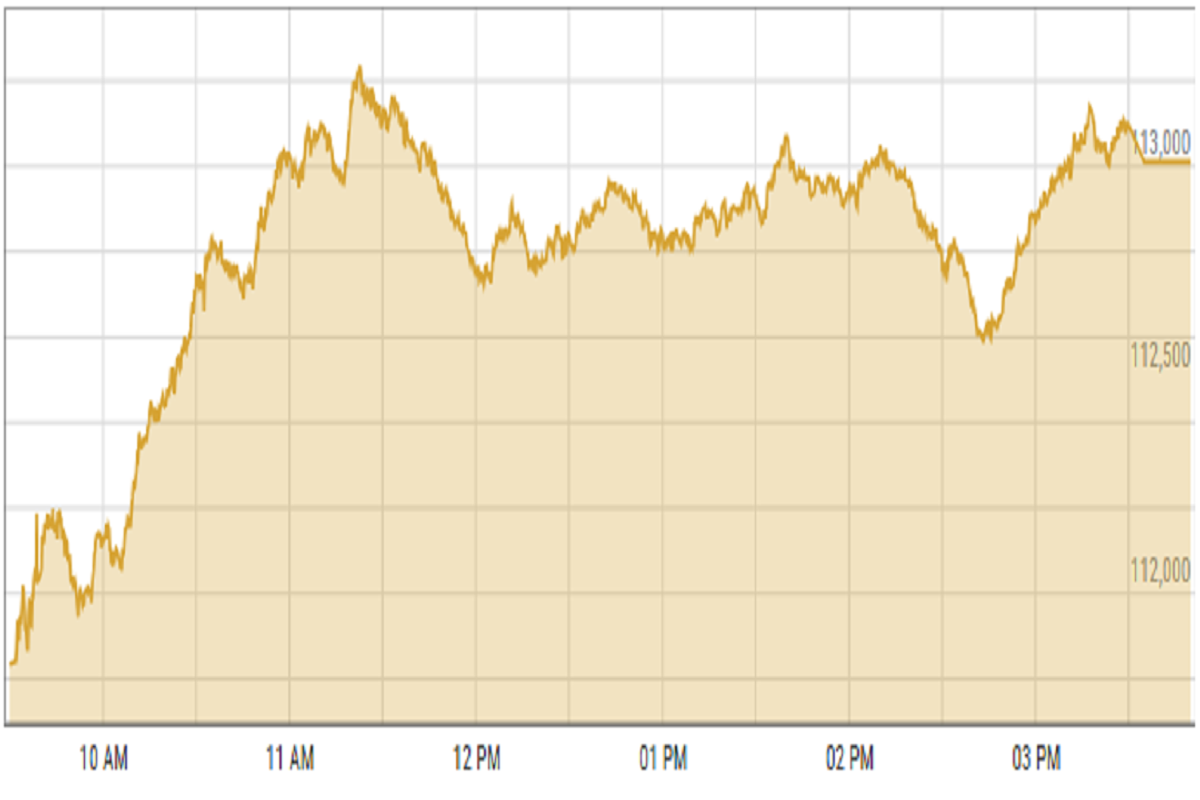

Pakistan stocks close positive buoyed by value buying

Two IPOs scheduled for this month fueled market momentum

KSE-100 index gained 1.47%

PSX

Pakistan's stock market closed on a positive note Tuesday, showcasing a glimmer of optimism as investors took advantage of value buying opportunities during the ongoing results season. The bullish sentiment was bolstered by the anticipation of two initial public offerings (IPOs) scheduled for this month, adding further momentum to the market.

Data released by the National Clearing Company of Pakistan Limited (NCCPL) yesterday indicated a reduction in selling pressure from local institutions, which played a crucial role in sustaining the market's gains. Investors capitalized on these favorable conditions, driving the market to close higher.

Market analysts believe that the combination of value buying and the upcoming IPOs has created an encouraging environment for investors, reflecting a renewed sense of confidence in the market.

KSE-100 index gained 1.47% or 1,632.03 points to close at 113,010.38 points.

Indian stocks did worse than other countries' stocks as major indices fell by more than 1%. This drop was mainly because of fears about a worsening trade war after Trump imposed a 25% import tariff on steel and aluminum, which could hurt India's business.

Investors are already worried because of expected low government spending and poor earnings reports, causing uncertainty and making them sell off their shares.

BSE-100 index shed 1.60% or 392.31 points to close at 24,057.42 points.

DFM General Index gained 1.41% or 74.45 points to close at 5,335.76 points.

Commodities

Oil prices continued to rise on Tuesday, driven by reports of Russian oil production falling below quotas and concerns over potential supply disruptions.

However, the gains were tempered by fears that increasing trade tariffs might hinder global economic growth.

Brent crude prices surged 1.15% to $76.74 per barrel.

On Tuesday, gold prices surged to a record high, driven by a demand for safe-haven assets. The increase was prompted by US President Donald Trump's new tariffs on steel and aluminum imports, which heightened fears of a potential global trade war.

International gold prices declined 0.04% reaching $2,905.57 per ounce.

Currency

US dollar eased against PKR in the inter-bank market. Pakistani currency gained 5 paisas to 279.16. In the open market USD was trading at PKR 281.

Popular

Spotlight

More from Business

Lulu Retail reports strong growth in 2024, expands store network and e-commerce presence

Lulu’s EBITDA grew 4.4% to $786.3 million, with stable margins at 10.32%, driven by improved gross margins.

Comments

See what people are discussing