Pakistan stocks surge as investors anticipate FY26 budget measures

Investor optimism drives gains in large-cap stocks; refinery sector boosted by pending dues clearance

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

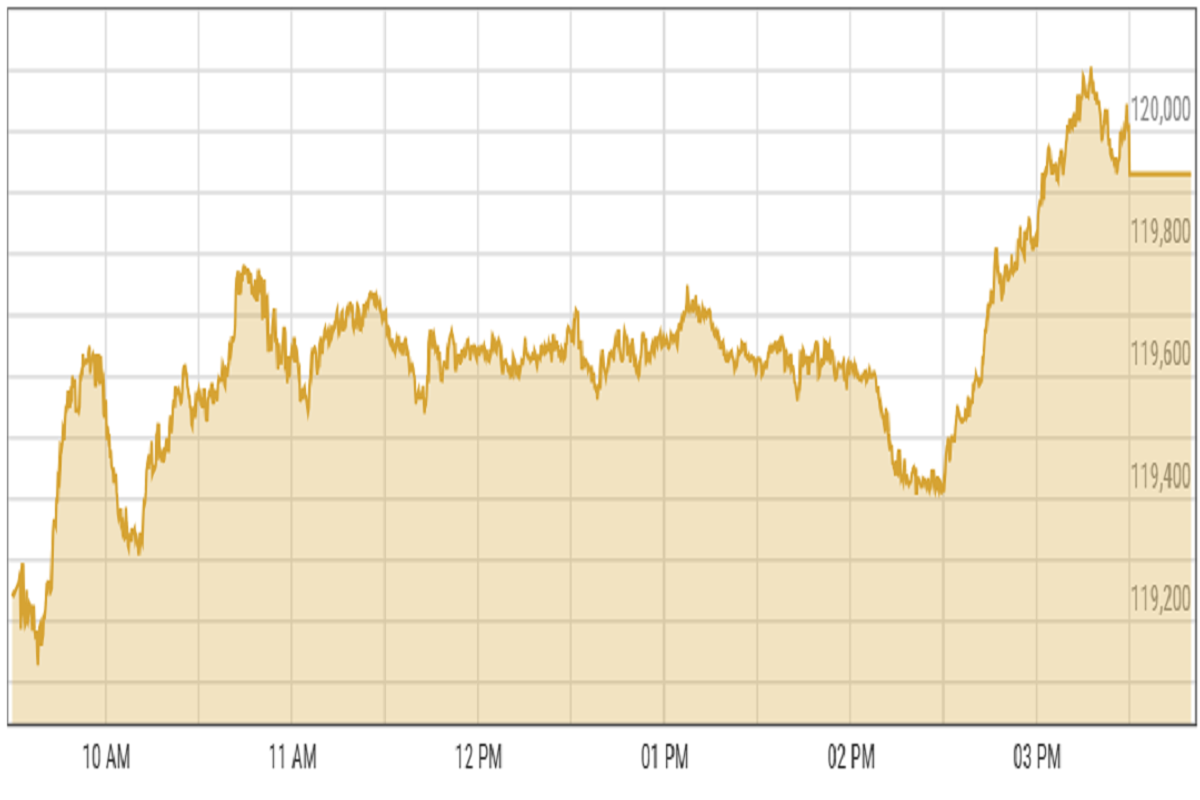

Pakistan’s benchmark stock index closed near a record high on Tuesday as investor optimism surged ahead of the federal budget for fiscal year 2026.

Ahsan Mehanti of Arif Habib Corp attributed the market’s strength to pre-budget speculation, while auto stocks faced pressure following reports of IMF-driven tariff relaxation on used vehicle imports, a proposal included in the upcoming National Tariff Policy.

Equities opened the session on a strong note, with large-cap stocks drawing significant interest, an analyst at Topline Securities noted.

The refinery sector also saw heightened activity after the government approved clearing PKR 34 billion in pending dues through petroleum pricing, a move expected to accelerate $6 billion in refinery upgrade projects.

Investor positioning ahead of key fiscal announcements drove further gains, an analyst at Ismail Iqbal Securities said, with commercial banks, oil and gas exploration firms, and power sector stocks contributing a combined 652 points to the index’s rally.

KSE-100 index gained 0.81% or 960.33 points to close at 119,931.46 points.

Currency

US dollar steadied against PKR in the inter-bank market. Pakistani currency shed 15 paisas to close at 281.92. In the open market USD was trading at PKR 283.8.

Indian Stocks

Indian equity markets rebounded sharply on Wednesday, snapping a three-day losing streak as banking and IT stocks fueled a broad recovery. Optimism in Asian markets provided additional support, creating a favorable environment for the turnaround.

Meanwhile, Moody’s Ratings reinforced confidence in India’s economic stability, highlighting the country’s vast domestic market and minimal reliance on exports as key strengths in navigating global trade disruptions.

BSE-100 index gained 0.64% or 165.01 points to close at 25,980.81 points.

DFM General Index shed -0.53% or 28.89 points to close at 5,438.42 points.

Crude Oil

Oil prices went up by more than 1% on Wednesday after reports said Israel might attack Iran's nuclear sites. This raised concerns that oil supply from the Middle East could be disrupted.

CNN reported on Tuesday that U.S. intelligence believes Israel is preparing for such a strike, according to several U.S. officials.

Meanwhile, there were signs that crude oil supply might be improving. Last week, U.S. crude oil stocks increased, though gasoline and distillate inventories went down, according to market sources who cited figures from the American Petroleum Institute on Tuesday.

Brent crude prices increased by 0.96% to $66.a1 per barrel.

Gold Prices

Gold prices bounced back on May 21 after a small drop the day before. A weaker U.S. dollar and uncertainty over government finances, as Congress debated a major tax bill, made investors turn to gold as a safer option.

Moody's downgrade and doubts about Trump's tax plan are still putting pressure on the dollar.

International gold prices increased 0.73% to close at $3,306.56 per ounce. In the local market, gold prices increased PKR 6,600 to 349,400 per tola.

Comments

See what people are discussing