Pakistan stocks volatile as investors split over interest rate decision

Moody’s assessment ruling out outright war with India adds to market confidence

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

KSE-100 index shed 0.01%

PSX

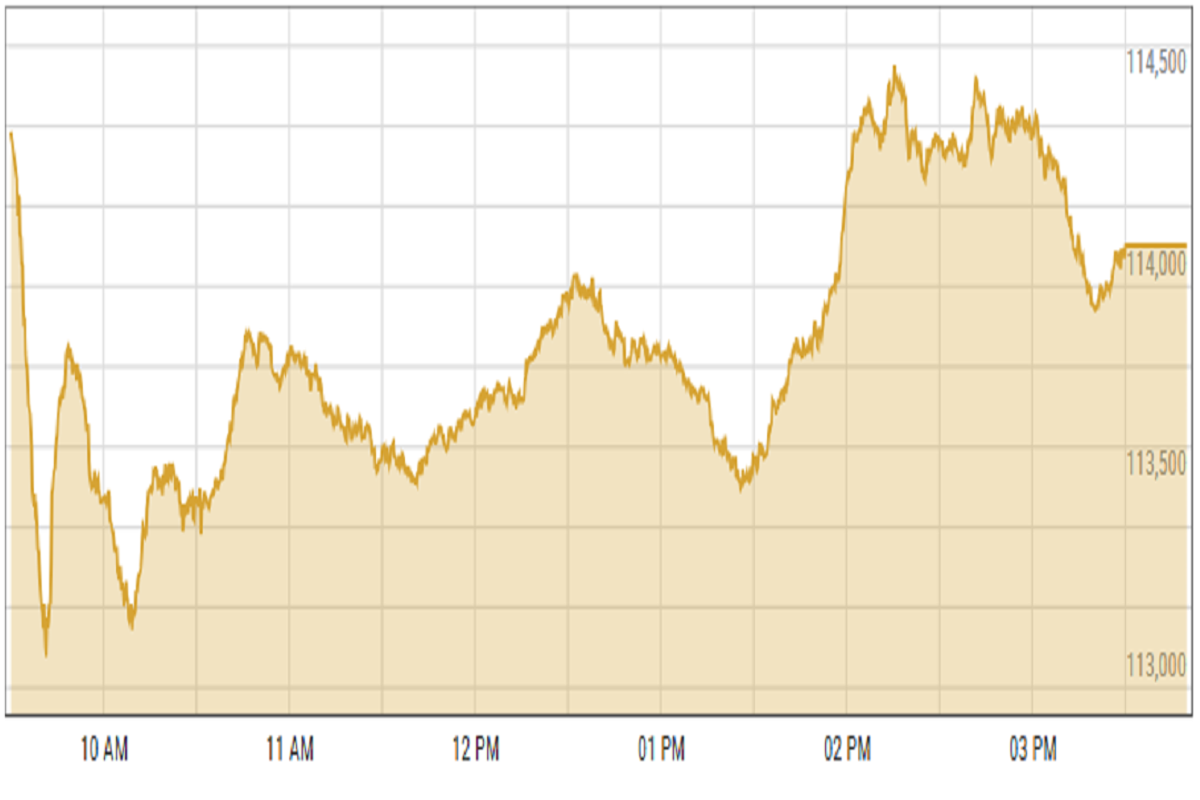

Pakistan stocks herald volatile session as investors remain divided over interest rate announcement, with active bouts of selling and buying witnessed.

After market close, the State Bank surprised investors by cutting the interest rate by 100 bps to 11%—a nearly three-year low.

The index hit a low of 113,077 points and a high of 114,102 points, closing at the day’s peak of 114,102 points.

The market buzzed with speculation over the interest rate decision, with most investors betting on unchanged rates while a few anticipated a cut.

Meanwhile, Moody’s report—stating that Pakistan and India would avoid outright conflict, though periodic flare-ups may occur—provided some comfort to the market.

KSE-100 index shed 0.01% or 11.7 points to close at 114,102.24 points.

Currency

US dollar gained against PKR in the inter-bank market. Pakistani currency lost 16 paisas to close at 281.22. In the open market USD was trading at PKR 282.9.

Indian Stocks

Indian stock markets continued to rise this week, building on last week's gains. Most industry sectors saw positive growth, with the auto and oil & gas sectors performing the best on Monday.

Throughout the week, investors will keep an eye on foreign portfolio investments (FPI), which have recently increased their buying activity. They will also watch for updates on the India-US trade deal and the latest earnings reports from major companies for new market trends.

On a global level, the results of the US Central Bank's monetary policy meeting will be an important factor to follow.

BSE-100 index gained 0.7% or 177.84 points to close at 25,568.36 points.

DFM General Index gained 0.84% or 44.31 points to close at 5,335.68 points.

Crude Oil

Oil prices dropped over 1% on Monday following OPEC+'s weekend decision to accelerate production increases, fueling concerns about a potential supply surge amid uncertain demand prospects.

At the start of trading, both contracts hit their lowest levels since April 9, as OPEC+ moved to boost output for a second consecutive month, with June’s increase set at 411,000 barrels per day (bpd).

With this adjustment, the eight OPEC+ producers will collectively raise their output by 960,000 bpd over April, May, and June—an unwinding of 44% of the 2.2 million bpd production cuts agreed upon since 2022, according to Reuters calculations.

Brent crude prices decreased by 1.42% to $60.42 per barrel.

Gold Prices

Gold prices climbed on Monday as investors anticipated the Federal Reserve's upcoming interest rate decision later in the week.

This year, gold has reached multiple record highs, surpassing the $3,500 mark for the first time last month after breaking through $3,000 in March.

The surge in prices has been fueled by concerns over an economic slowdown, uncertainties surrounding tariffs, and increased demand driven by central bank purchases.

Market expectations suggest that the Federal Reserve will likely maintain interest rates without any adjustments when it convenes on Wednesday.

International gold prices increased 2.32% to close at $3,316.88 per ounce. In the local market, gold prices increased PKR 7,800 to 350,000 per tola.

Comments

See what people are discussing