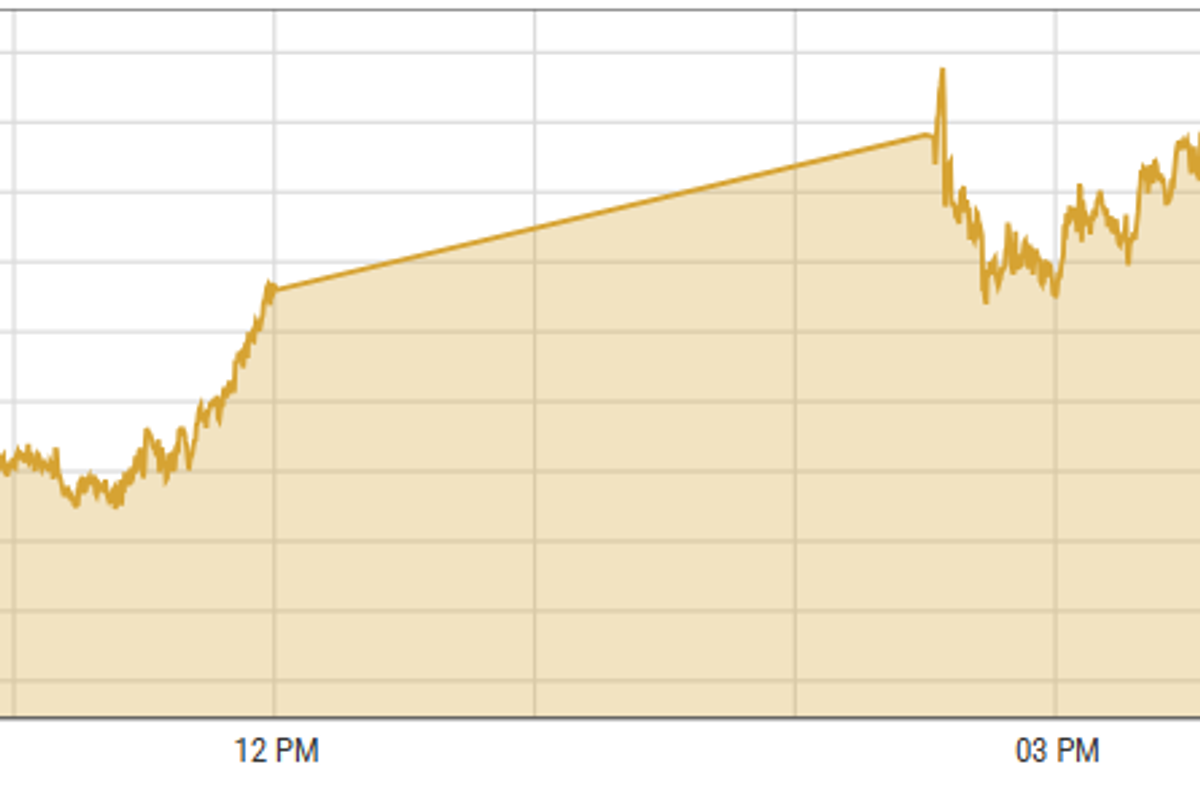

Pakistan stocks hit all-time highs amid likely tax relief for banks

KSE-100 index gained 0.61% to close at 94,763.64 points

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

KSE-100 index gained 0.61% to close at 94,763.64 points

PSX

Pakistan's stock market closed on a positive note, reaching new all-time highs in both intraday and closing levels.

The surge was driven by news of the Islamabad High Court granting temporary relief to banks from the ADR-based tax on those failing to meet a 50% private sector lending ratio by year-end.

Analysts attributed the bullish trend to continuous buying by local funds following a sharp decline in interest rates. Additionally, the ongoing visit by International Monetary Fund (IMF) staff highlighted signs of economic stabilization, further boosting investor confidence.

KSE-100 index gained 571.75 points or 0.61% to close at 94,763.64 points.

The Dubai Financial Market (DFM) General Index gained 0.22% or 10.53 points to close at 4,739.76 points.

Commodities

Oil held steady on Friday. The Energy Information Administration (EIA) reported a slight increase in US crude stockpiles, rising by 2.089 million barrels last week, slightly above expectations. However, gasoline inventories fell sharply by 4.4 million barrels, hitting a two-year low.

A stronger US Dollar (USD) could limit oil’s upside, making it more expensive for buyers in other currencies and potentially reducing demand.

Further pressure on oil could come from OPEC’s downward revision of global oil demand growth for 2024 and 2025, citing weaker demand in key markets like China and India.

Additionally, market sentiment is influenced by expectations that the incoming Trump administration may roll back Biden era energy policies. Brent crude prices decreased 0.39% to $72.28 per barrel.

Gold is struggling to gain momentum. The metal faces continued selling pressure due to a strong US Dollar and growing uncertainty about the Federal Reserve's future interest rate decisions.

Expectations of higher inflation next year, driven by potential policies under Donald Trump, have reduced the likelihood of significant rate cuts, which in turn diminishes gold's appeal as higher rates make non-yielding assets less attractive.

International gold prices declined 0.05% reaching $2,567.16 per ounce. In Pakistan, gold prices increased by PKR 1,300 to PKR 267,700/tola.

Currency

US dollar weakened against PKR, down 0.04% in the inter-bank market. Pakistani currency settled at 277.66, a gain of 08 paisas against the US dollar. In the open market USD was trading at PKR 280.

Comments

See what people are discussing