Pakistan stocks surge on value-buying opportunities

Ghandhara closed at upper circuit, boosted by launch of new vehicle

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

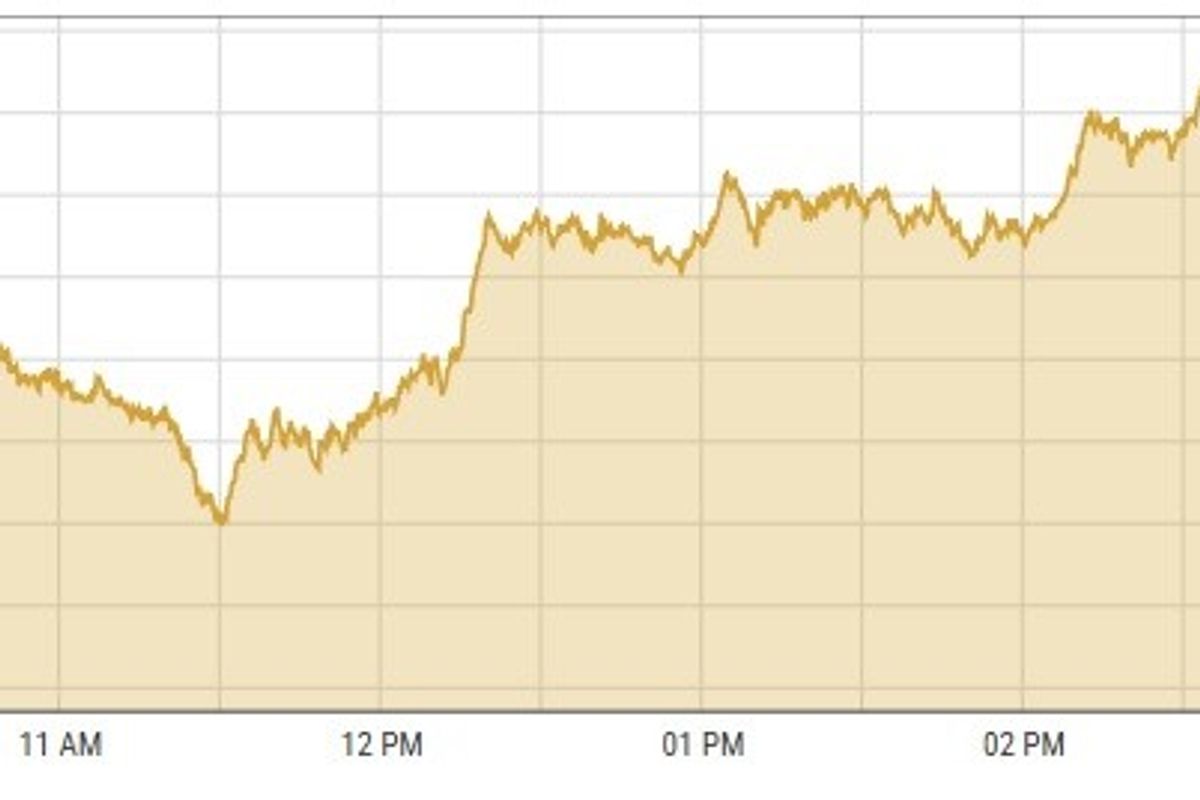

KSE-100 index gained 0.87%

PSX

Pakistan stocks soared on Monday led by the automobile sector as the Pakistan Stock Exchange is expecting higher sales in the coming months.

All auto sector shares performed, surging in range of PKR 2-38 per share.

Analysts said investors capitalized on value-buying opportunities across various sectors.

The market rally was fueled by strong buying activity, driven by optimism over economic indicators and expectations of improved December quarter earnings.

Blue-chip stocks and high-volume sectors experienced heightened investor activity following last week's market pullback.

Among the standout performers was Ghandhara Automobiles Limited (GAL), which continued its upward trajectory.

GAL closed at its upper circuit, boosted by the successful launch of the new vehicle — JAC T9 Hunter — which attracted significant investor attention.

Honda Atlas Cars also surged on reports that Federal Board of Revenue (FBR) will buy over one thousand Honda City vehicles.

The benchmark KSE-100 index gained 0.87% or 982.77 points to close at 114,230.06 points.

Indian stocks fell sharply on Monday after a strong U.S. jobs report lowered hopes for early interest rate cuts by the Federal Reserve.

So far in January, Indian markets are down 2.3%. The losses are due to rising oil prices, a weaker rupee, and large amounts of foreign capital leaving the country.

The BSE-100 index lost 2.02% or 498.01 points to close at 24,131.60 points.

Separately, the DFM General Index gained 0.08% or 4.18 points to close at 5,232.50 points.

Commodities

Oil prices have gone up for three days in a row. On Monday, Brent crude oil reached over $80 a barrel, the highest in over four months. This increase is due to stricter U.S. sanctions on Russian oil, which will likely affect exports to major buyers like India and China.

The new sanctions will significantly hurt Russian oil exports. As a result, China and India will need to buy more oil from the Middle East, Africa, and the Americas. This shift is expected to raise prices and shipping costs, according to traders and analysts.

Brent crude prices gained 1.71% to $81.12 per barrel.

Gold prices fell on Monday, ending a four-day rise. This drop happened as markets adjusted to the latest U.S. Nonfarm Payrolls report. The report suggested that the Federal Reserve might keep interest rates high for a longer period.

Higher interest rates usually make gold less attractive since it doesn't earn interest. Investors are also preparing for more market changes as President-elect Donald Trump returns to the White House on January 20.

International gold prices decreased 0.40% reaching $2,678.72 per ounce.

Currency

US dollar eased against PKR in the inter-bank market. Pakistani currency shed 10 paisas to 278.67. In the open market, USD was trading at PKR 280.

Comments

See what people are discussing