Pakistan stocks soar to new record high of 91,000 points

During the preceding week, the index gained 5.6% or 4,744 points, and was in the top five best-performing markets in the world

Haris Zamir

Business Editor

Experience of almost 33 years where started the journey of financial journalism from Business Recorder in 1992. From 2006 onwards attached with Television Media worked at Sun Tv, Dawn Tv, Geo Tv and Dunya Tv. During the period also worked as a stringer for Bloomberg for seven years and Dow Jones for five years. Also wrote articles for several highly acclaimed periodicals like the Newsline, Pakistan Gulf Economist and Money Matters (The News publications)

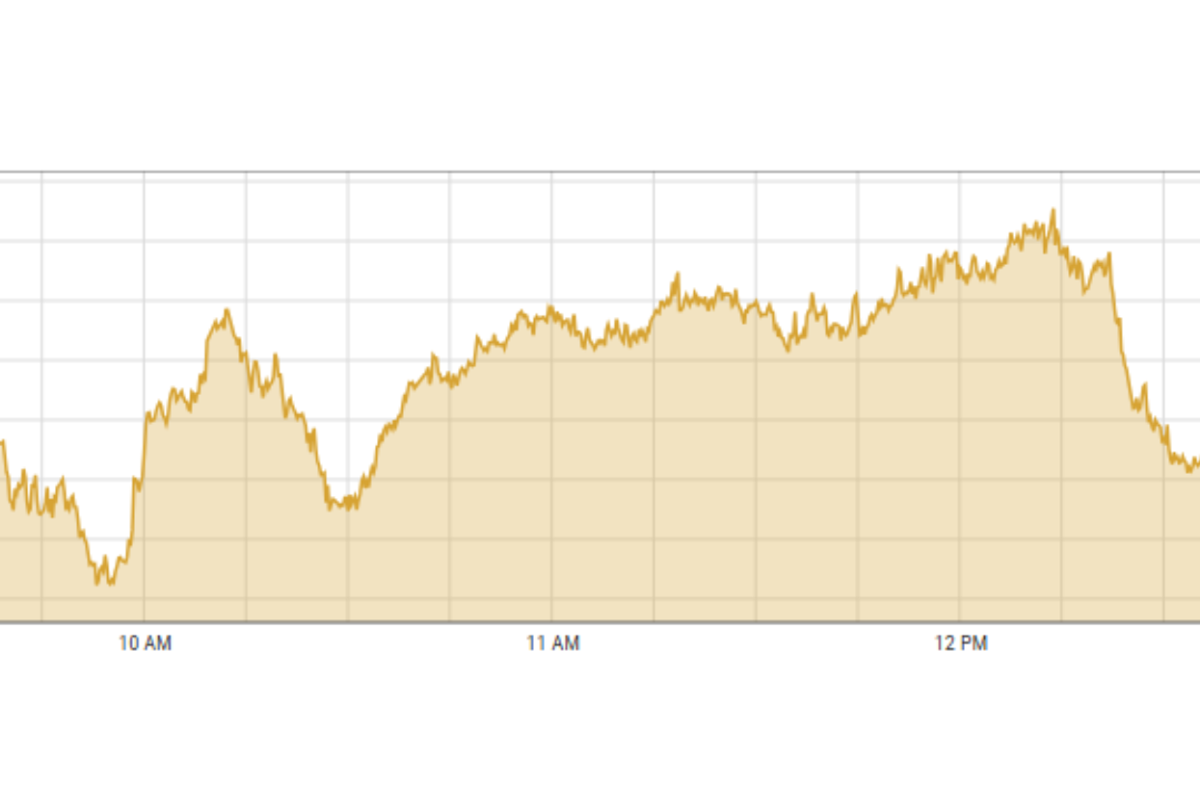

A view of intraday trading at the Pakistan Stock Exchange

PSX Website

The Pakistan Stock Exchange (PSX) reached a new milestone on the first day of the week with the benchmark KSE-100 index climbing to 91,000 points on renewed buying from mutual funds, high net-worth individuals and some other financial institutions, following assurance from international lenders to support the country's economy.

The KSE-100 index climbed to an intra-day high of 91,054 points around 12:15 PM. However some profit taking activities clipped a bit of the gains and the index started trailing around 90,696 points.

During the preceding week, the index gained 5.6% or 4,744 points, and was in the top five best-performing markets in the world. The major factor behind this was the renewed buying from the domestic financial institutions. Mutual funds last week bought shares worth $12.1 million, followed by other organizations amounting to $8.3 million.

Investors took cue from positive developments, including the attendance of Finance Minister Muhammad Aurangzeb at the annual meetings of the World Bank and the IMF. The finance minister sought financial assistance from the IMF amounting to $1.2 billion under the Climate Resistance plan.

Moreover, International Islamic Trade Corporation announced that it would give Pakistan $3 billion over three years, in addition to financing assurances already announced by the International Finance Corporation, Asian Development Bank and Standard Chartered Bank.

Another reason which improved investor sentiment has been the continuous falling of yields in the secondary market-treasury bills and Pakistan Investment Bonds, which increased hopes of a further cut in the benchmark interest rate.

Since June, the interest rate has declined by 450 basis points to 17.5% with market expectations of another 200bps cut. Pakistan's central bank is set to announce the monetary policy on Nov 4 while inflation numbers for October will be released on Nov 1.

Comments

See what people are discussing