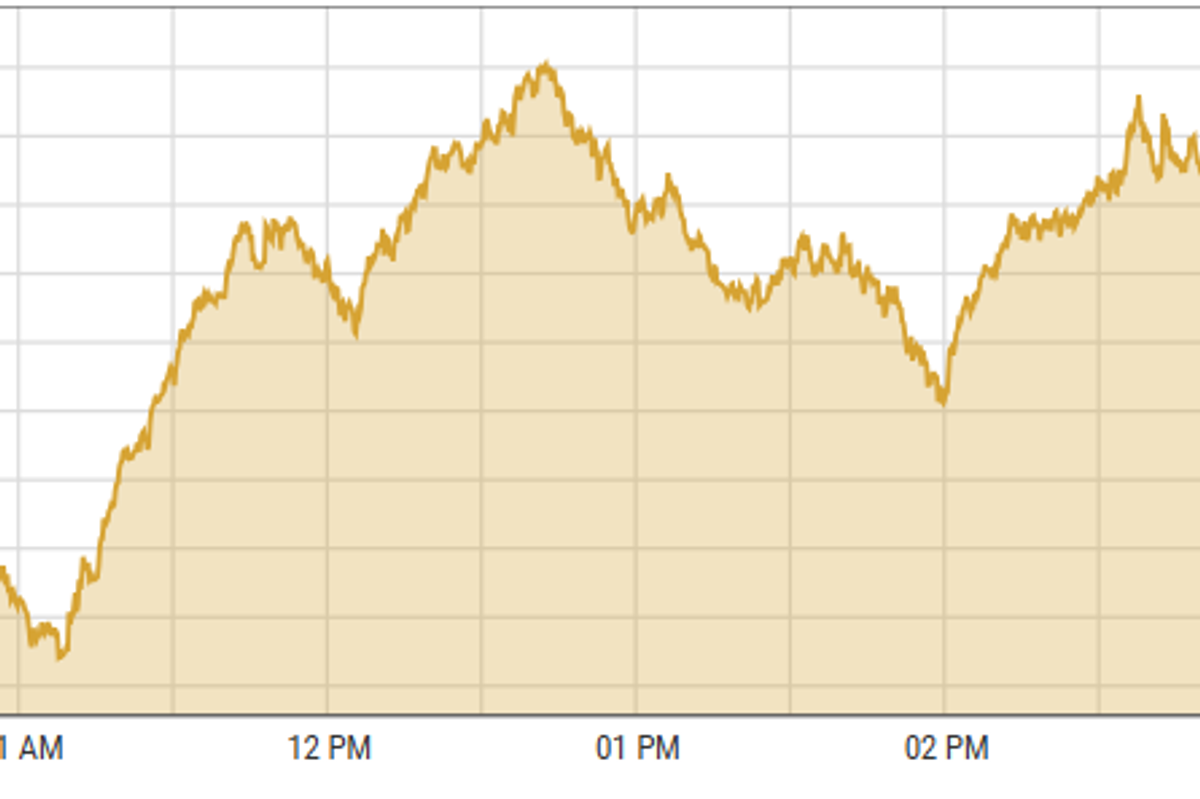

Pakistan stocks recover, driven by strong valuations of second and third-tier scrips

KSE-100 index gained 0.14% to close at 93,355.42 points

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

KSE-100 index gained 0.14% to close at 93,355.42 points

PSX

Pakistan stocks showed a recovery on Wedneday, driven by strong valuations of second and third-tier scrips.

The surge was supported by positive data showing car sales rising 112% in October and the Federal Board of Revenue (FBR) assuring the International Monetary Fund (IMF) that there would be no contingency measures affecting revenue, easing fears of a mini-budget.

In other news, Bank Al Falah withdrew its offer to buy Samba Bank after the Saudi National Bank terminated the process of selling its 84.51% stake in Samba Bank.

Rousch Power has approved a negotiated settlement to end its power purchase agreement, which was originally set to expire in 2032, and will receive payments until December 31.

Additionally, CCL Holdings has offered to buy voting shares and take control of Mitchells Fruit Farms.

KSE-100 index gained 130.86 points or 0.14% to close at 93,355.42 points.

Separately, Indian stock markets have been very unstable over the past two days, with sharp drops causing concern among investors. On Wednesday, selling was observed across most sectors except for private banks during early trading. Market experts note that this year's market movements show significant differences across various countries and regions.

India’s BSE 100 Index lost 1.46% or 366.69 points to close at 24,828.40 points.

The Dubai Financial Market (DFM) General Index gained 0.67% or 31.41 points to close at 4,732.81 points.

Commodities

Crude oil prices rose slightly on Wednesday as global supply tightened, though demand concerns weighed on benchmarks. Brent crude traded at $71.97 per barrel and West Texas Intermediate at $68.18 per barrel.

The Organization of Petroleum Exporting Countries (OPEC) revised down its demand growth outlook to 1.82 million barrels daily from 1.93 million barrels. Despite this, ANZ noted that strong current demand led to higher prices, with buyers quickly snapping up available cargoes.

Brent crude prices increased 0.77% to $72.44 per barrel.

Gold prices stayed mostly unchanged on Wednesday as investors looked for deals after big drops the day before. Attention shifted to upcoming US inflation data, which could provide clues about the Federal Reserve's plans for monetary policy.

Recently, gold prices were hurt by a stronger dollar, influenced by expectations of inflationary policies from Donald Trump affecting the rate cut cycle. Traders now see a 62% chance of a 25 basis points rate cut at the Fed's December meeting, down from 77.3% a week ago, according to the CME's FedWatch Tool.

International gold prices declined 0.07% reaching $2,609.53 per ounce. In Pakistan, gold prices increased by PKR 1,400 to PKR 271,900/tola.

Currency

The PKR strengthened against the US dollar, up 0.07% in the interbank market. Pakistani currency settled at 277.85, a gain of seven paisas against the US dollar. In the open market, USD was trading at PKR 280.

Comments

See what people are discussing