Pakistan central bank likely to cut interest rate by 50bps

This would reduce the rate to 10.5%, the lowest in nearly three years

Haris Zamir

Business Editor

Experience of almost 33 years where started the journey of financial journalism from Business Recorder in 1992. From 2006 onwards attached with Television Media worked at Sun Tv, Dawn Tv, Geo Tv and Dunya Tv. During the period also worked as a stringer for Bloomberg for seven years and Dow Jones for five years. Also wrote articles for several highly acclaimed periodicals like the Newsline, Pakistan Gulf Economist and Money Matters (The News publications)

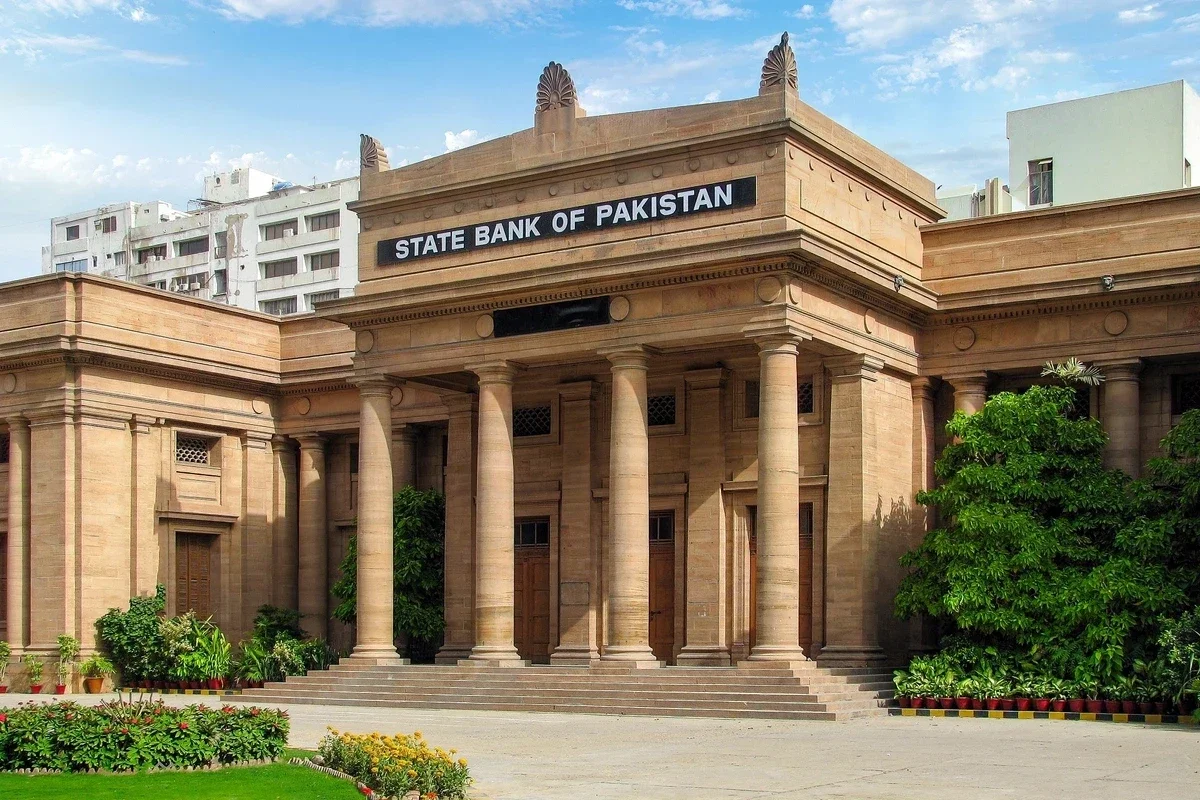

Pakistan's central bank is likely to cut the benchmark interest rate by 50 basis points (bps) to 10.5% — a nearly three-year low — in a meeting of its Monetary Policy Committee on Wednesday.

The primary reasons for the expected cut are easing inflation, and the improving external position which showed a surplus in June.

Reports of brokerage firm Arif Habib Ltd. and Topline Securities revealed that the State Bank of Pakistan is likely to slash the rate by 50bps.

The last time the interest rate was this low was in December 2021 when it stood at 9.75%.

"With inflation down, the external position currently in a manageable zone, and yields already on a downward slope, conditions seem ripe for further monetary easing, though some risks cast a shadow. Inflation fades, confidence builds," said Sana Tawfik, head of research at Arif Habib Ltd.

Inflation appears to have been contained as it eased to 3.2% in June from 3.5% in May. Core inflation is also drifting lower, clocking in at 7.5% in June.

Going forward, average headline inflation for FY26 is expected to remain within the State Bank's medium-term target of 5-7%, while core inflation is also likely to hover around 8%.

Pakistan posted a $328 million current account surplus in June, pushing the FY25 tally to $2.1 billion, a mirror image of last year's $2.1 billion deficit, according to an Arif Habib report. This improvement in external balances has helped restore macro stability.

"Looking ahead, while the current account is expected to slip back into deficit, our projection suggests it will remain at a manageable level — $1.6 billion — in FY26. This improved outlook hasn't gone unnoticed. With global rating agencies taking notice; S&P recently upgraded Pakistan to 'B-' with a stable outlook, confidence in the country's macro story is returning," Tawfik said.

She also noted that the PKR has depreciated just 0.4% since the start of the fiscal year, showcasing relative calm. However, with imports rising, pressure could gradually build.

A modest rate cut, however, is unlikely to trigger volatility, supported by the external flows expected by the authorities in FY26, the head of research added.

Comments

See what people are discussing