Six Pakistani banks to face 10% additional tax, 10 to pay 16% extra

Only two of 18 banks meet 50% advance to deposit ratio requirement

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

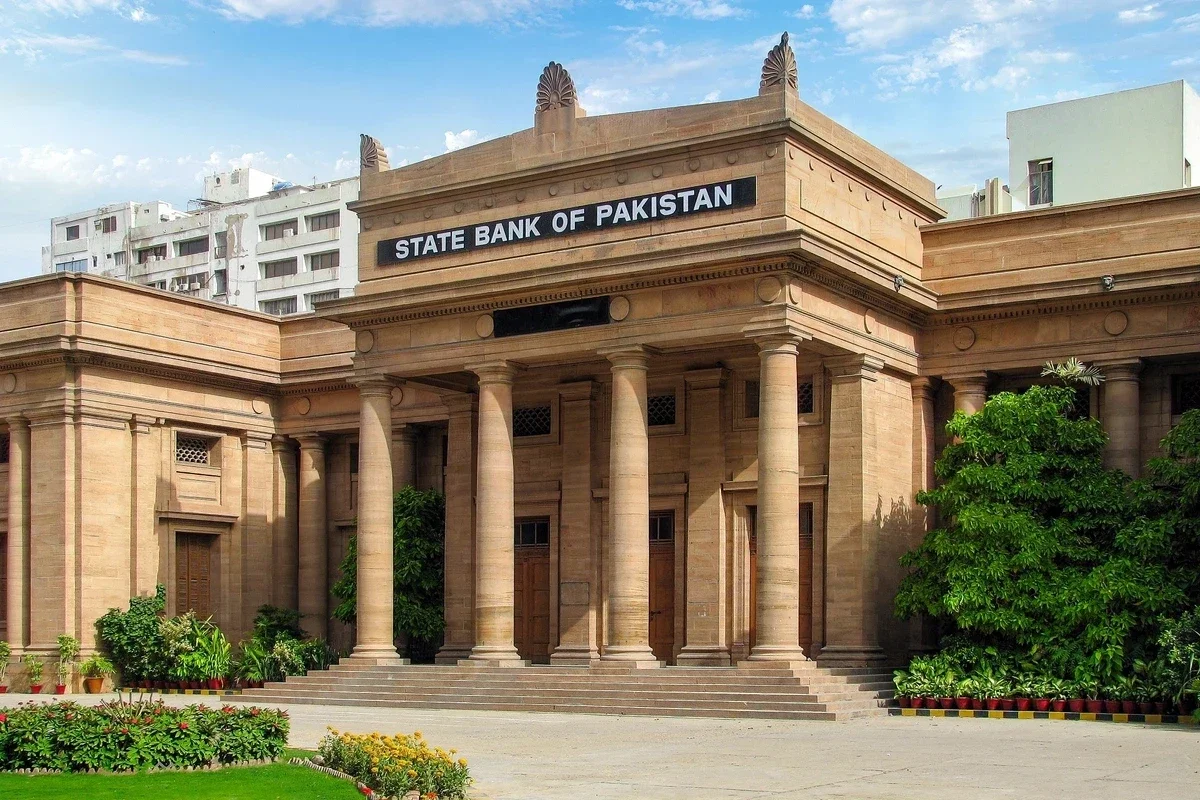

State Bank of Pakistan

Shutterstock

Six Pakistani banks will face an additional 10% tax, and 10 will incur a 16% additional tax for failing to meet the central bank's requirement of a 50% Advances to Deposit Ratio (ADR).

As of September 30, only two out of 18 listed banks met the ADR threshold, thus avoiding extra taxes.

The tax, initially imposed in 2022 to boost business and lending but paused in 2023, is being enforced again. Banks must now adjust to avoid a 10% tax if their ADR is between 40-50%, or a 16% tax if below 40%.

As of September, the average ADR was 39.47%, with only two out of 18 banks meeting the 50% requirement.

Samba Bank, with an ADR of 58%, and JS Bank, with an ADR of 54%, will not face additional tax. However, Habib Metropolitan Bank, Faysal Bank, Allied Bank, Meezan Bank, Bank of Punjab, and Bank Alfalah will pay an additional 10% tax as their ADR ranges from 40% to 50%. They can avoid the tax by improving their ADR to 50%.

On the other hand, Habib Bank, National Bank of Pakistan, Bank Al Habib, Askari Bank, Bankislami Pakistan, MCB Bank, Soneri Bank, Standard Chartered Bank, United Bank, and Bank of Khyber will bear a 16% additional tax due to their ADR being below 40%.

For the quarter ended September 30, the average effective tax rate on banks was 50.8%, with The Bank of Khyber paying the highest at 58.5% and Askari Bank paying the lowest at 48.2%.

Comments

See what people are discussing