Why millions of dollars may flow out of Pakistan's stock market on Sept 23

Nukta explains what FTSE Russell is and the results of a classification downgrade

Javed Mirza

Correspondent

Javed Iqbal Mirza is an experienced journalist with over a decade of expertise in business reporting, news analysis, and investigative journalism. His work spans breaking news, editorial pieces, and in-depth interviews.

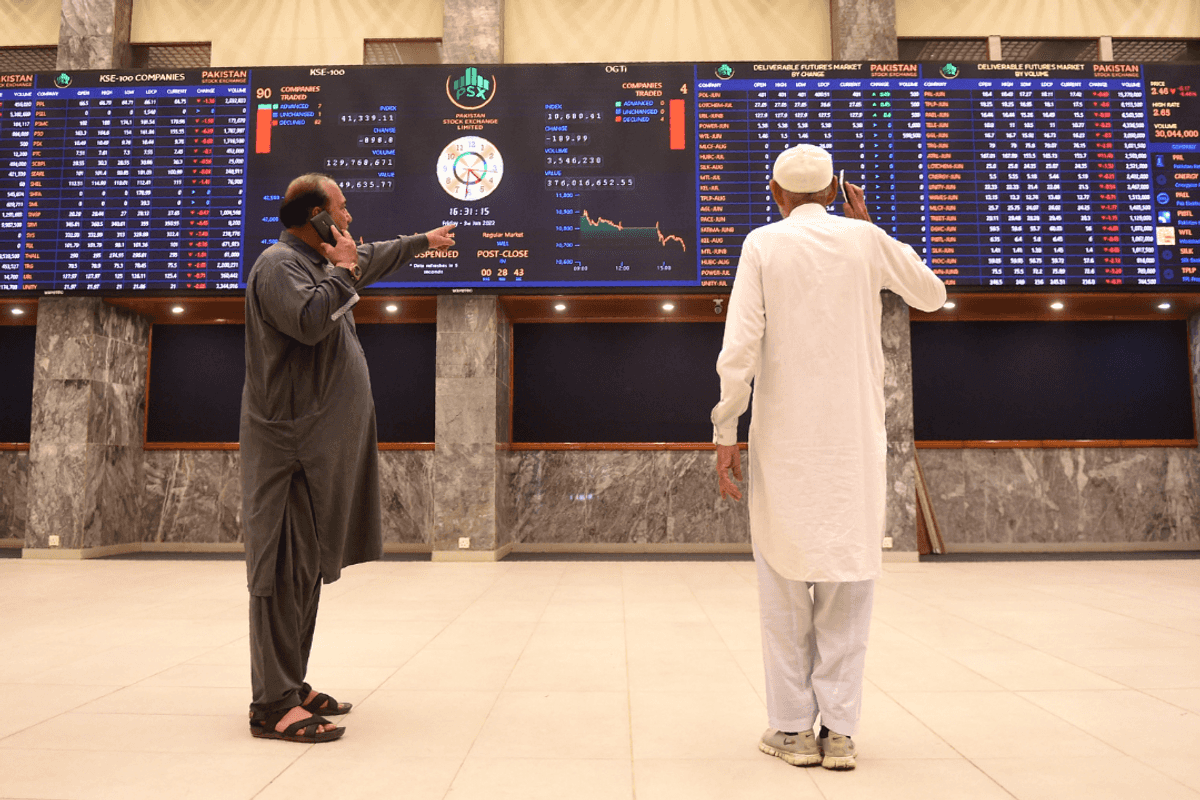

Stockbrokers monitor the share prices during a trading session at the Pakistan Stock Exchange (PSX) in Karachi

AFP

The Pakistan Stock Exchange's benchmark KSE-100 index will see an outflow of around $50 million on September 23. This is because the country's downgrade by FTSE Russell will come into effect.

The Financial Times Stock Exchange Russell — a leading provider of benchmarks, analytics and data — classifies equities as Developed, Advanced Emerging, Secondary Emerging or Frontier based on a set criteria.

Fund managers, asset management companies and large corporations use these benchmarks and classifications to make investment decisions. Inclusion in a FTSE Russell benchmark increases a company's visibility by bringing it to the notice of international investors.

FTSE Russell conducts an annual review of all markets included in its benchmarks and adjusts their classification, if necessary.

The Pakistan case

Last year, FTSE Russell placed Pakistan on its watchlist for possible reclassification from Secondary Emerging to Frontier category, stating that the country's index weight had decreased steadily in recent years. Consequently, Pakistan failed to meet the minimum investable market capitalization exit level threshold required to retain a Secondary Emerging market status.

Following the end of this fiscal year, FTSE Russell conducted another review and decided to downgrade the country.

Frontier markets have smaller market capitalizations, less accessibility to investors, and low stock turnover compared to emerging markets, and are considered to be higher risk in terms of investment.

A reclassification to this index suggests a downtrend in the company's growth prospects as well as the country's economy shaking investor confidence.

So, why the outflow?

Whenever equities are downgraded, investors tend to offload them resulting in outflows from the market.

Quoting latest available data from Bloomberg, an analyst report from AKD Securities noted the FTSE Emerging Markets Index included 14 Pakistani stocks valued at $53.1 million.

“However, the actual outflow may be lower due to the offsetting of some emerging and frontier market flows,” it added.

According to AKD Securities, FTSE Emerging Markets-related foreign holding in Hubco is worth $7.9 million, followed by Fauji Fertilizer ($6.1 million), Engro ($5.1 million) and OGDC ($4.4 million). HBL, UBL, LUCK, POL, PPL, MTL, PSO, TRG, SYS are also included in FTSE EM Index.

Since the FTSE rebalancing, foreign portfolio investments have recorded a net inflow of $26.2 million. In total, Pakistan's equity market has attracted $91.7 million in net foreign investment so far this year.

Comments

See what people are discussing