Pakistan completes landmark privatization of PIA after competitive bidding

Kamran Khan calls PIA sale a key test for government privatization drive

News Desk

The News Desk provides timely and factual coverage of national and international events, with an emphasis on accuracy and clarity.

Pakistan on Tuesday completed the long-awaited privatization of its national airline, Pakistan International Airlines (PIA), marking the sale of one of the country’s largest state-owned enterprises after nearly two decades.

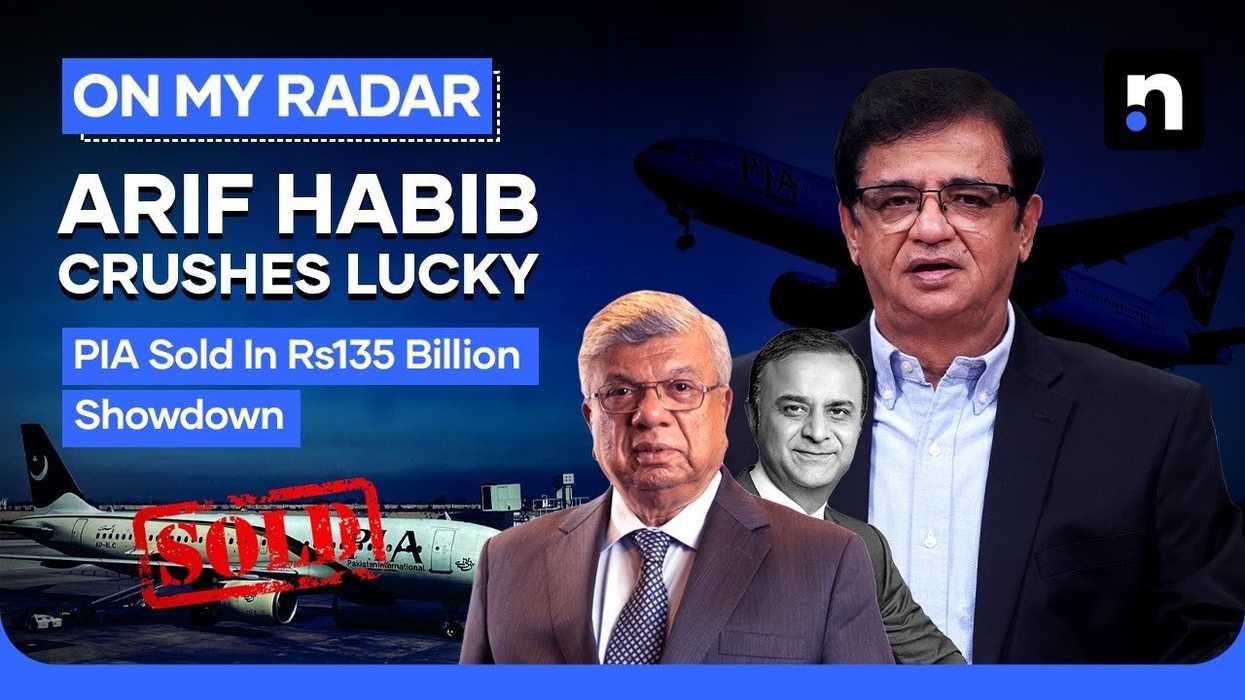

Following a competitive open bidding process, the Arif Habib–led consortium acquired a 75 percent stake in the airline for Rs135 billion, valuing PIA at approximately $482 million.

In the latest episode of On My Radar, Kamran Khan said the successful conclusion of the bidding marked a critical test case for the government’s privatization agenda, particularly given the size, complexity, and political sensitivity surrounding PIA. He noted that the transaction reflected a sharp contrast with earlier failed attempts and signaled renewed investor confidence.

The Arif Habib Consortium emerged victorious after a bidding war with a rival consortium led by Lucky Cement, which submitted a final offer of Rs134 billion. A third bidder, Airblue, was eliminated in the first round after offering Rs26.5 billion, far below the reference price.

The winning consortium comprises Fatima Fertilizer, AKD Group, The City School, and Lake City Holdings. In the first round of bidding, against a reference price of Rs100 billion, the Arif Habib Consortium submitted the highest bid of Rs115 billion, while the Lucky Cement - led group offered Rs101.5 billion. The two leading bidders proceeded to a second round, ultimately pushing the final price well above the benchmark.

Observers noted that the process drew comparatively reasonable offers, a marked departure from the previous privatization attempt in October 2024, which collapsed after only one bidder - Blue World City - submitted a bid of just Rs10 billion against a base price of Rs85 billion, drawing widespread criticism and ridicule.

Under the approved privatization structure, the government will receive 7.5 percent of the total bid amount within 120 days, while the remaining 92.5 percent will not be deposited into the national exchequer. Instead, the bulk of the funds will be reinvested into PIA within one year, aimed at restructuring the airline, addressing operational weaknesses, and improving service delivery.

Speaking earlier, Prime Minister’s Adviser on Privatization Muhammad Ali had outlined the post-privatization roadmap, explaining that the model was designed to prioritize the airline’s revival rather than short-term fiscal gain.

The sale represents the first privatization of a major state-owned enterprise in nearly 20 years. Between 1991 and 2005, Pakistan privatized institutions including MCB Bank, Habib Bank, United Bank, PTCL, and K-Electric.

In 2006, however, the privatization of Pakistan Steel Mills was struck down by former Chief Justice Iftikhar Muhammad Chaudhry, effectively halting large-scale privatization for years.

Although the government recently sold the First Women Bank to the UAE’s International Holding Company for $14 million (Rs4.1 billion), that transaction was relatively small in scale. By contrast, the privatization of PIA stands as a defining milestone.

Analysts say the successful completion of the PIA transaction could reshape Pakistan’s broader privatization drive, restoring credibility to a process long viewed with skepticism and positioning the deal as a benchmark for future reforms.

Comments

See what people are discussing