Pakistan stocks fall after 3 days of gains

Oil, banks and cement face selling

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

SE-100 index shed 0.27%

PSX

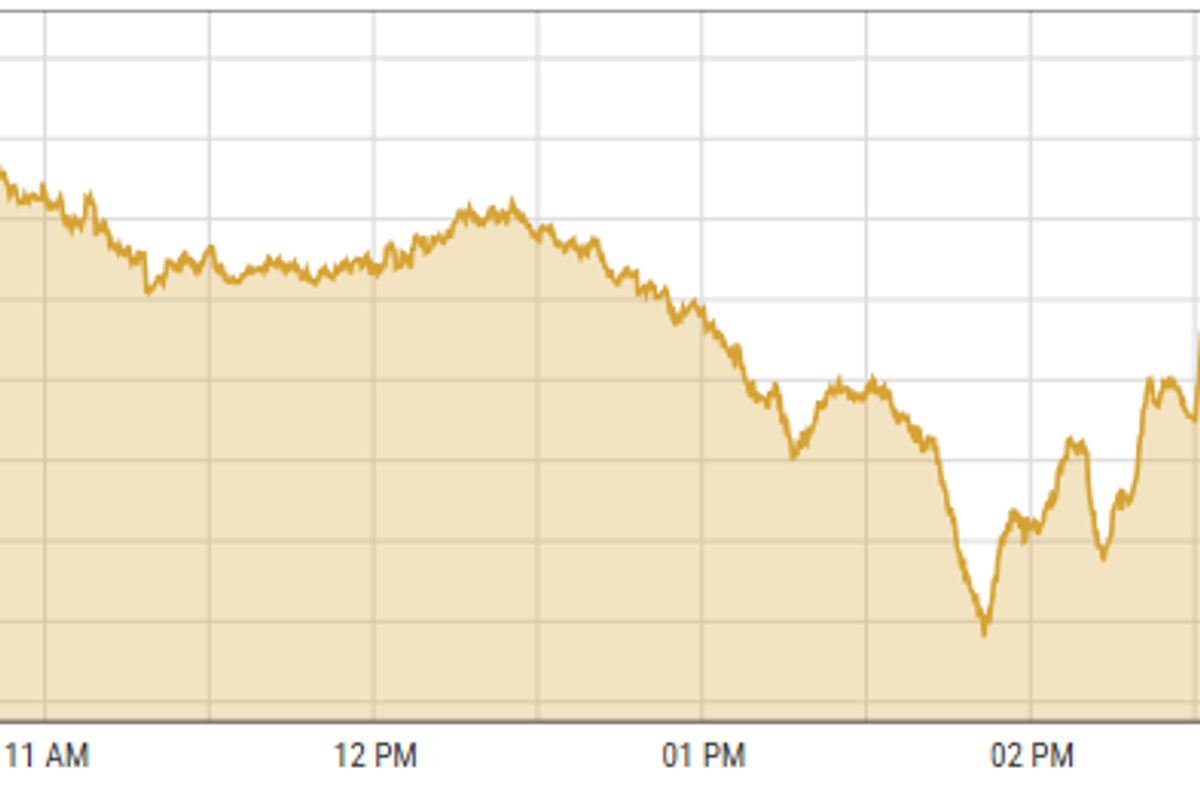

Pakistan's stock market experienced a downturn on Wednesday, closing on a negative note after three consecutive days of gains.

Slight volatility was observed as the market corrected itself.

Major sectors such as oil & gas exploration companies, commercial banks, and cement were the primary laggards, collectively shedding 253 points from the index.

Moreover, the Ministry of Power announced plans to initiate and process settlements of contracts with 14 additional independent power producers. The government has reportedly saved PKR 1.4 trillion by revising agreements with power companies, leading to expectations of a reduction in power tariffs to be announced by the prime minister

The benchmark KSE-100 index shed 0.27% or 308.46 points to close at 114,495.71 points.

Separately, Indian stock markets closed higher for the second day in a row on Wednesday, mainly due to gains in IT and energy stocks.

However, the overall rise was limited because of worries about slowing company profits and economic growth. Investors were also cautious before the release of US inflation data.

The BSE-100 index gained 0.3% or 73.95 points to close at 24,385.90 points.

The DFM General Index gained 0.10% or 5.31 points to close at 5,250.86 points.

Commodities

Oil prices surged because of more U.S. sanctions on Russia, making people worry about potential disruptions to the world's oil supply. This is happening even though the U.S. Energy Information Administration (EIA) predicts there will be more oil than needed over the next two years.

Investors are now waiting for official inventory data from the EIA, expected later today, which is likely to show a one-million-barrel drop in crude oil stocks for the second week in a row.

Brent crude prices gained 0.10% to $80 per barrel.

Gold prices went up on Wednesday because the U.S. dollar weakened. Investors are waiting for the December consumer price inflation data, especially after yesterday's producer prices were lower than expected.

They are watching this data to get clues about future monetary policy changes. The forecast predicts an increase in annual inflation to 2.9% in December, up from 2.7% the previous month.

International gold prices increased 0.65% reaching $2,685.96 per ounce.

Currency

U.S. dollar eased against PKR in the inter-bank market. Pakistani currency shed five paisas to close at 278.77 per dollar. In the open market, the dollar was trading at PKR 280.50.

Comments

See what people are discussing