PSO's profit surges over 100% to PKR 19.65 billion in FY24

The company's other income increased by 50.62% to PKR 28.29 billion

A Pakistan State Oil fuel station in Pakistan

Shutterstock

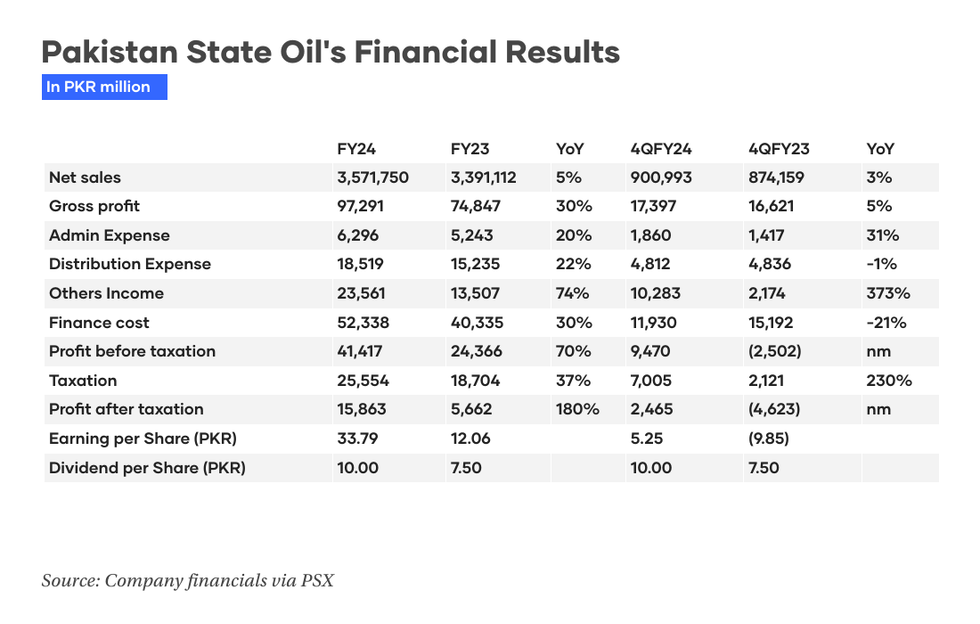

Pakistan State Oil's (PSO) profits surged by over 100% to PKR 19.65 billion — translating to earnings per share of PKR 39.04 — in fiscal year 2023-24 due to significantly higher income from government securities and realization of penal income from power generation companies.

PSO, the country’s largest oil marketing company, announced its financial results in a Pakistan Stock Exchange filing on Tuesday.

The company also declared a dividend of PKR 10 per share, which is broadly in line with market expectations.

Its other income for FY24 surged 50.62% to PKR 28.29 billion compared to PKR 16.79 billion in FY23.

Abdul Hadi, an analyst at Sherman Securities, said the surge in other income was attributable to investment in government securities. “This one-off impact in other income resulted in higher-than-expected earnings for the company. Otherwise, the market was expecting a loss in the fourth quarter due to inventory losses.”

Iqbal Jawaid, senior research analyst at Arif Habib Limited, attributed the substantial rise in other income to the realization of penal income from power generation companies. Notably, in FY24's fourth quarter, other income jumped 4.7 times to PKR 10.27 billion compared to PKR 1.96 billion in the previous quarter.

The company’s gross margins also increased by 52 basis points largely due to a 51% increase in Oil Marketing Company margins, averaging PKR 7.36 per liter, up from PKR 4.87 per liter in FY23.

Moreover, the share of profit from associates stood at PKR 1.64 billion compared to a loss of PKR 868.78 million in the previous year.

Net sales during the period under review also increased 5.9% to PKR 3.74 trillion compared to PKR 3.53 trillion in the previous year.

Comments

See what people are discussing