Beware of crypto scams: How to spot a pump-and-dump scheme

These schemes often proliferate on social media, frequently featuring celebrity endorsements to bolster their credibility.

Tamanna Sajeed

Producer, Dubai Desk

Tamanna Sajeed is a Dubai-based journalist who is passionate about local culture and international affairs. She is a multimedia journalist with a special interest in inter-disciplinary feature reporting.

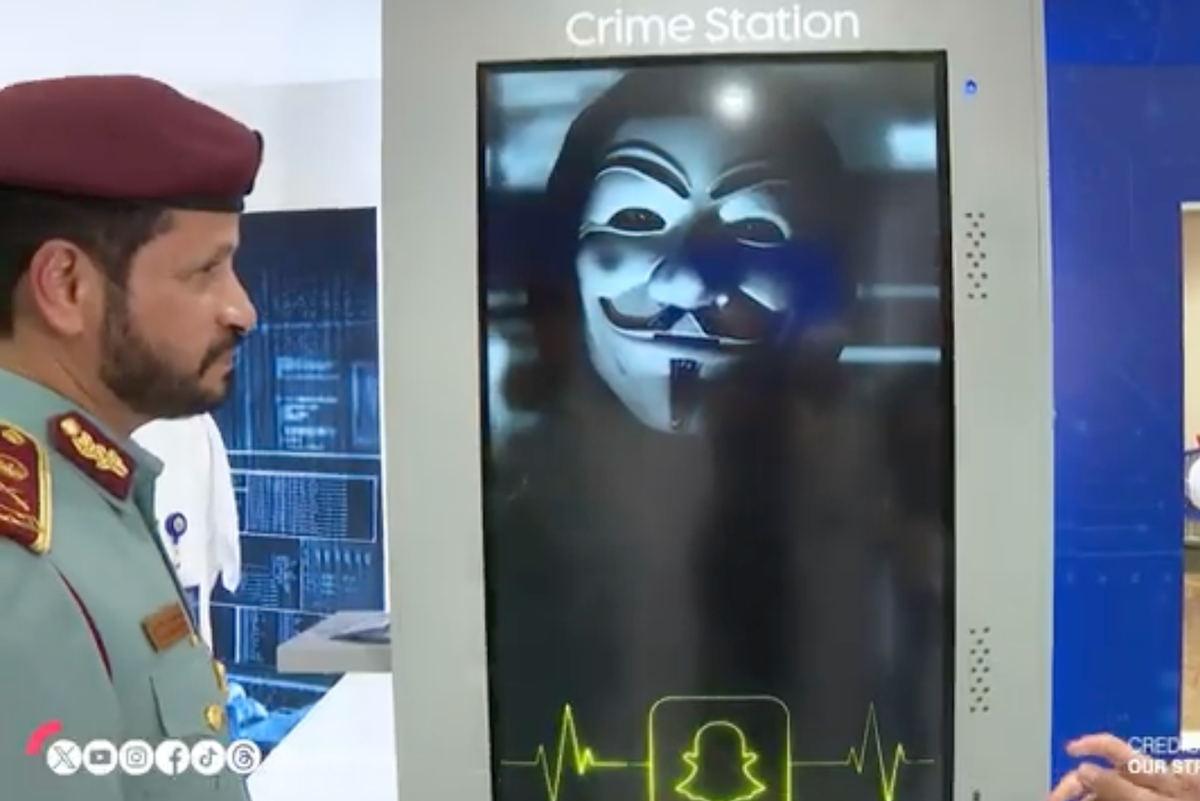

Sharjah Police at a cybercrime awareness campaign in 2023.

Photo credit: WAM News

Promoted as get-rich-quick schemes, crypto scams are easy to fall for.

The Securities and Commodities Authority (SCA) and Dubai’s Virtual Assets Regulatory Authority (VARA) established a regulatory framework for virtual assets in the UAE this month. This move aims to curb crypto fraud and enhance investor protection in the country.

One of the most common types of crypto fraud is the pump-and-dump scheme. In this scam, fraudsters create a social media group for a new cryptocurrency, touting it as unique investment opportunity with “insider knowledge”.

They often use online forums or messaging platforms like Telegram to orchestrate price manipulation on exchanges—a practice deemed illegal by VARA. Some scammers may even enlist influencers or celebrities to falsely promote their cryptocurrencies.

Initially, victims may see promising returns and decide to invest more, inflating the cryptocurrency's value, or "pumping" it. Once the value is sufficiently elevated, scammers will “dump” their coins by selling their holdings and transferring large amounts to their accounts. Investors will only realize they’ve been deceived when the cryptocurrency’s value crashes, leaving them with worthless tokens.

Many victims hesitate to take action due to fear of self-incrimination.

What to do if you've been scammed

If you’ve fallen prey to a crypto scam in the UAE, here are steps you can take:

- Document all evidence of the scam, including emails, messages, and transaction records.

- Report the incident to the local police either in person or online through their app or website.

- Contact your bank to inquire about the possibility of recovering the transferred funds.

- Inform your cryptocurrency exchange by reaching out to their customer service department, as they may have procedures to assist fraud victims.

- Consider legal action if necessary; consult with a lawyer for advice on the best course of action.

How to spot a pump-and-dump scheme

According to the U.S. Securities and Exchange Commission, here are key indicators of a pump-and-dump scheme:

Promises of high returns: Be skeptical of investments that guarantee significant returns in a short period. If it sounds too good to be true, it likely is.

Verify service providers: Only engage with licensed service providers.

Heavy online promotion: Watch out for cryptocurrencies that are aggressively promoted online, particularly if influencers or celebrities are involved. This can be a sign of manipulation.

Pressure tactics: Be cautious if you encounter promotions that create a sense of urgency, urging you to buy quickly due to a “limited opportunity.” Fraudsters often use hype and fear of missing out to pressure investors.

Unexplained price fluctuations: Rapid and unexplained changes in the value of a cryptocurrency are a red flag for price manipulation. If the coin’s value fluctuates dramatically without any news or clear reasons, it may be part of a scam.

Comments

See what people are discussing