Pakistan lawmakers push for wage hike, e-commerce relief among key Finance Bill reforms

Senate Standing Committee on Finance seeks withdrawal of the 2% tax on online purchases to support digital growth

Haris Zamir

Business Editor

Experience of almost 33 years where started the journey of financial journalism from Business Recorder in 1992. From 2006 onwards attached with Television Media worked at Sun Tv, Dawn Tv, Geo Tv and Dunya Tv. During the period also worked as a stringer for Bloomberg for seven years and Dow Jones for five years. Also wrote articles for several highly acclaimed periodicals like the Newsline, Pakistan Gulf Economist and Money Matters (The News publications)

Credit: Anadolu Agency

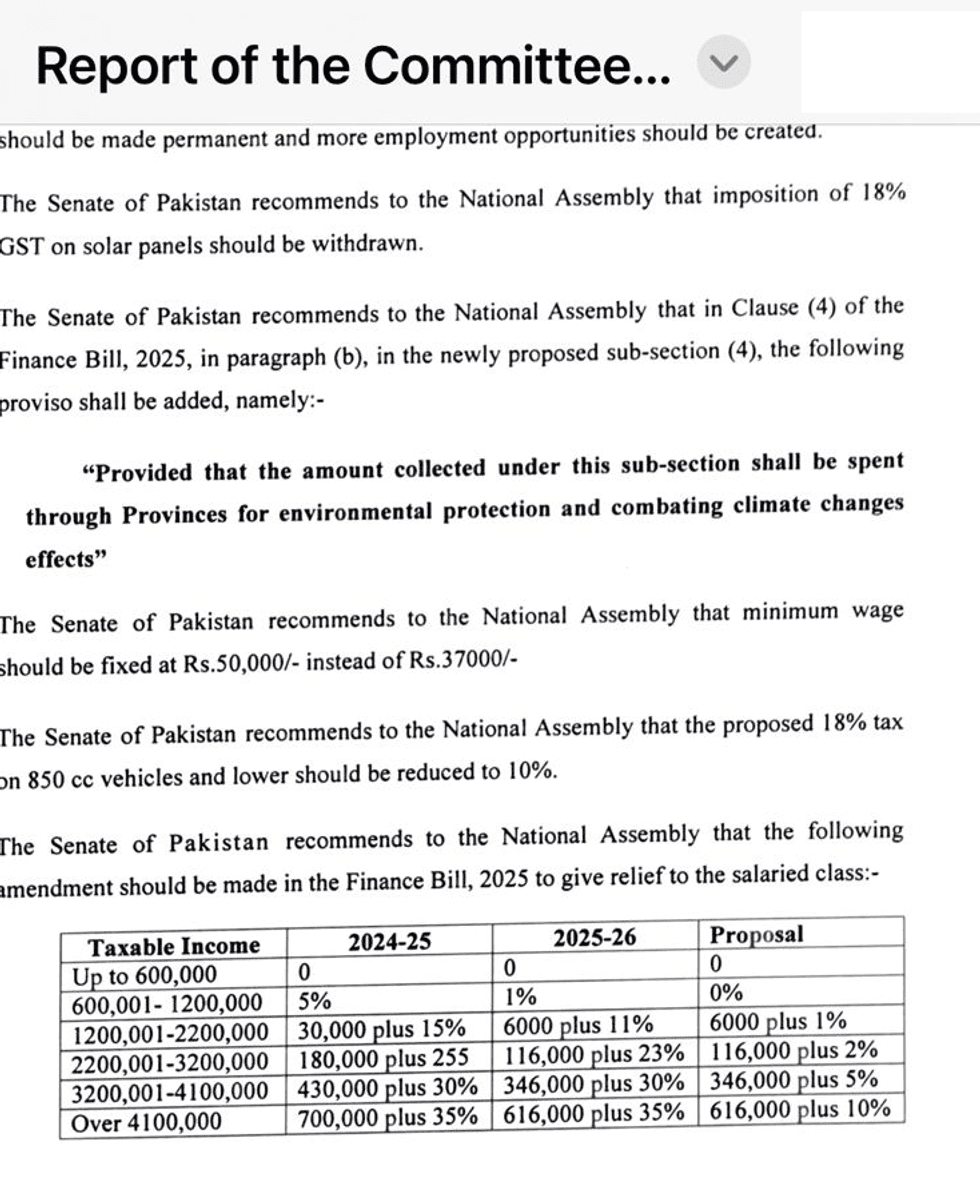

Pakistan’s Senate Standing Committee on Finance and Revenue has proposed a series of key amendments to the Finance Bill 2025-26, including a higher minimum wage, reduced taxes on essential sectors, and relief for the digital and construction industries.

The recommendations, compiled in a formal report prepared under the chairmanship of Senator Salim Mandviwalla and obtained by Nukta, have been forwarded to the National Assembly.

Among the most notable proposals is a call to withdraw the newly proposed income and sales tax (up to 2%) on online purchases. The committee stated that eliminating this tax would encourage the growth of Pakistan’s digital marketplace and e-commerce sector.

The committee also recommended that the minimum monthly wage be increased to Rs50,000, up from the currently proposed Rs37,000, to better align with inflation and the rising cost of living.

To support the automobile sector, the Senate body proposed that the sales tax on vehicles up to 850cc be reduced from 18% to 10%, making small vehicles more affordable for middle-income consumers.

Boosts for real estate, agriculture and pensioners

In a bid to strengthen the real estate market, the committee advised that stamp duty be fixed at 0.5% for property purchases up to Rs20 million for tax filers, and 1% for non-filers. This, they said, would help formalize property transactions and provide a boost to the real estate sector.

On the issue of pensions, the committee urged that the proposed increase of 7% be raised to at least 20%, ensuring adequate relief for pensioners amid rising economic pressures.

To ease the burden on farmers, the committee recommended that the sales tax on locally manufactured and imported tractors be capped at 5%, enabling more affordable access to agricultural machinery.

Fiscal governance

The report also addresses the construction industry, suggesting that the withholding income tax rate be set between 1.5% and 2%, with any balance to be adjusted at the time of filing annual tax returns. It also called for an end to the designation of construction contractors as withholding agents, and proposed allowing up to 40% of contract values to be transacted in cash without additional requirements.

In addition, the Senate committee proposed that Section 236C (advance tax on sale/transfer of property) and Section 236K (advance tax on purchase of property) be amended to equalize tax rates for buyers and sellers, promoting fairness in property transactions.

Regarding the steel sector, the committee recommended exempting it from the Tariff Reform Scheme until Pakistan achieves global competitiveness. Future tariff reductions, it advised, should be linked to specific performance benchmarks.

Another key recommendation is that surplus cash held by public entities should be brought under the administrative control of the Finance Division, to ensure effective utilization for public welfare and improved macroeconomic management.

The committee urged the government to extend concessional withholding tax rates to print media services, similar to those already granted to the IT sector, as an immediate form of relief.

Comments

See what people are discussing