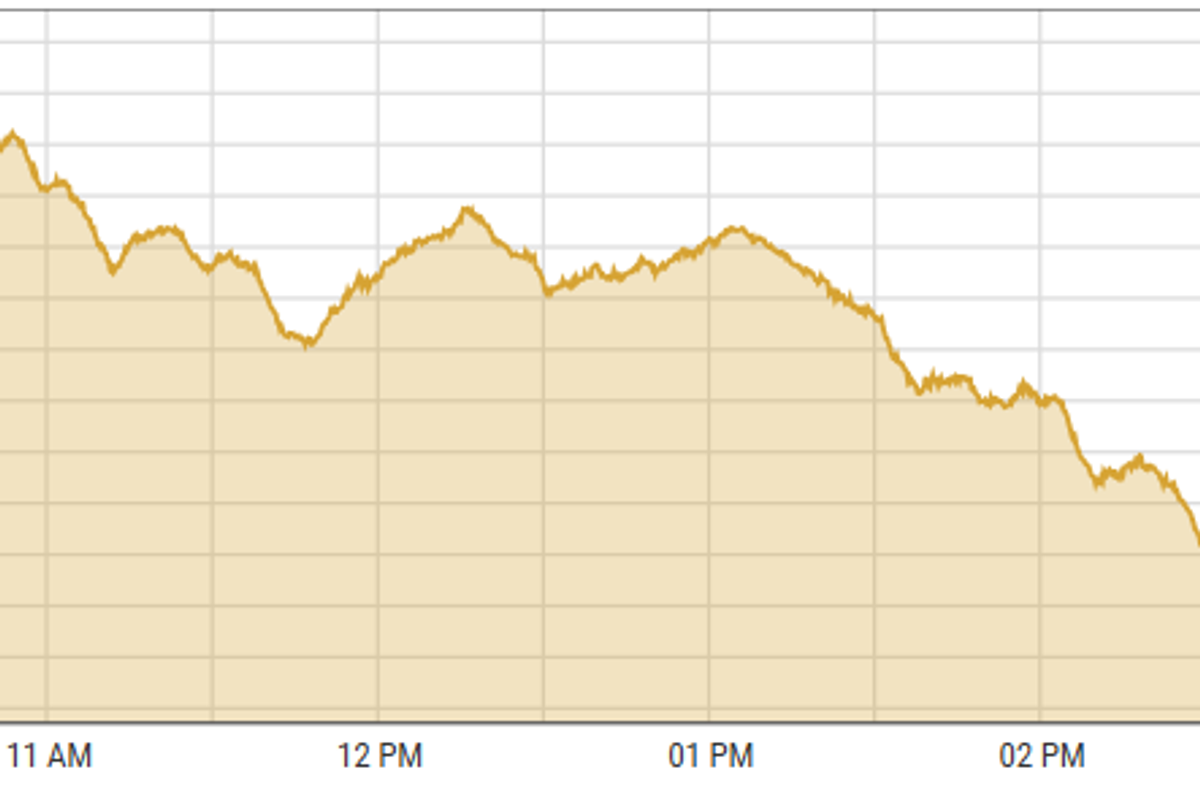

Pakistan stocks plummet by 4,795 points

It was the largest single-day decline at the benchmark KSE-100 index

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

The KSE-100 index lost 4.32%

PSX

Pakistan's stock market saw its largest single-day drop in history on Thursday, as the KSE-100 index nosedived by 5,132 points during the day.

The steep decline was triggered by significant redemptions from local mutual funds and year-end profit-taking by institutions. The collective actions of these entities sent the market into turmoil.

Investors opted for widespread selling following the State Bank of Pakistan's cautious policy easing amid multiple risks.

Marri Petroleum Company Limited (MARI) continued its downward trend, hitting the lower circuit for the third consecutive session with a 10% drop. Investors' ongoing concerns about the company's overvaluation and near-term fundamentals contributed to the relentless sell-off.

The KSE-100 index lost 4,795.32 points or 4.32% to close at 106,274.98 points.

Separately, Indian stocks fell sharply on Thursday because the US Federal Reserve announced a less aggressive rate cut, suggesting fewer cuts in 2025, which increased global economic uncertainty.

This, along with a general sense of caution in global markets, led to significant losses in Indian stock indices, a drop in the value of the rupee, and large withdrawals of capital by foreign investors.

BSE-100 index shed 242.68 points or 0.94% to close at 25,455.01 points.

DFM General index gained 9.48 points or 0.19% to close at 5,046.55 points.

Commodities

Oil prices dropped on Thursday because the US Federal Reserve said it would slow down the pace of cutting interest rates in 2025.

Although oil prices slightly recovered during the day, they stayed lower than they were a day earlier, when they went up due to a drop in US oil stocks and a 0.25% interest rate cut by the Fed.

The prices weakened further after US central bankers predicted two small rate cuts in 2025 due to concerns about rising inflation, which was less than what they had predicted in September.

Brent crude prices shed 0.15% to $73.28 per barrel.

The gold market is having a tough time because the Federal Reserve is cutting interest rates after their last meeting of 2024.

They also said they would slow down rate cuts in 2025. The central bank is still positive about the economy's health, even though inflation is still high.

International gold prices declined 0.64% reaching $2,621.22 per ounce.

Currency

The PKR weakened against the US dollar in the interbank market, down 0.08%. Pakistani currency settled at 278.35 with a loss of 13 paisas. In the open market, USD was trading at PKR 279.

Comments

See what people are discussing