Pakistan imposes new climate levy on fuel, offsetting part of petroleum tax

New levy replaces part of PDL, which is cut by PKR 2.50 to PKR 75.52/liter for petrol and PKR 74.51 for diesel.

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

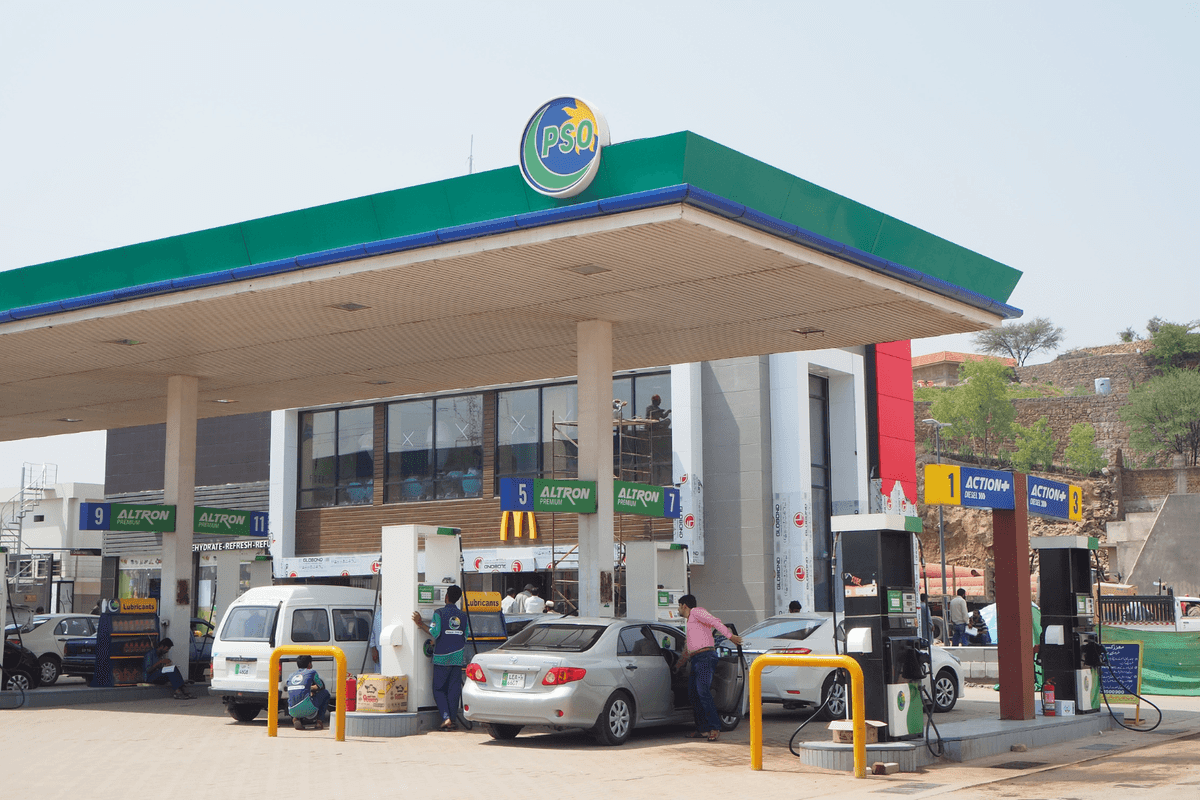

Pakistan has introduced a new Climate Support Levy of PKR 2.50 per liter on petrol and diesel, effective Tuesday, as part of the Finance Bill 2025–26. The measure aims to strike a balance between environmental goals and fiscal demands.

According to documents shared by oil marketing companies and refiners, the new charge replaces a portion of the existing Petroleum Development Levy (PDL), which has been reduced by the same amount—PKR 2.50 per liter—for both petrol and diesel.

Following this adjustment, the PDL now stands at approximately PKR 75.52 per liter for petrol and PKR 74.51 for diesel.

The government’s move comes amid rising fuel costs, as prices surged for the second straight fortnight.

On Monday night, authorities announced a PKR 8.36 hike in petrol prices, bringing the rate to PKR 266.79 per liter, while diesel prices rose by PKR 10.39 to PKR 272.98 per liter.

Officials indicated that without the PDL offset, the recent price hikes would have been even steeper for consumers.

Initially labeled the Carbon Levy, the rebranded Climate Support Levy is expected to generate an estimated PKR 48 billion in revenue during the current fiscal year.

Government sources suggest that the levy could double to PKR 5 per liter in FY26, potentially doubling its revenue contribution.

In tandem with the new levy, the government has also raised the PDL target to PKR 1.468 trillion for FY26. This marks a 26% increase from the revised target for the previous fiscal year.

As tax revenues remain under pressure, the PDL continues to serve as a crucial non-tax revenue source for the government. The increase also aligns with Pakistan’s commitments under the IMF fiscal reform program, which places emphasis on improving revenue collection.

Economic analysts say the dual strategy of adjusting levies reflects a delicate balance between fiscal necessity and shielding consumers from full-price shocks.

They caution, however, that the cumulative impact of such levies could have longer-term implications for inflation, household budgets, and national energy consumption patterns.

Comments

See what people are discussing