Pakistan projects 4.2% economic growth in FY26 amid industrial rebound

Government targets broad-based recovery led by agriculture and large-scale manufacturing, with inflation expected to ease to 7.5%

Haris Zamir

Business Editor

Experience of almost 33 years where started the journey of financial journalism from Business Recorder in 1992. From 2006 onwards attached with Television Media worked at Sun Tv, Dawn Tv, Geo Tv and Dunya Tv. During the period also worked as a stringer for Bloomberg for seven years and Dow Jones for five years. Also wrote articles for several highly acclaimed periodicals like the Newsline, Pakistan Gulf Economist and Money Matters (The News publications)

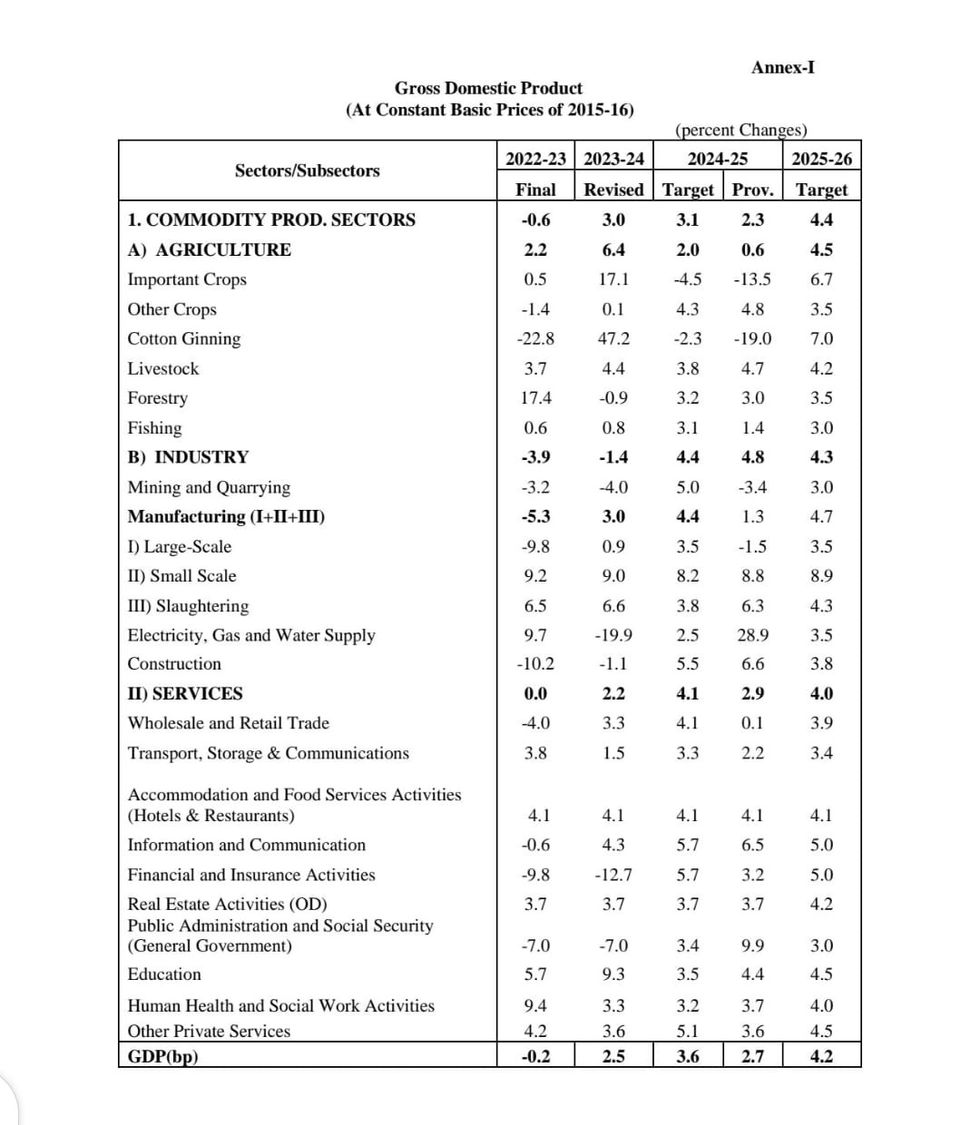

Pakistan’s economy is projected to grow by 4.2% in the fiscal year 2025-26, signaling expectations of a broad-based recovery driven by a rebound in agriculture and large-scale manufacturing, according to a working paper for the Annual Plan Coordination Committee (APCC) meeting obtained by Nukta.

The document forecasts that commodity-producing sectors will expand by 4.4%, fueled by a 4.5% rebound in agriculture and a 3.5% uptick in large-scale manufacturing. Agriculture growth is expected to be supported by a recovery in important crops (6.7%) and cotton ginning (7.0%), along with continued strength in the livestock sector.

The industrial sector is also projected to benefit from positive momentum in large-scale manufacturing (3.5%) and mining and quarrying (3.0%), alongside sustained growth in construction and the energy, gas, and water supply sectors.

The services sector — the largest component of GDP — is expected to grow by 4.0%, supported by stronger performances in wholesale and retail trade, transport, storage and communications, financial services, and real estate. These projections reflect cautious optimism, contingent on sound macroeconomic management and stable external conditions.

National savings are forecast to remain at 14.3% of GDP in FY2025-26, financing total investment of 14.7% of GDP — up from 13.8% in FY2024-25 — reflecting a narrowing savings-investment gap to be bridged through modest external inflows. Public investment is projected to increase from 2.9% to 3.2% of GDP, while private investment is expected to rise from 9.1% to 9.8%.

Fiscal and monetary policies will focus on consolidation and stability, with inflation forecast to ease to 7.5%, aided by a low base effect. However, risks remain due to ongoing global trade tensions and domestic tariff rationalization measures.

The external sector may experience pressure as easing import controls and debt repayments are expected to widen the current account deficit. Nonetheless, strong remittances, recovering exports, and anticipated external financing are projected to help cushion these pressures and support external sustainability.

Comments

See what people are discussing