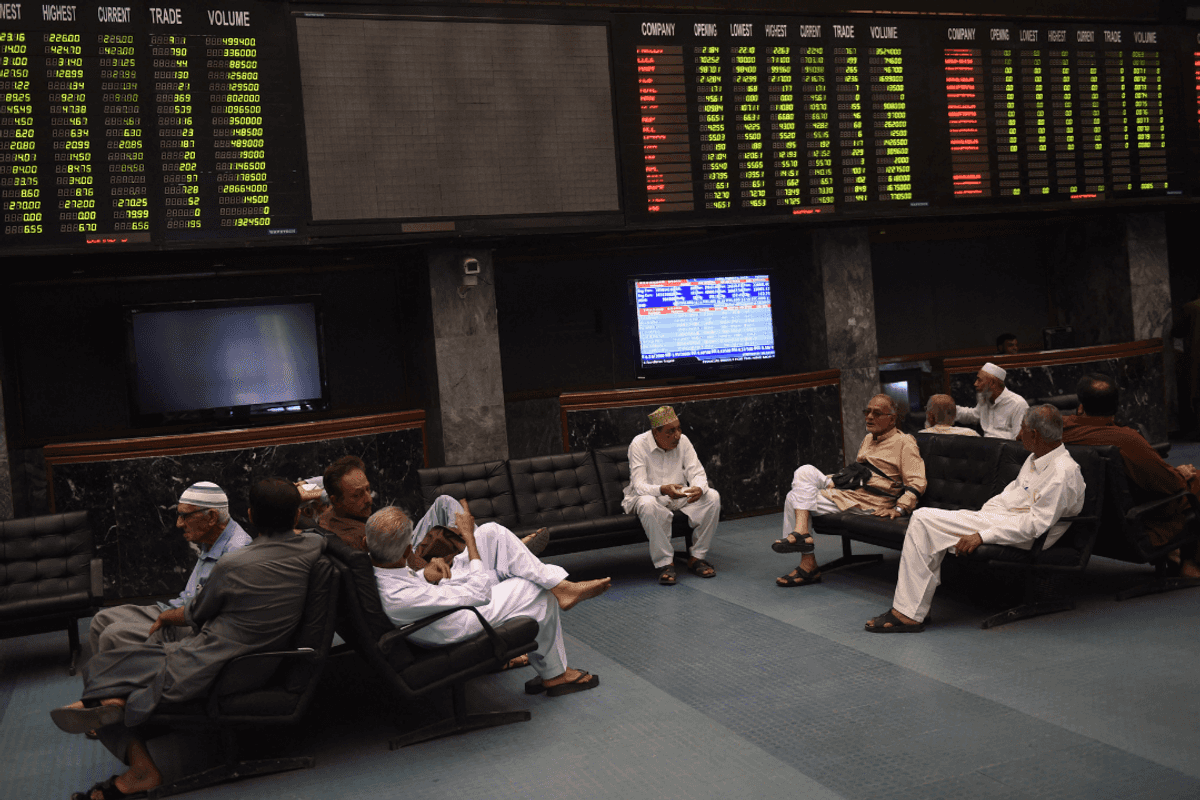

Domestic investors drive liquidity surge at Pakistan Stock Exchange

Rising participation offsets foreign selling as market hits record highs

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

Liquidity at the Pakistan Stock Exchange has strengthened amid rising investor participation and improved market conditions, as domestic investors continue to play a larger role in supporting the market despite persistent foreign selling.

Recent rallies at the PSX, including record highs in the benchmark KSE-100 index, have been driven by heightened trading activity and renewed confidence among local investors. Market participants say the improved liquidity reflects both stronger sentiment and broader participation across investor categories.

The mutual fund sector has recorded robust growth, with total assets under management reaching about PKR 4.1 trillion by the end of 2025. The expansion has been supported by a widening investor base and deeper capital allocation across multiple asset classes, according to market data.

Equity allocations within mutual funds rose 14%, fueled by improved market sentiment and selective positioning in large-cap sectors. Analysts say the shift highlights growing confidence in equities as macroeconomic conditions stabilize.

Investor participation has also expanded at the retail and institutional levels. The number of active trading accounts climbed to roughly 450,000 by late November, based on data from the National Clearing Company of Pakistan Limited. Individual investors accounted for the largest share, with more than 409,000 active accounts, followed by foreign individuals and Roshan Digital Account holders.

Foreign individuals held nearly 17,900 active accounts at the end of November, while accounts linked to overseas Pakistanis rose to more than 18,400. Corporate companies and funds maintained a smaller but stable presence in the market.

Despite notable foreign selling in recent months, domestic investors and local companies have largely absorbed the outflows, helping to maintain market stability. Brokers say sustained liquidity and diversified investment allocations are expected to continue supporting depth at the PSX.

However, analysts caution that external macroeconomic risks, including global interest rates, commodity prices and geopolitical developments, remain key factors to monitor and could influence market direction in the months ahead.

Comments

See what people are discussing