DFM) General Index gained 0.27% or 12.6 points to close at 4,652.43 points.

Commodities

Oil prices are down for the second consecutive day, driven by weaker demand expectations following disappointing stimulus measures from China.

While China announced a large debt package to support economic growth, it lacked direct stimulus, which raised concerns. Additionally, lower-than-expected Chinese economic data, including a slight dip in the Consumer Price Index (CPI) and a larger-than-expected drop in producer prices, highlighted deflation risks.

Oil prices also eased after concerns about supply disruptions from Storm Rafael in the US Gulf of Mexico subsided.

Brent crude prices declined 1.49% to $72.77 per barrel.

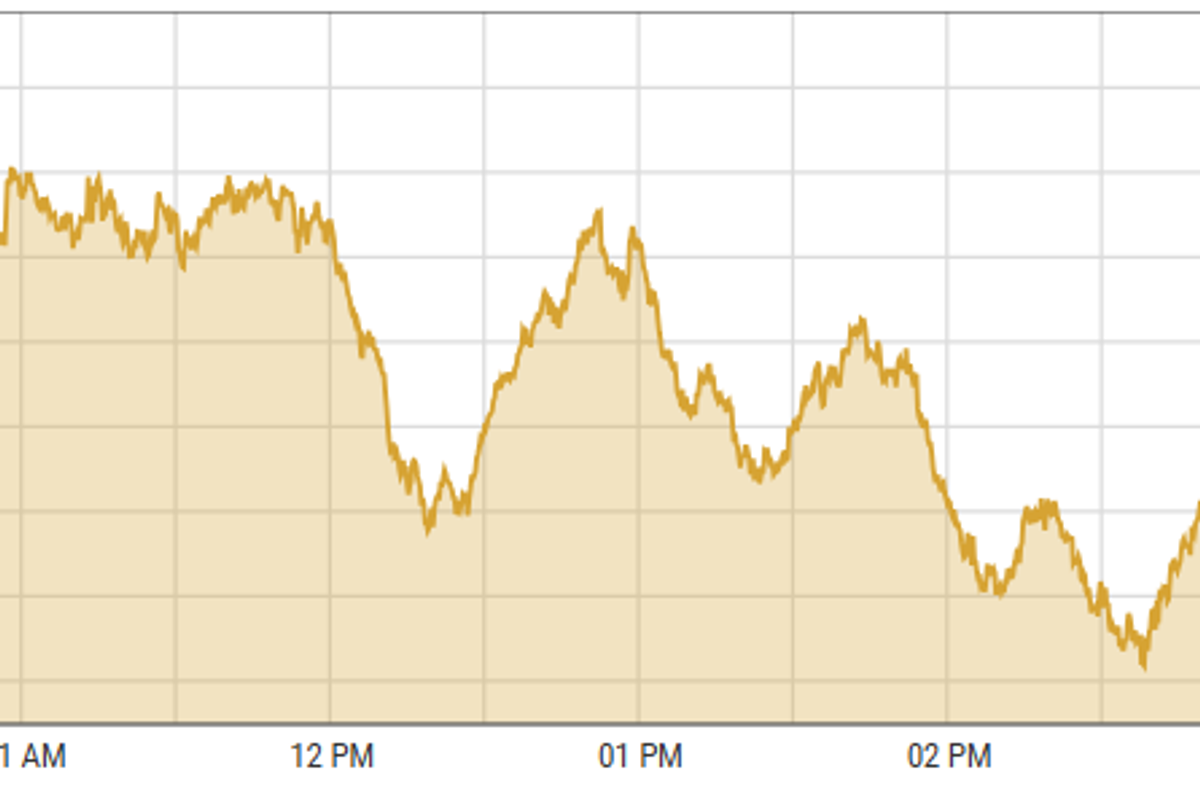

Gold prices continued to slide for a second consecutive day on Monday, adding to last week's significant losses. Optimism surrounding Donald Trump's expected expansionary policies is supporting the dollar, which remains near a four-month high, and is a key factor weighing on gold.

Additionally, a positive sentiment in US equity futures is diverting investment away from the safe-haven metal.

International gold prices declined 0.91% reaching $2,660.54 per ounce. In Pakistan, gold prices decreased by PKR 1,300 to PKR 277,500 per tola on Monday.

PKR-USD parity

The PKR strengthened against the dollar, up 0.08% in the inter-bank market. The Pakistani rupee settled at 277.73, a gain of 21 paisas against the US dollar. In the open market, USD was trading at PKR 280.5.

Comments

See what people are discussing