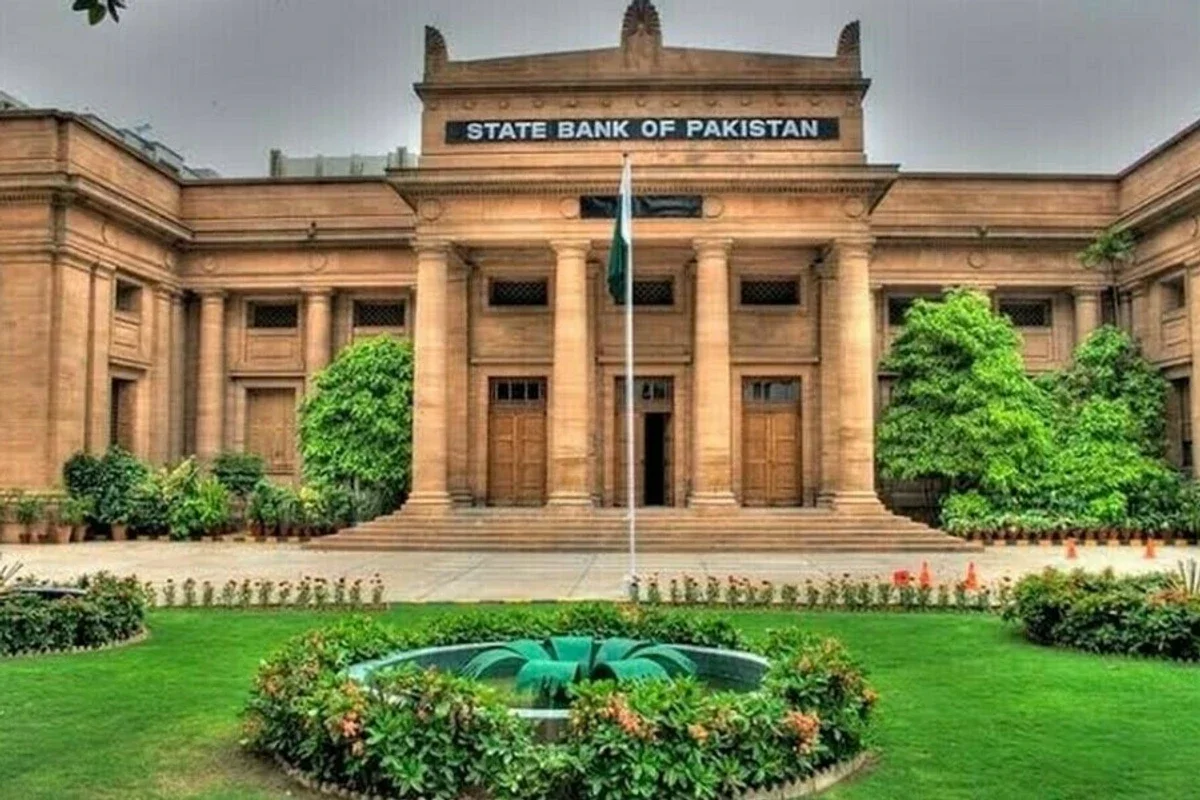

Pakistan's central bank launches ‘InvestPak’ digital portal to simplify investment in government securities

New platform allows individuals and corporates to open accounts, bid in auctions, and trade government securities online through their banks and financial institutions

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

The State Bank of Pakistan (SBP) has launched a new digital platform, “InvestPak”, to make investment in government securities easier and fully online for individuals and corporate customers.

The web-based system, which goes live on Nov. 6, will allow customers of banks, primary dealers and microfinance institutions to open Investor Portfolio of Securities (IPS) accounts, place bids in primary auctions of government securities, and trade in the secondary market—all without visiting their financial institutions.

According to the SBP, the move is part of the central bank’s efforts to digitize financial services and expand access to government securities. All banks and primary dealers are required to facilitate their customers’ registration on the portal, while microfinance banks are encouraged to do the same.

The SBP said the new system will enhance transparency, streamline transactions, and improve customer experience by integrating digital onboarding and trading under one platform.

How the portal works

Individuals, joint account holders and corporate customers with PKR-denominated bank accounts can register on InvestPak using their International Bank Account Number (IBAN). Those without existing IPS accounts can request one digitally through their financial institution.

Customers will be able to link multiple bank and IPS accounts to a single InvestPak profile and use the platform to participate directly in primary auctions. Registered users can submit both competitive and non-competitive bids for treasury bills, Pakistan Investment Bonds, and other securities.

In addition, customers will be able to buy and sell government securities in the secondary market through the portal by requesting real-time quotes from their banks. These quotes will remain binding for a specified period, and transactions can be settled either the same day or at a future value date.

The central bank said primary dealers must continuously update indicative yields and prices of active issues during normal business hours, which will be visible to the public on the portal.

Customer protection, complaint redressal

To ensure investor protection, financial institutions must process all onboarding and IPS account requests within 48 hours and provide justification for any rejection, which will be monitored by the SBP.

A complaint management system has also been built into the platform. Customers can lodge complaints directly through InvestPak or via a dedicated call center, and financial institutions are required to ensure prompt resolution.

The SBP said the portal has been designed to meet the operational needs of both primary auctions and secondary market trading, allowing financial institutions to integrate their front, middle, and back-office functions.

Other instructions related to the trading and settlement of government securities remain unchanged.

Comments

See what people are discussing