3 companies show interest in acquiring majority stake in Rafhan Maize

The company earned a net profit in 2024 amounting to PKR 7.475 billion

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

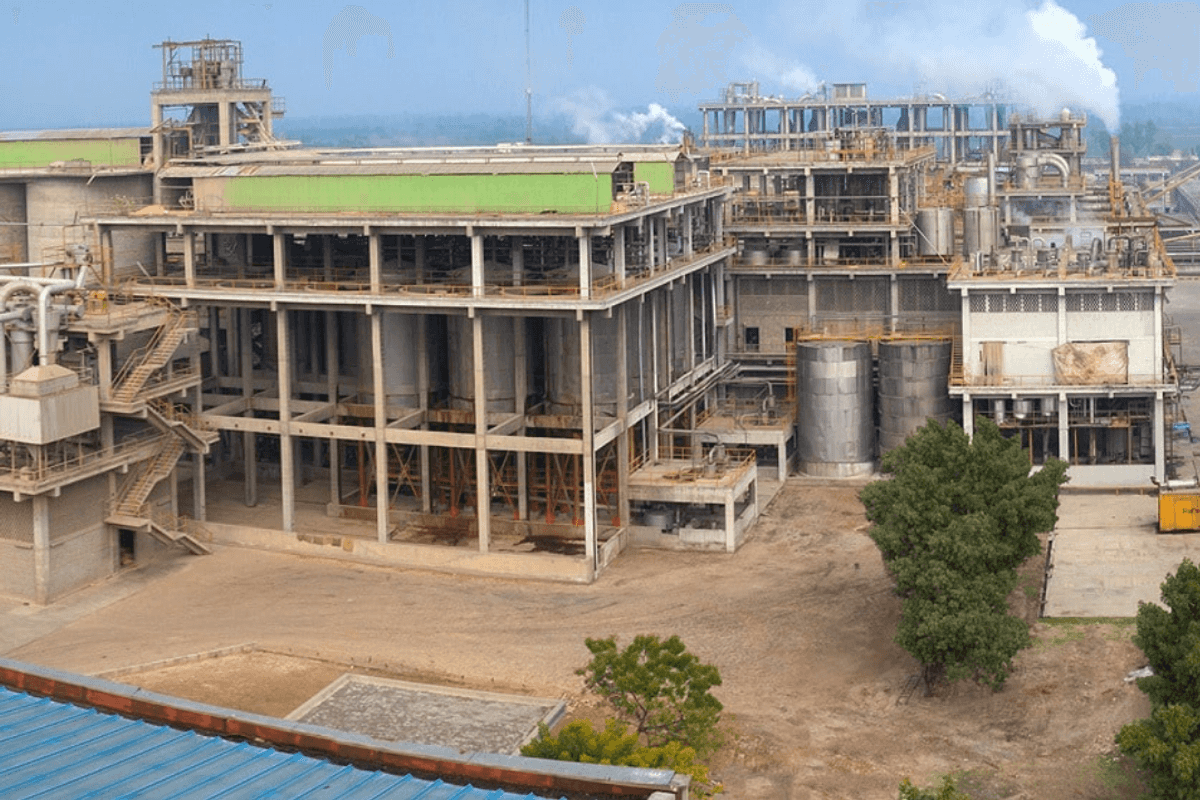

A Rafhan Maize plant

Company website

Three companies have shown interest in acquiring majority stakes in Rafhan Maize having market capitalization of PKR 85 billion.

Through a filing to the Pakistan Stock Exchange, Rafhan Maize informed that Cherat Cement & Shirazi Investments, Nishat Group, and Sapphire Group have expressed an interest in the company's intention to sell 75.69% or 6.991 million shares.

The company earned a net profit in 2024 amounting to PKR 7.475 billion compared with PKR 6.913 billion in the previous year, showing an increase of 8%. The company’s net sales amounted to PKR 69.923 billion compared with PKR 65.467 billion of the previous year.

According to the quarterly report of Rafhan Maize, for the three months ended March 31, the company delivered strong financial performance, recording sales revenue growth of 9% and a net profit-after-tax growth of 8% versus the same period last year.

Prudent pricing, better financial management and strong cost discipline across the organization helped mitigate the impact of raw material price volatility and preserve margin integrity.

The quarterly profit of the company rose to PKR 1.955 billion compared with PKR 1.808 billion where the EPS stood around PKR 211.67 compared with PKR 195.77 in the previous year.

The company’s export business remained a key driver of growth during the quarter, with double-digit sales growth and expansion into new international markets. It also strengthened relationships with existing customers, further integrating its products into global value chains. The performance aligned with the company’s broader diversification strategy and commitment to increasing the export share of its portfolio.

Performance in the industrial segment was mixed amid a challenging operating environment. The textile industry, the largest market for the company’s industrial-grade starches, faced headwinds. While export demand remained steady, domestic downstream demand slowed due to high production costs and weaker demand for fabrics and other textile items.

Meanwhile, the paper and board market stabilized, and packaging products showed strong growth. The chemical and allied as well as home and personal care segments continued to post favorable sales growth.

The food segment's performance was subdued, primarily due to a sharp increase in sugar prices, which affected the operational patterns of the confectionery industry—the main consumer of the company’s liquid glucose. As a result, glucose sales declined.

However, sales to other food categories, including ketchup, sauces, beverages, and processed foods, improved, aided by seasonal demand during Ramzan.

Demand for animal nutrition ingredients remained steady, though lower prices of alternative feed ingredients tempered overall growth. Strategic pricing, partnerships with large farms and feed millers, and expanded geographic reach helped sustain volume sales.

Comments

See what people are discussing