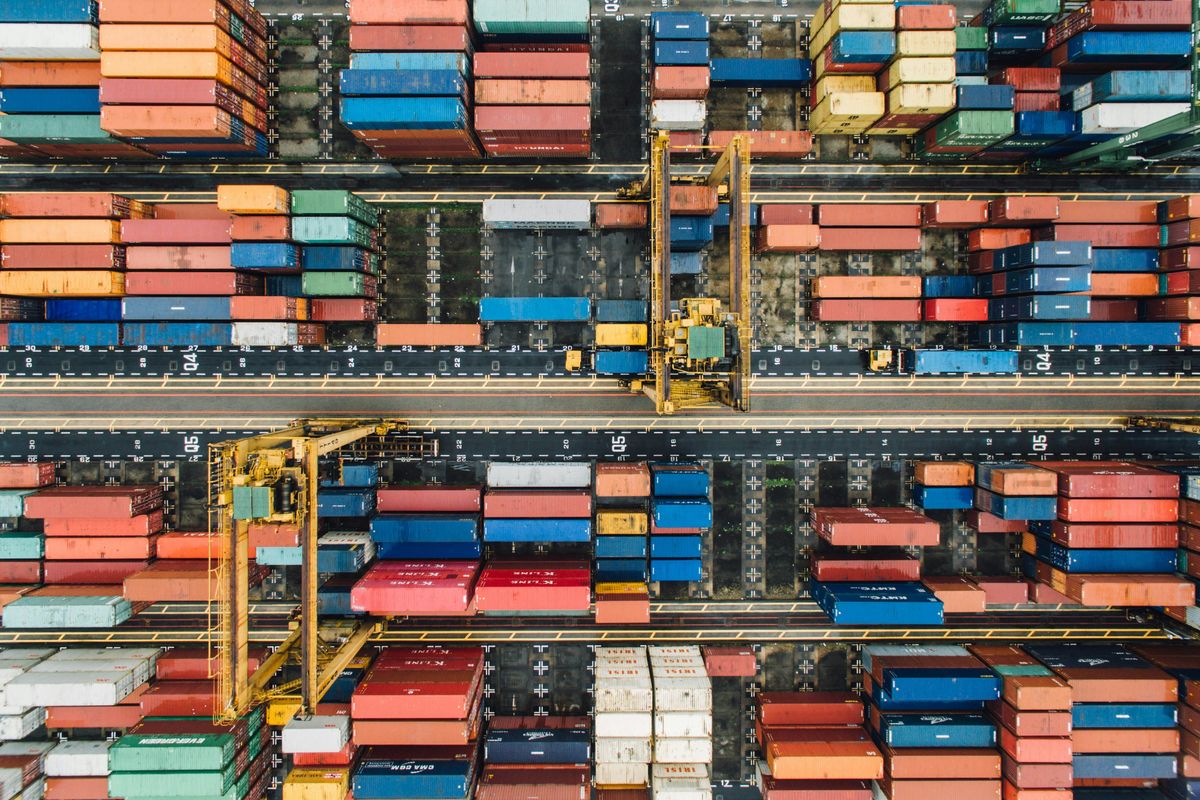

Pakistan formalizes barter trade rules with Russia, Iran, and Afghanistan

New customs framework introduces digital clearance via Pakistan Single Window

Haris Zamir

Business Editor

Experience of almost 33 years where started the journey of financial journalism from Business Recorder in 1992. From 2006 onwards attached with Television Media worked at Sun Tv, Dawn Tv, Geo Tv and Dunya Tv. During the period also worked as a stringer for Bloomberg for seven years and Dow Jones for five years. Also wrote articles for several highly acclaimed periodicals like the Newsline, Pakistan Gulf Economist and Money Matters (The News publications)

Pakistan has officially notified the customs clearance procedure for barter trade with Russia, Iran and Afghanistan, a move officials say will strengthen regional economic cooperation and reduce reliance on the U.S. dollar for cross-border settlements.

According to the Ministry of Commerce, all customs authorities will now follow a structured procedure for processing imports and exports under the barter trade system. The new framework is designed to improve transparency, ensure regulatory compliance and streamline documentation through the Pakistan Single Window (PSW) system.

Under the notified rules, import and export values must remain balanced, with a 20% tolerance margin allowed for fluctuations in assessed values. Importers and exporters will be required to submit a single declaration through the PSW, tagging the relevant approval number to waive financial instruments typically required for conventional trade.

All goods traded under the barter arrangement must comply with Import and Export Policy Orders, including applicable permits, licenses and certificates. Each transaction will also be subject to relevant duties, taxes and fees, with the assessed value determining the monetary limit of authorization.

A certificate of origin issued by the exporting country’s authorized body must accompany all consignments. Traders will be required to settle the net value of goods within 120 days of the transaction; failure to do so will render the authorization invalid.

The regulatory Collectorate of Customs will oversee compliance and may initiate legal action under the Customs Act of 1969 in case of violations. The Federal Board of Revenue will reconcile barter trade data through its computerized system and submit quarterly reports to the Commerce Division detailing total applications, authorizations and trade balances.

Analysts say the move represents a significant step toward promoting non-dollar trade and deepening regional economic ties with neighboring and sanctioned economies.

Under the notified procedure:

- Import and export values must remain balanced, with a 20% tolerance margin allowed for fluctuations in assessed values.

- Both importers and exporters are required to submit a single declaration via the PSW, tagging the relevant approval number to waive financial instruments typically required for regular trade.

- All goods traded under the barter arrangement must comply with Import and Export Policy Orders (IPO/EPO), including applicable permits, licenses, and certificates.

- Each transaction will be subject to relevant duties, taxes, and fees, with the assessed value determining the monetary limit of authorization.

Comments

See what people are discussing