SBP awards first digital retail bank license to Easypaisa Bank

Governor Jameel Ahmad calls for digital banks to innovate and design customer-centric solutions

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

State Bank of Pakistan (SBP) has awarded the first Digital Retail Bank (DRB) license to Easypaisa Bank Limited, formerly known as Telenor Microfinance Bank Limited.

This license authorizes Easypaisa Bank to commence commercial operations, marking a significant milestone in promoting innovation, enhancing financial inclusion, and ensuring accessible and affordable digital financial services.

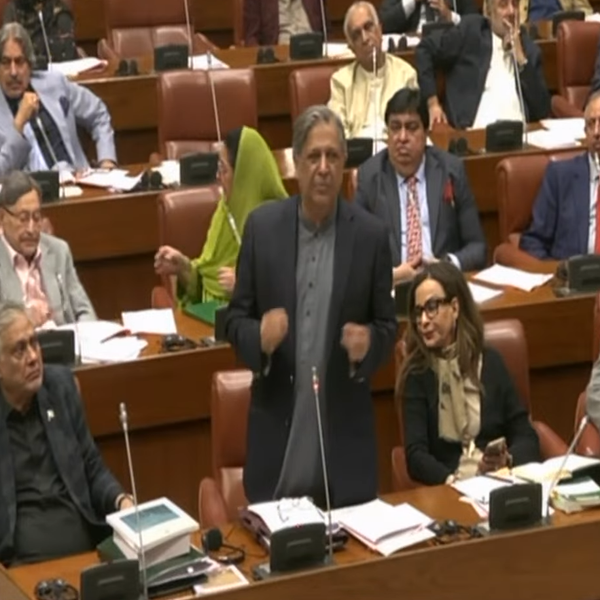

The event was attended by CEOs of digital banks, members of the Executive Committee of the Pakistan Banks’ Association, the Board of Directors, and senior management of Easypaisa Bank, as well as senior executives of the SBP.

In his address, Governor Jameel Ahmad underscored the SBP's strategic role in establishing the framework for digital banking in Pakistan. He highlighted the importance of prioritizing the digital transformation of small and medium enterprises (SMEs) in Pakistan, drawing inspiration from Easypaisa Bank's sponsor, Ant Group.

Governor Ahmad emphasized the need for digital banks to innovate and design customer-centric solutions tailored to individuals, micro, small, and medium enterprises (MSMEs), and other underserved segments. He stressed that such efforts are crucial for fostering financial inclusion and driving economic growth.

Addressing the challenges associated with rapid technological advancements, Governor Ahmad highlighted the critical areas of digital literacy for customers and cybersecurity measures.

He expressed confidence that Easypaisa Bank will develop innovative, customer-focused, and affordable digital financial solutions, particularly for underserved and unserved segments of society.

In January 2023, SBP issued No Objection Certificates (NoCs) to five successful applicants: HugoBank Limited, KT Bank Pakistan Limited, Mashreq Bank Pakistan Limited, Raqami Islamic Digital Bank Limited, and Easypaisa Bank Limited.

These entities were selected following a rigorous evaluation process assessing key criteria, including governance and fitness, industry expertise, financial capacity, business strategies, implementation frameworks, funding plans, and IT and cybersecurity infrastructure.

In September 2023, these banks received In-Principle Approval (IPA) to prepare for operational readiness. After fulfilling the required conditions, Easypaisa Bank Limited has now been authorized to commence commercial DRB operations.

The ceremony also featured remarks from members of the Board of Directors of Easypaisa Bank, who shared their vision and commitment to driving innovation in digital financial services.

They expressed gratitude to the SBP for its support and reaffirmed their dedication to setting new benchmarks in customer-centricity and technological advancement in the financial sector.

Comments

See what people are discussing