Pakistan's tax collection in July-August falls short of target by PKR 98 billion

The FBR collected PKR 1,456 billion against a target of Rs1,554 billion during the two months

Shahzad Raza

Correspondent

Shahzad; a journalist with 12+ years of experience, working in Multi Media. Worked in Field, covered Big Legal Constitutional and Political Events in Pakistan since 2012. Graduate of Islamic University Islamabad.

The FBR collected PKR 1,456 billion against a target of Rs1,554 billion during the two months

Shutterstock

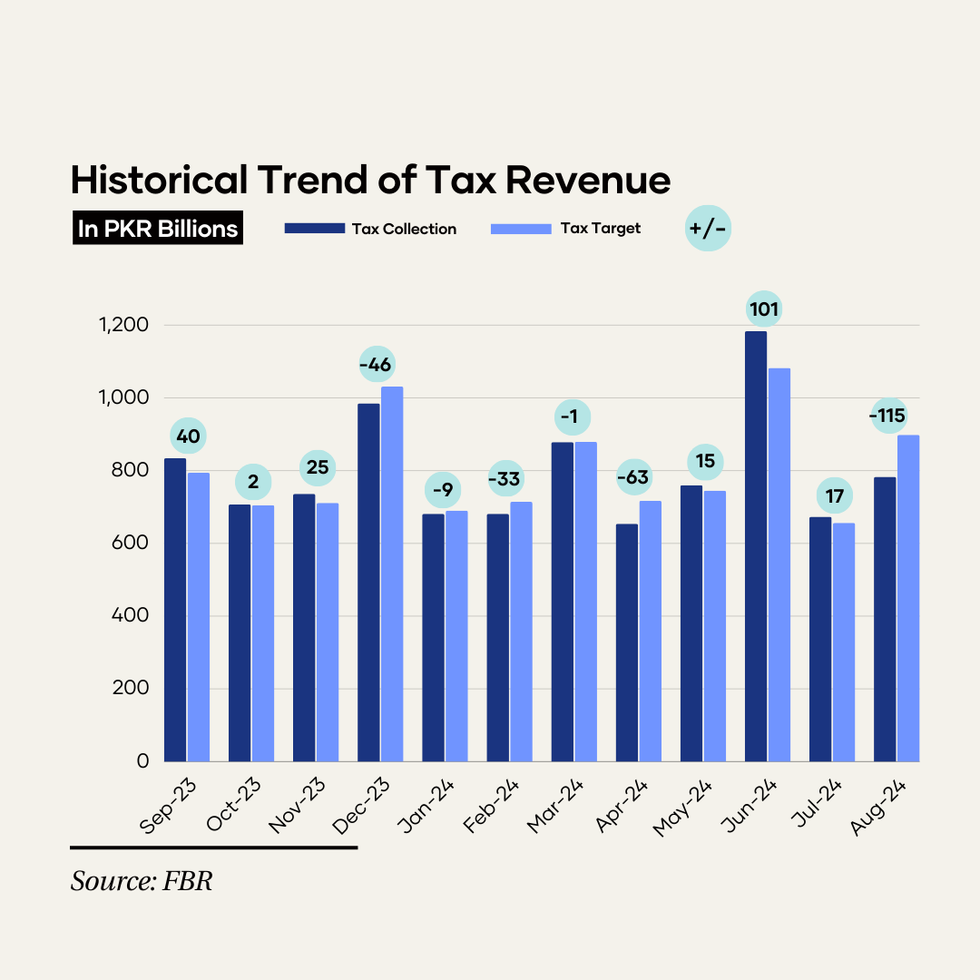

Pakistan missed its revenue collection target for July-August by PKR 98 billion, data released by the Federal Board of Revenue (FBR) showed on Sunday.

The FBR collected PKR 1,456 billion against a target of Rs1,554 billion during the two months. It also issued refunds of PKR 132 billion — 44% higher compared to the same period last year — to exporters to resolve their liquidity problems.

Overall, the FBR collected gross revenue of PKR 1,588 billion in the first two months of the current fiscal year.

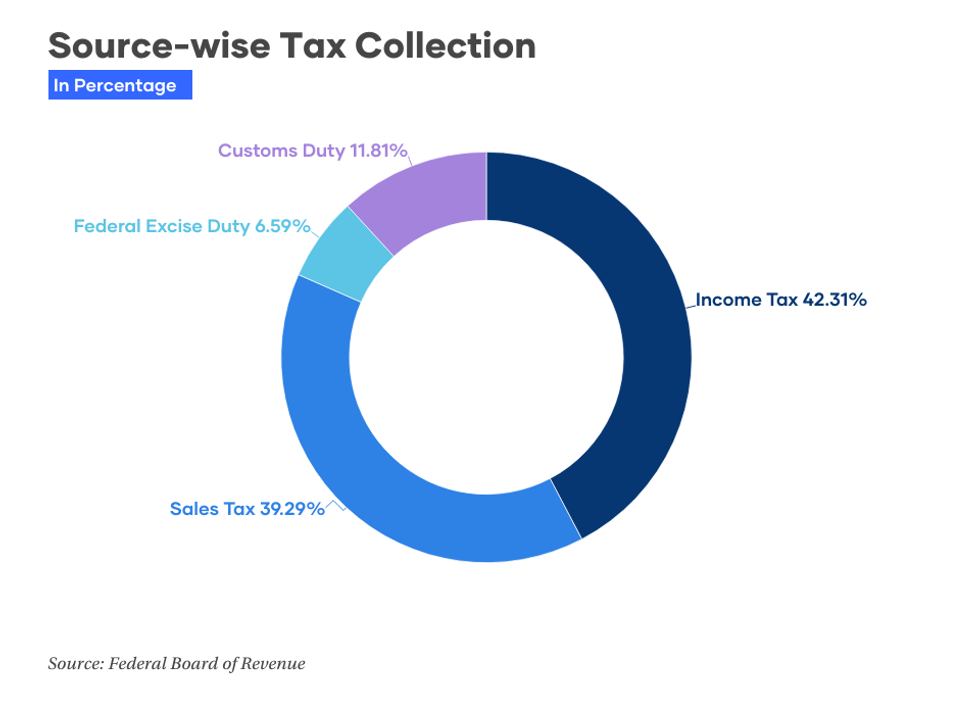

Of this amount, PKR 616 billion was collected in the form of income tax, an increase of 26% compared to PKR 489 billion in July and August 2023.

Meanwhile, sales tax collection grew by 21% year-on-year to reach PKR 572 billion.

Around PKR 96 billion was collected as Federal Excise Duty (FED) showing a year-on-year increase of 19%.

However, on the import side, the same momentum could not be maintained due to continued compression in imports. Data showed the country's imports declined by 2.2% in dollar terms and 7% in rupee terms in August compared to the same month last year.

Moreover, the import of items that have high duties such as vehicles, home appliances and miscellaneous consumer goods — including garments, fabrics, footwear etc — have reduced significantly, changing the import mix. This trend has impacted collection of customs duties as well as other taxes collected at the import stage.

Consequently, collection of customs duties increased by a modest 4% during the period to PKR 172 billion.

The FBR is likely to achieve revenue targets of the first quarter as both the economic activity and imports are expected to grow in September due to a lower policy rate, interventions by the government in recent months, and the tax body's digitalization and other reforms.

These reforms include an end-to-end monitoring of supply chains, automated production monitoring, POS, AI-based data integration, import scanning and strict integrity management of the FBR workforce.

The FBR is also doing a revamp of its business processes to facilitate business growth and ease.

Comments

See what people are discussing