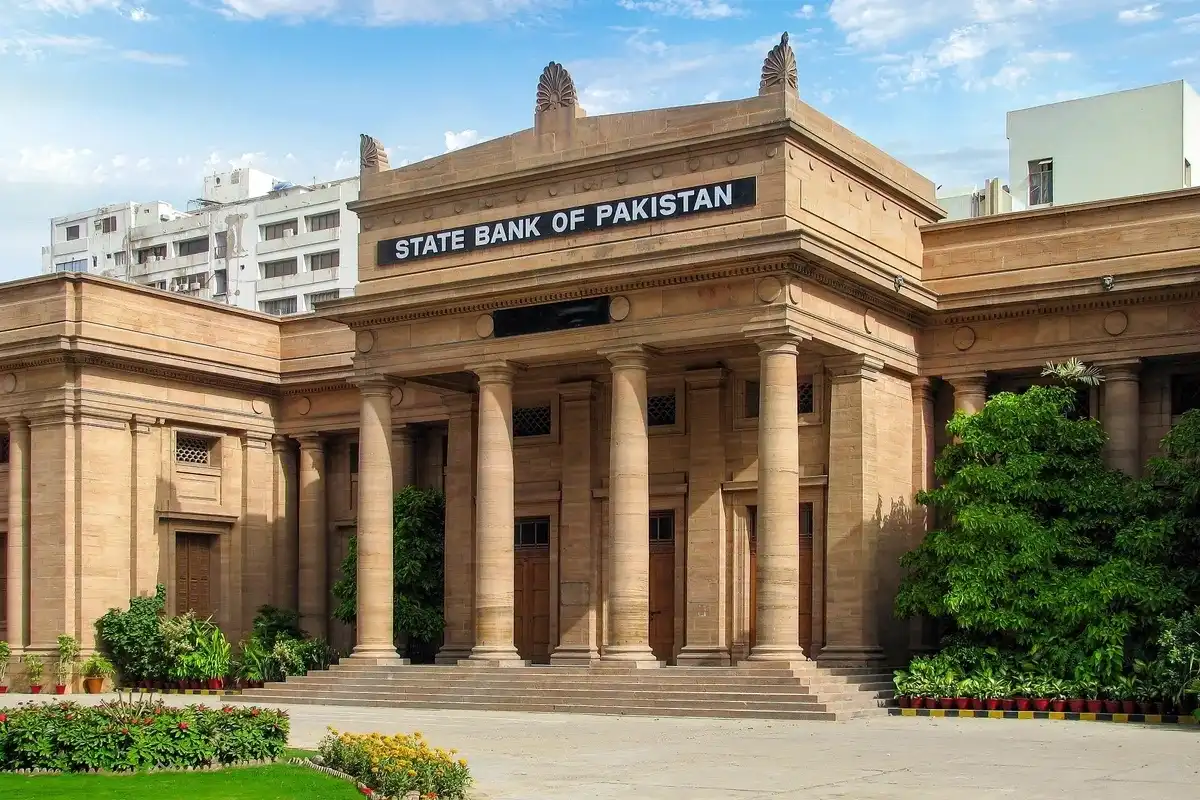

Pakistan's central bank keeps interest rate unchanged yet again

The interest rate has remained 11% since May

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

The State Bank of Pakistan (SBP) decided on Monday to maintain the benchmark interest rate at 11% for the fourth time in a row.

The decision was announced after a meeting of its Monetary Policy Committee, and was in line with market expectations.

In its Monetary Policy Statement, the State Bank said headline inflation rose significantly to 5.6% in September from 3% in August, while core inflation remained steady at 7.3%. The MPC said the decision to maintain the current policy rate was “appropriate to maintain ongoing price stability” given the still-unfolding effects of earlier monetary easing.

The committee noted that the overall macroeconomic outlook has improved compared with its previous assessment. “Crop losses are likely to be contained, while supply disruptions turned out to be minimal,” the statement said. “Economic activity gained further momentum, as depicted by robust growth in high-frequency economic indicators.”

At the same time, the MPC highlighted uncertainties stemming from volatile global commodity prices, challenging export prospects amid changing tariff dynamics, and potential domestic food supply frictions.

Among major developments since its last meeting, the MPC noted that real GDP growth for FY25 was revised upward by the Pakistan Bureau of Statistics to 3% from 2.7%. Initial estimates for major Kharif crops by the Federal Committee on Agriculture remained close to last year’s levels despite the floods.

The central bank also reported that its foreign exchange reserves continued to increase despite a $500 million Eurobond repayment, reaching $14.5 billion as of October 17. Pakistan also reached a staff-level agreement with the International Monetary Fund on reviews under the Extended Fund Facility (EFF) and Resilience and Sustainability Facility (RSF). Inflation expectations of both consumers and businesses have eased in recent sentiment surveys, the bank added.

Global commodity prices showed mixed trends, with oil prices displaying heightened volatility.

The MPC said the real policy rate remains adequately positive to stabilize inflation within the 5 to 7% target range over the medium term. It emphasized the importance of continued buildup in external and fiscal buffers to absorb future shocks and support economic recovery without fueling inflation or external imbalances.

Economic growth strengthens

High-frequency indicators point to sustained growth momentum, the MPC said. Major Kharif crops performed better than expected, with satellite imagery showing healthier vegetation cover. Improved input conditions and expected post-flood yield recovery have also brightened prospects for Rabi crops.

Large-scale manufacturing expanded by 4.4% during July-August FY26, compared with a slight contraction during the same period last year. Strong demand for automobiles, cement, fertilizers, and petroleum products, along with stronger private-sector credit and improved business sentiment, contributed to the improved industrial outlook.

The central bank now expects real GDP growth to be in the upper half of its earlier projected range of 3.25 to 4.25% for FY26.

External position remains stable

Pakistan recorded a current account surplus of $110 million in September, reducing the cumulative deficit to $594 million for the first quarter of FY26. The figures were broadly in line with expectations, the bank said.

Exports grew moderately while imports increased at a faster pace, widening the trade deficit. However, workers’ remittances remained resilient, and net financial inflows helped boost reserves.

The bank projects that the current account deficit will remain within 0 to 1% of GDP in FY26, with reserves expected to reach $15.5 billion by December and around $17.8 billion by June next year.

Fiscal consolidation continues

Tax collection grew by 12.5% year-on-year to PKR 2.9 trillion in the first quarter of FY26 but fell short of the target by PKR 198 billion. Non-tax revenues were bolstered by higher petroleum levy receipts and the transfer of sizable SBP profits.

Both the overall fiscal and primary balances are likely to post surpluses in Q1-FY26, the MPC said. It reiterated the need to maintain fiscal discipline to meet balance targets and ensure long-term fiscal sustainability, noting that post-flood rehabilitation expenditures are expected to be met from budgeted resources.

Monetary and credit conditions

Broad money (M2) growth decelerated to 12.3% as of October 10, driven by a decline in banks’ net domestic assets, mainly due to slower credit to non-bank financial institutions. Net budgetary borrowing remained contained, creating room for private-sector credit, which grew 17%.

Private-sector credit expansion was broad-based, led by sectors including textiles, telecommunications, chemicals, and wholesale and retail trade. On the liability side, currency in circulation grew year-on-year while deposit growth slowed, pushing the currency-to-deposit ratio to 37.6%. This high cash growth kept reserve money expansion elevated, the statement said.

Inflation outlook

The central bank attributed September’s sharp inflation uptick to flood-related food price pressures, higher energy prices, and persistent core inflation. However, it said the recent rise in food prices appears milder than in previous flood episodes, with a slowdown already visible in weekly price data for wheat, sugar, and perishables.

Still, the MPC expects inflation to temporarily exceed the 5-7% target range for a few months in the second half of FY26 before returning to the target in FY27. Risks to this outlook stem from global commodity volatility, energy price adjustments, and domestic food supply uncertainties.

The MPC concluded by reaffirming the need for “coordinated and prudent monetary and fiscal policies and structural reforms” to sustain the recent economic improvement and ensure medium-term stability.

Comments

See what people are discussing