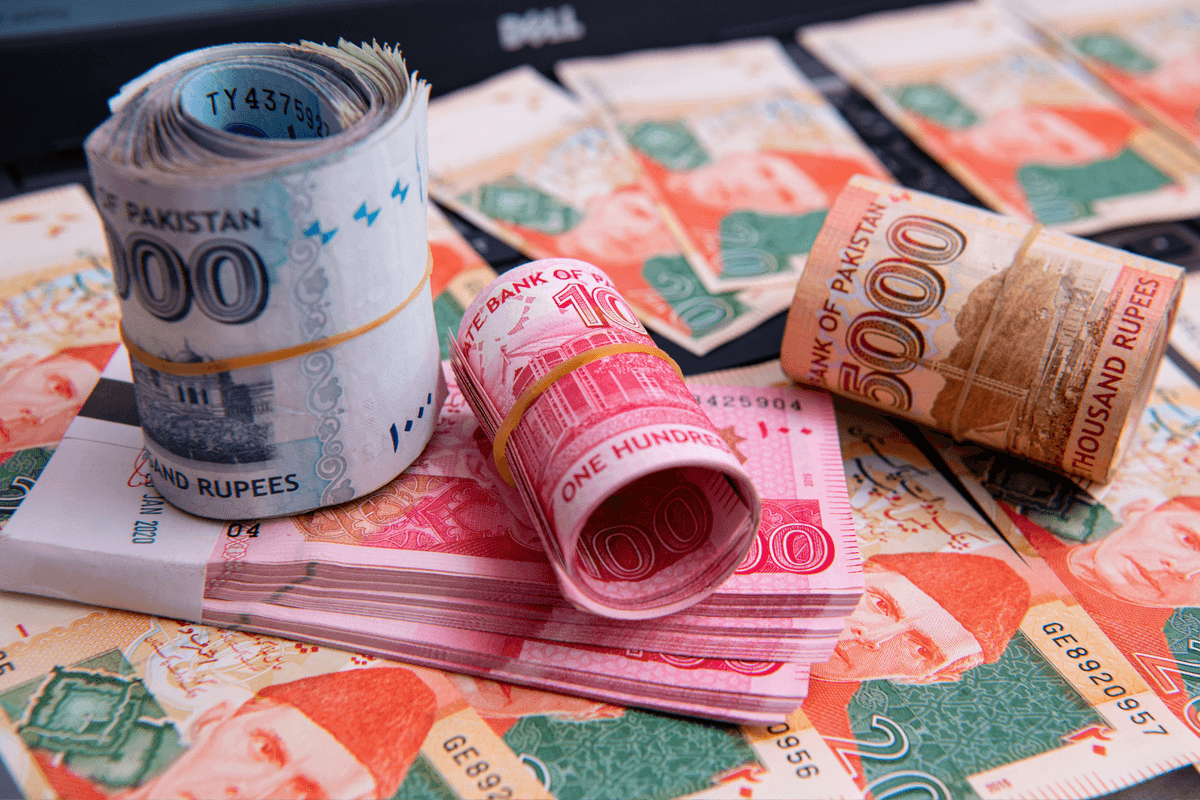

Pakistan’s central bank increases financing limits for SMEs

Small enterprises can obtain loans of up to PKR 100 million

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

To bolster the financing of small and medium enterprises (SMEs), Pakistan's central bank has revised the per party exposure limits. This adjustment aims to enhance the promotion and accessibility of SME financing across the country.

Under the new regulations, small enterprises can now obtain financing of up to PKR 100 million ($0.36 million) from a single bank or Development Finance Institution (DFI), or from all banks and DFIs combined. Medium enterprises, on the other hand, can secure financing, including leased assets, of up to PKR 500 million from a single bank or DFI, or from all banks and DFIs combined.

Historically, banks and DFIs have shown a preference for larger medium enterprises over small enterprises in their lending practices. However, the SME sector plays a crucial role in Pakistan's economy, contributing significantly to national GDP, employment generation, and export earnings. The financial inclusion of SMEs is vital for economic growth, competitiveness, and job creation.

Recognizing the potential of the SME sector to drive economic development, the State Bank of Pakistan has been proactive in supporting this segment.

The SBP issued separate Prudential Regulations for SMEs in 2003, which have been periodically revised to align with changing market dynamics. This latest enhancement in financing limits is part of the ongoing efforts to unleash the sector's potential, fostering job creation, increasing incomes, improving competitiveness, and boosting exports.

Comments

See what people are discussing