Pakistan stocks end flat amid pre-budget caution

Profit-taking, sectoral declines weigh on index as investors await policy clarity

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

KSE-100 index shed 0.03%

PSX

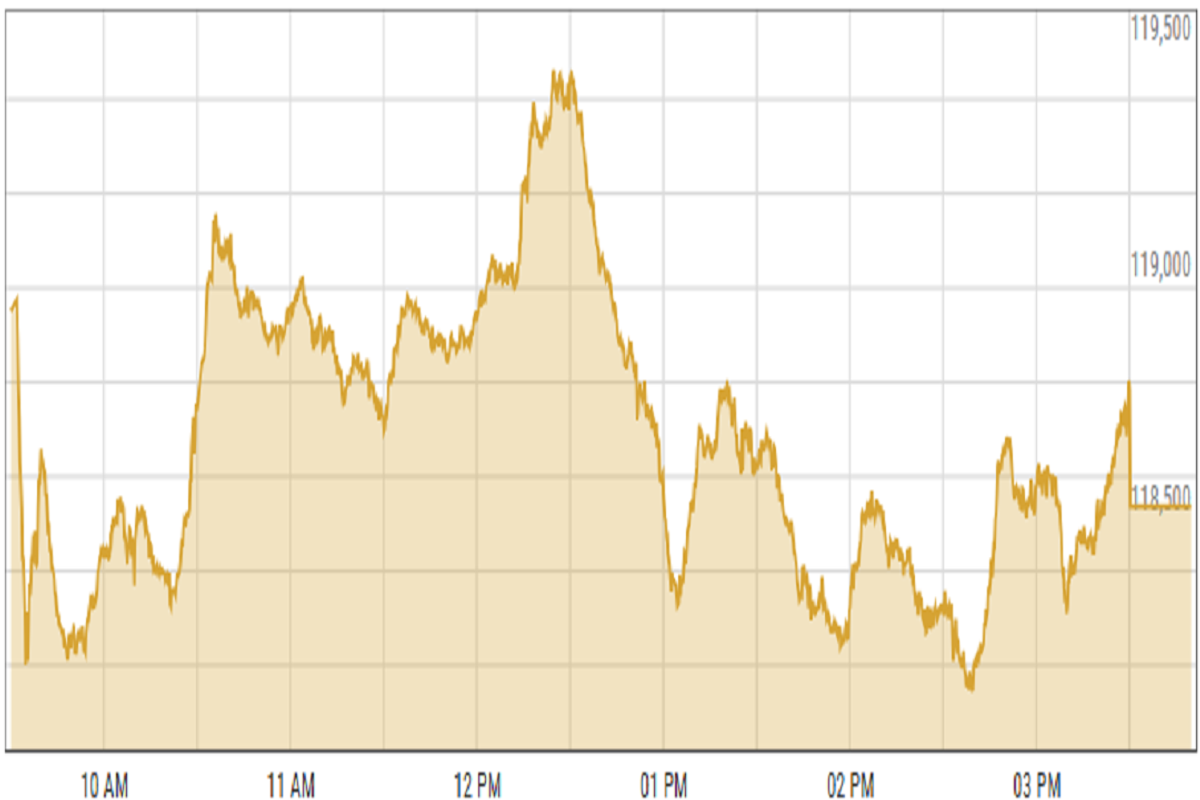

Pakistan’s benchmark stock index closed relatively unchanged Tuesday, as investors exercised caution ahead of the upcoming federal budget for fiscal year 2026.

The KSE-100 index experienced a turbulent trading session following two consecutive days of strong gains. Analysts attributed the volatility to strategic profit-taking and uncertainty surrounding economic policy.

“With most known factors already priced in, market participants stayed cautious ahead of the upcoming budget,” an analyst at Ismail Iqbal Securities said.

A Topline Securities analyst described the trading activity as a “tug-of-war between gainers and losers,” noting heightened fluctuations throughout the day.

Ahsan Mehanti, an analyst at Arif Habib Corp, said weak auto sales in April and stringent tax regulations on cement distributors dampened sentiment.

Major sectors, including oil & gas exploration, commercial banking, and oil & gas marketing companies, collectively dragged the index down by 328 points.

KSE-100 index shed 0.03% or 39.36 points to close at 118,536.53 points.

Currency

US dollar gained against PKR in the inter-bank market. Pakistani currency lost 5 paisas to close at 281.72. In the open market USD was trading at PKR 283.70.

Indian Stocks

The Indian stock market went up on Wednesday, May 14, thanks to good global news about lower geopolitical risks. IT stocks rose as fears of a U.S. recession faded, and metal stocks gained as the U.S. dollar weakened.

The future looks bright for India's market because lower inflation will let the central bank cut interest rates, which will help the economy grow and boost company profits.

BSE-100 index gained 0.4% or 101.66 points to close at 25,787.80 points.

DFM General Index gained 0.08% or 4.03 points to close at 5,366.71 points.

Crude Oil

Oil prices dipped on Wednesday as traders anticipated a rise in US crude inventories, but remained near two-week highs due to optimism over the temporary easing of US-China tariffs.

The two countries agreed to pause their trade war for 90 days, with the US reducing tariffs to 30% from 145% and China lowering duties to 10% from 125%, fostering hopes of increased demand.

Brent crude prices decreased by 1.05% to $65.93 per barrel.

Gold Prices

Gold prices declined on Wednesday, May 14, as reduced trade tensions between the U.S. and China weakened demand for safe-haven assets.

Investors are now closely monitoring upcoming U.S. inflation data for insights into the Federal Reserve's future interest rate decisions.

International gold prices decreased 0.38% to close at $ 3,231.85 per ounce. In the local market, gold prices decreased PKR 2,300 to 341,900 per tola.

Comments

See what people are discussing