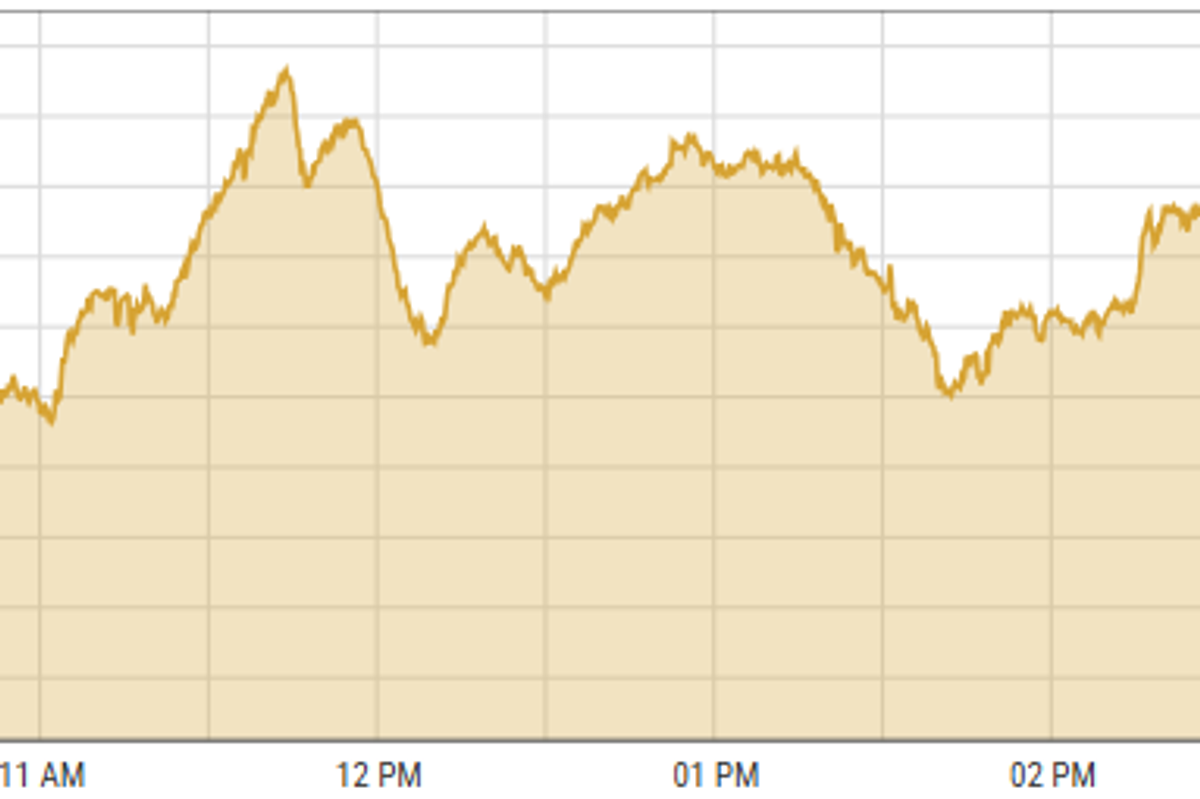

Pakistan stocks decline amid sector volatility

KSE-100 index shed 1.32% to close at 112,638 points

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

KSE-100 index shed 1.32%

PSX

Pakistan stocks closed in the red on Thursday, as the market experienced significant volatility driven by uncertainty in the cement and gas sectors, affecting investor sentiment.

Commercial banks, cement, and technology & communication sectors were the major laggards in the session, collectively shedding 580 points.

Analysts observed that persistent sectoral challenges continue to dampen market confidence.

The benchmark KSE-100 index lost 1.32% or 1,510.19 points to close at 112,638.26 points.

Separately, India's stock market fell on Thursday because investors were selling in IT, bank, finance, pharma, and auto sectors, ahead of the upcoming Q3FY25 results.

This drop in the Indian market followed similar trends in other Asian markets and was influenced by a sell-off in US bonds, leading to cautious investor behavior.

The BSE-100 index lost 0.71% or 177.56 points to close at 24,818.41 points.

Meanwhile, the DFM General Index gained 0.38% or 20.01 points to close at 5,229.34 points.

Commodities

Oil prices steadied on Thursday after data showed a surprise rise in US product inventories and weak economic data from China. Crude benchmarks had dropped over 1% on Wednesday, but trading is expected to remain limited on Thursday.

US gasoline and distillate inventories rose sharply in the week ending January 3, with gasoline up 6.3 million barrels (expected 0.5 mb) and distillates up 6.1 million barrels (expected 0.5 mb). Overall crude inventories decreased less than expected, at 0.96 million barrels (expected 1.8 mb).

This marks the eighth consecutive week of significant inventory builds, raising concerns about cooling demand in the US.

Brent crude prices gained 0.24% to $76.34 per barrel.

Gold prices rose despite mixed US jobs data. Private companies hired fewer workers than expected, but jobless benefit applications decreased.

Traders are waiting for Friday's Nonfarm Payroll report and University of Michigan's Consumer Sentiment reading. Strong results might lower gold prices due to the dollar's strength.

International gold prices increased 0.52% reaching $2,670.19 per ounce.

Currency

The PKR strengthened against the US dollar in the interbank market. Pakistani currency gained 12 paisas to reach 278.60 per USD. In the open market, one USD was trading at PKR 279.

Comments

See what people are discussing