Pakistan stocks rally as investors brace for fiscal year 2026 budget

Market closes bullish on investor optimism, with fertilizer, banking, and power sectors leading gains

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

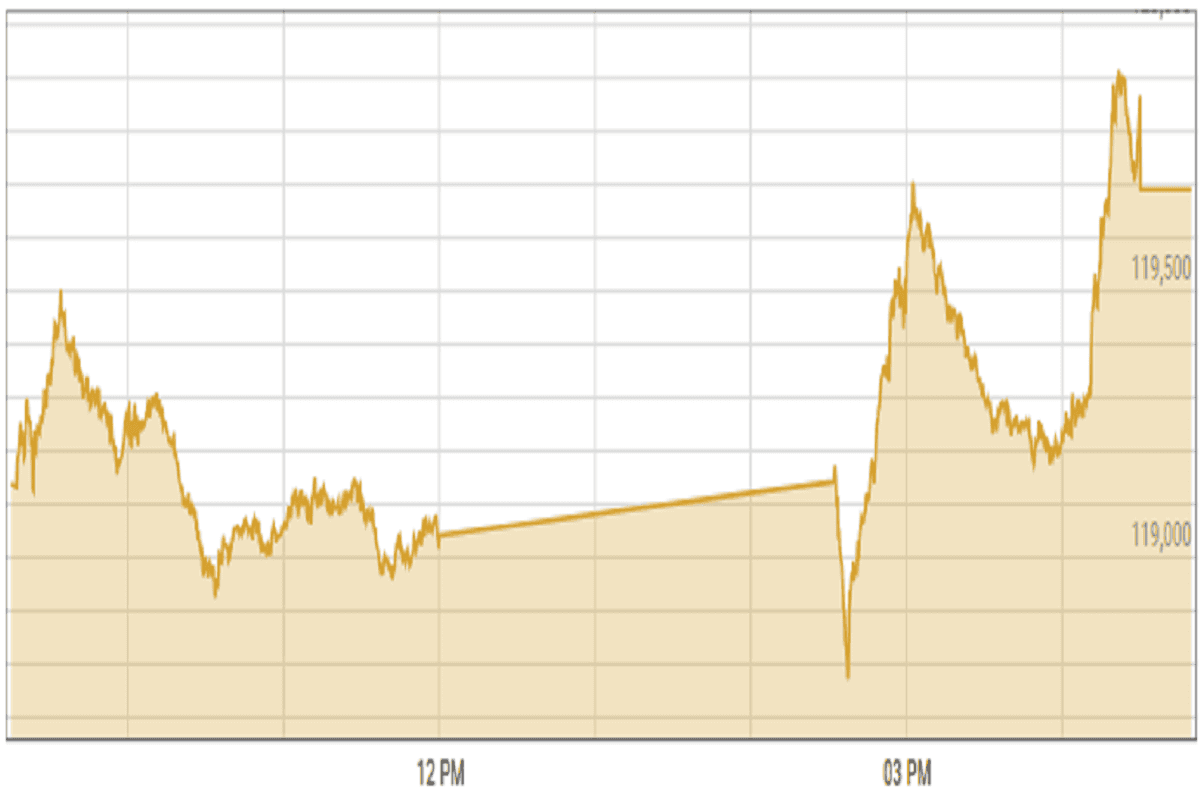

Pakistan’s stock market closed higher on Friday as investors positioned themselves ahead of the upcoming fiscal year 2026 budget, analysts said.

The benchmark index ended on a positive note, with volatility largely attributed to the last day of the rollover week, said an analyst at Ismail Iqbal Securities.

“Investors gradually positioned themselves ahead of the upcoming FY26 budget, showing selective interest across sectors,” the analyst said.

The fertilizer, commercial banking, and power generation & distribution sectors were the major contributors to Friday’s gains, collectively adding 649 points to the index.

Ahsan Mehanti of Arif Habib Corp said stocks closed bullish, led by blue-chip scrips in oil, banking, and fertilizers amid optimism about potential federal budget announcements.

Budgetary relief for oil refineries, real estate, and the agricultural sector, along with a proposed 1.5% tax levy on imports to support industrials, played a key role in the market’s bullish close at the Pakistan Stock Exchange, Mehanti said.

KSE-100 index shed 0.6% or 719.69 points to close at 119,691.09 points.

Currency

US dollar eased against PKR in the inter-bank market. Pakistani currency gained 5 paisas to close at 282.02. In the open market USD was trading at PKR 284.15.

Indian Stocks

Indian stock markets didn't move much on Friday, influenced by weak signals from Asia. Early in the day, IT and auto stocks faced selling pressure.

Despite a lack of strong positive news, steady investments from both foreign and domestic institutions are helping keep the market stable. Analysts believe this period of little movement may continue for now.

BSE-100 index shed 0.30% or 77.23 points to close at 25940.24 points.

DFM General Index shed 0.22% or 12.15 points to close at 5,480.51 points.

Crude Oil

Oil prices dropped on Friday and were set for a weekly decline. This was mainly due to uncertainty about U.S. President Donald Trump’s trade tariffs, as investors waited for a key decision from OPEC+ on oil production.

This was the second week in a row that oil prices were falling, with concerns growing over how Trump’s tariffs could affect the economy and demand for oil in the long run.

However, the drop in oil prices wasn’t too steep, as data showed that U.S. oil inventories unexpectedly shrank by 2.8 million barrels last week.

Brent crude prices decreased by 0.48% to $63.84 per barrel.

Gold Prices

Gold prices dropped slightly on Friday and were heading for a nearly 2% decline for the week. Traders were adjusting their positions ahead of an important US inflation report.

Investors were waiting for the release of the PCE price index, which the Federal Reserve uses to measure inflation.

Despite this, gold is still considered a strong investment. Its appeal as a safe option increased after a US court temporarily delayed a ruling that could disrupt Donald Trump’s trade policies, adding uncertainty to the market.

International gold prices decreased 0.49% to close at $ 3,305.26 per ounce. In the local market, gold prices remained flat at PKR 3,600 to 349,300 per tola.

Comments

See what people are discussing