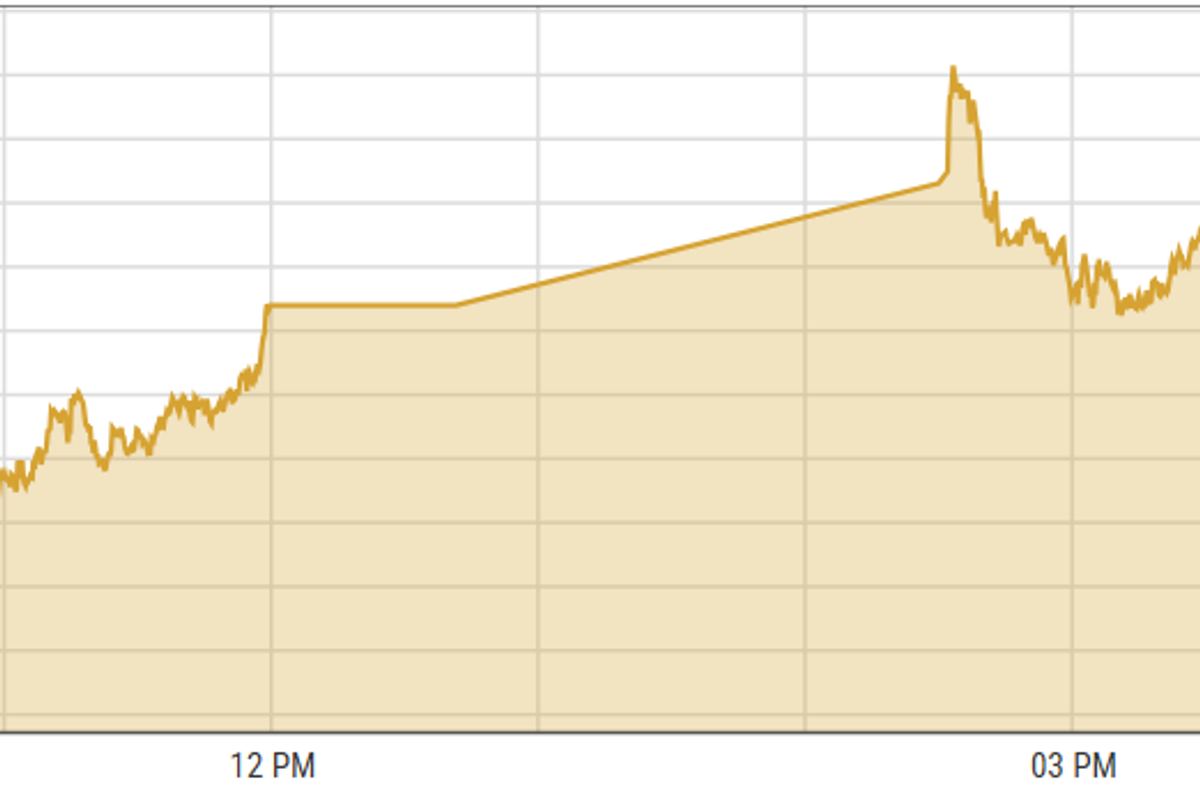

Pakistan stocks hit all-time high amid global easing measures and investor optimism

KSE-100 index gained 0.83% to close at 93,291.68 points

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

PSX

Pakistan's stock market closed on a high note, reaching an all-time high. Investors engaged in value buying, encouraged by global easing measures as the Federal Reserve and the Bank of England both cut interest rates by 25 basis points each, boosting optimism for lower rates in future.

Additionally, MSCI increased its standard index weight to 4.4%, attracting foreign interest. Falling bank lending rates and government bond yields further fueled the record bullish activity at the Pakistan Stock Exchange (PSX).

KSE-100 index gained 771.2 points or 0.83% to close at 93,291.68 points.

Benchmark Indian equity indices fell for the second consecutive session on Friday, largely due to declines in financial and Oil Marketing Company (OMC) stocks.

Concerns over disappointing corporate earnings and ongoing foreign outflows overshadowed gains in information technology stocks, following the U.S. Federal Reserve's anticipated interest rate cut.

India’s BSE 100 Index lost 1.09% or 282.66 points to close at 25,585.45 points.

The Dubai Financial Market (DFM) General Index shed 0.09% or 4.34 points to close at 4,639.83 points.

Commodities

Oil prices dropped on Friday as worries about Hurricane Rafael's impact on U.S. Gulf oil and gas infrastructure faded.

Investors were also considering new economic stimulus measures from China.

Despite reversing Thursday's nearly 1% gains, Brent and WTI are still expected to end the week 2% higher.

Investors are also looking at how U.S. President-elect Donald Trump's policies might affect oil supply and demand.

Additionally, crude imports in China, the world's largest oil importer, fell by 9% in October, marking the sixth straight month of decline.

Brent crude prices declined 0.98% to $74.89 per barrel.

Gold prices dropped on Friday and were heading for their biggest weekly fall in over five months.

This happened as markets reacted to Donald Trump's victory and its potential impact on U.S. interest rates.

On Thursday, the Federal Reserve cut interest rates by 25 basis points, as expected, but signaled a cautious approach to further cuts. Fed Chair Jerome Powell said the election results would not affect U.S. monetary policy in the near term. Traders believe there is a 71% chance of another 25-basis-point cut in December.

International gold prices declined 0.33% reaching $2,688.68 per ounce. In Pakistan, gold prices increased by PKR 2,000 to PKR 278,800/tola on Friday.

Currency

US dollar weakened against PKR, down 0.08% in the inter-bank market. Pakistani currency settled at 277.73, a gain of 21 paisas against the US dollar. In the open market USD was trading at PKR 280.5.

Comments

See what people are discussing