PSO tops mutual fund holdings in November, capturing 47% of free float

Arif Habib report shows strong institutional tilt toward energy and cement stocks, with sharp shifts in fund positioning during the month

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

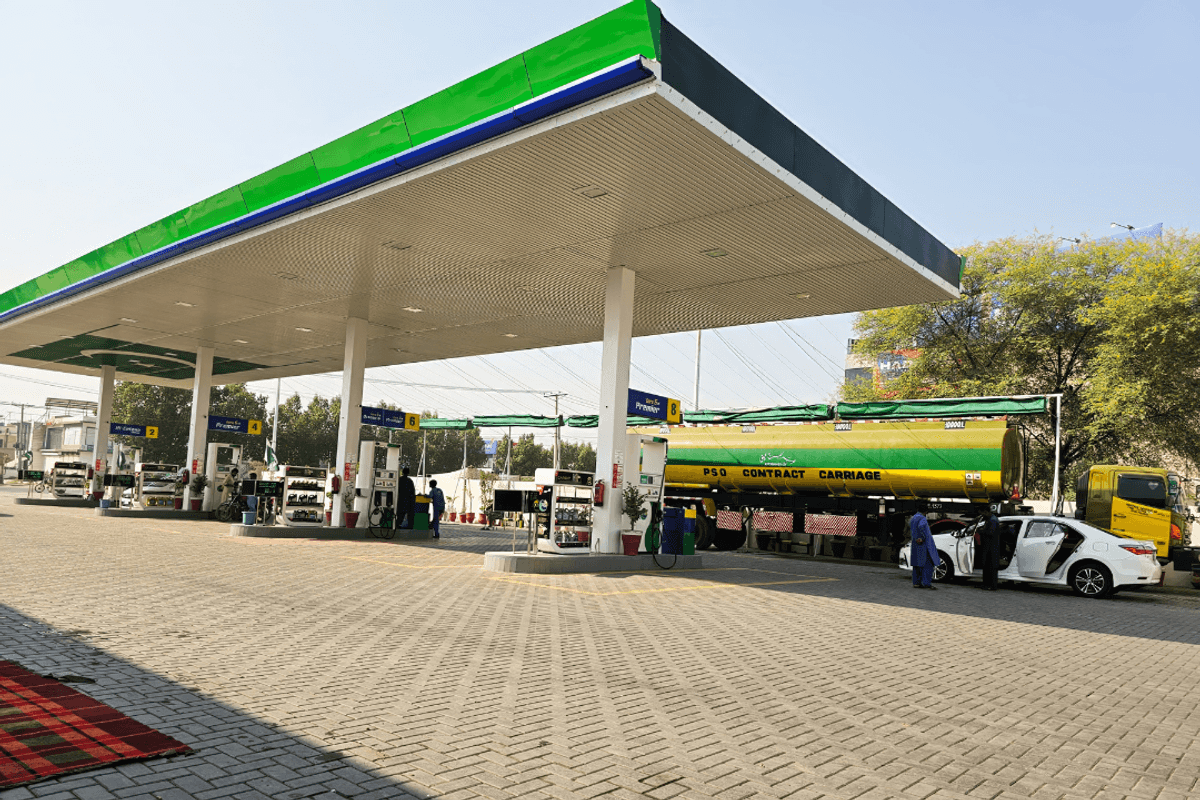

Shutterstock

Pakistan State Oil (PSO) emerged as the most widely held stock among the top 30 equity holdings of mutual funds in November, with funds collectively owning 47.2% of its free float, according to a report released by Arif Habib Ltd.

The brokerage said PSO ranked first by mutual fund exposure during the month, underscoring continued institutional preference for select large-cap energy names.

Other stocks with significant mutual fund ownership included Kohat Cement Company Ltd. (KOHC) with 27.7% of its free float held by funds, Oil and Gas Development Company Ltd. (OGDC) at 22.8%, Pakistan Petroleum Ltd. (PPL) at 20.4%, Khyber Tobacco Company Ltd. (KTML) at 19.4%, Lucky Cement Ltd. (LUCK) at 16.8%, Pakistan Tobacco Company Ltd. (PAKT) at 16.4%, and Mari Petroleum Company Ltd. (MARI) at 15.2%.

On a month-on-month basis, Arif Habib noted sharp changes in fund positioning among the top 30 holdings.

Maple Leaf Cement Factory Ltd. (MLCF) recorded the largest increase in mutual fund ownership, surging 266.2%, followed by Fauji Cement Company Ltd. (FCCL) with a 41.8% rise and PPL with a 31.5% increase.

In contrast, the steepest reductions in holdings were seen in First Abu Dhabi Bank Pakistan (FABL), down 41.22%, AGP Ltd. (-27.43%), PAKT (-21.71%), and MCB Bank Ltd. (-21.56%).

The report also highlighted stock popularity based on the number of funds invested. OGDC topped the list, being held by 85 mutual funds, representing 22.8% of its free float. Lucky Cement followed with 84 funds holding 16.8%, PPL with 79 funds holding 20.4%, Fauji Fertilizer Company (FFC) with 78 funds holding 9.3%, and PSO with 68 funds holding 47.2%.

Beyond traditional large-cap names, Arif Habib said several stocks gained traction as funds diversified their portfolios. These included Cherat Cement Company Ltd. (CHCC), held by 15 funds; Fatima Fertilizer Company Ltd. with 14 funds; Bank Alfalah Ltd. (BAFL) with 13 funds; D.G. Khan Cement Company Ltd. (DGKC) and FCCL with 11 funds each; Askari Bank Ltd. (AKBL) with 10 funds; Sui Northern Gas Pipelines Ltd. (SNGP) and KOHC with nine funds each; Nishat Mills Ltd. (NML) with eight funds; and AGP with seven funds.

Arif Habib further reported that equity mutual funds’ assets under management accounted for 14.82% of Pakistan’s total mutual fund industry as of November, down from 15.3% in the previous month, indicating a marginal reduction in equity exposure during the period.

Comments

See what people are discussing