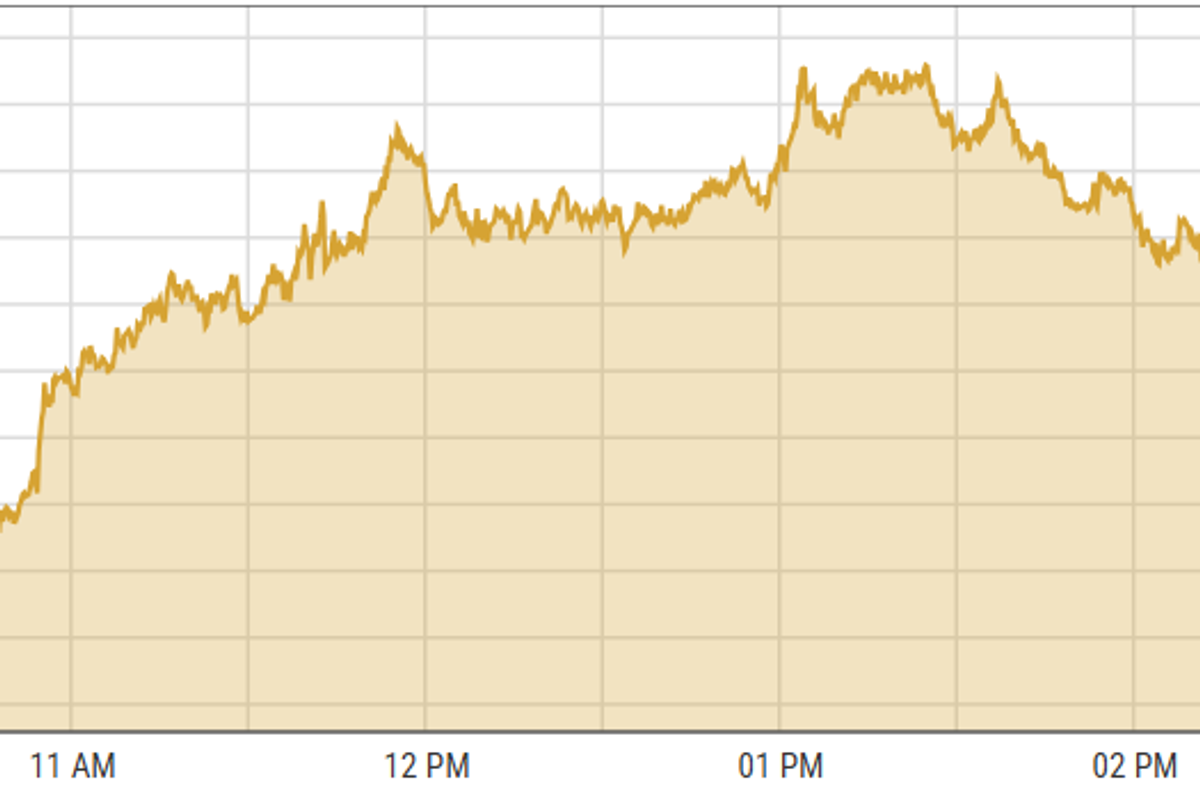

Pakistan stocks continue to rally on the back of improved economic indicators

KSE-100 index gained 0.74% to close at 90,864.09 points

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

KSE-100 index gains 0.74% to 90,864.09 points.

PSX

Pakistan stocks gained another 0.74% on Tuesday driven by improved macroeconomic indicators and growing investor confidence post Saudi Arabia’s confirmation for a fresh $1.2 billion oil facility.

Analysts said that lower inflation and declining interest rates have increased liquidity, encouraging investors to take fresh positions in the market.

The market is surging due to lower inflation, declining interest rates, strong company profits, rupee stability, a favorable external outlook, and cheap valuations.

The upcoming Monetary Policy Committee (MPC) meeting, expected to cut the interest rate by 200 basis points, is the near-term trigger.

KSE-100 index gained 668.58 points or 0.74% to close at 90,864.09 points.

Indian shares were lackluster on Tuesday, dragged down by auto and pharma stocks. Caution prevailed due to weak earnings, foreign selling, upcoming U.S. jobs data, and uncertainty over the presidential election.

Indian stock markets went up on Monday as investors opted for value buying.

India’s BSE 100 Index gained 0.55% or 141.86 points to close at 25,787.92 points.

The Dubai Financial Market (DFM) General Index gained 1.29% or 57.73 points to close at 4,536.92 points.

Commodities

Oil prices rose modestly on Tuesday after the Energy Department announced plans to buy 3 million barrels of crude for the Strategic Petroleum Reserve.

This followed the largest one-day fall in over two years after Israel's strike spared Iran's oil infrastructure.

Despite short-term gains, the longer-term outlook remains negative due to China's economic struggles, bad news from Germany, potential plant closures by Volkswagen, and increased crude production by non-OPEC countries.

Brent crude prices surged 1.06% to $72.18 per barrel.

Gold prices stayed near record highs on Tuesday, supported by uncertainty around the upcoming U.S. presidential election.

Investors are waiting for key economic data to understand the Federal Reserve's interest rate plans.

The elections may keep gold attractive as a hedge against market turbulence. A temporary pause in the U.S. dollar and Treasury yields also supported gold.

International gold prices increased 0.27% reaching $2,750.17 per ounce. In Pakistan, gold prices surged by PKR 1,600 to PKR 285,000/tola on Tuesday.

Currency

US dollar gained ground against PKR, up 0.02% in the inter-bank market. Pakistani currency settled at 277.74, a loss of 6 paisas against the US dollar. In the open market USD was trading at PKR 280.

Comments

See what people are discussing