Pakistan stocks close positive on institutional buying

Autos, cement, commercial banks, and exploration companies saw strong buying

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

KSE-100 index gained 0.38%

PSX

Pakistan stocks closed positively on Friday amid optimism surrounding a successful review of the International Monetary Fund (IMF) program.

An analyst at JS Global Capital reported that the market experienced a buying rally on Friday. "The rise was driven by strong buying momentum in key sectors such as autos, cement, commercial banks, and exploration and production (E&P) companies," the analyst said.

An analyst at Topline Securities noted that the KSE-100 Index extended its gains due to expectations that Pakistan will clear its first review of the $7 billion IMF bailout program, which continues to attract investor interest.

In addition, Pakistan and the IMF have agreed to revise downward the macroeconomic and fiscal framework for the current fiscal year.

As a result, the Federal Board of Revenue's (FBR) annual tax collection target has been reduced from PKR 12.97 trillion to PKR 12.35 trillion.

Looking ahead, market experts anticipate that the market will continue to perform positively, supported by investor confidence and sectoral strength.

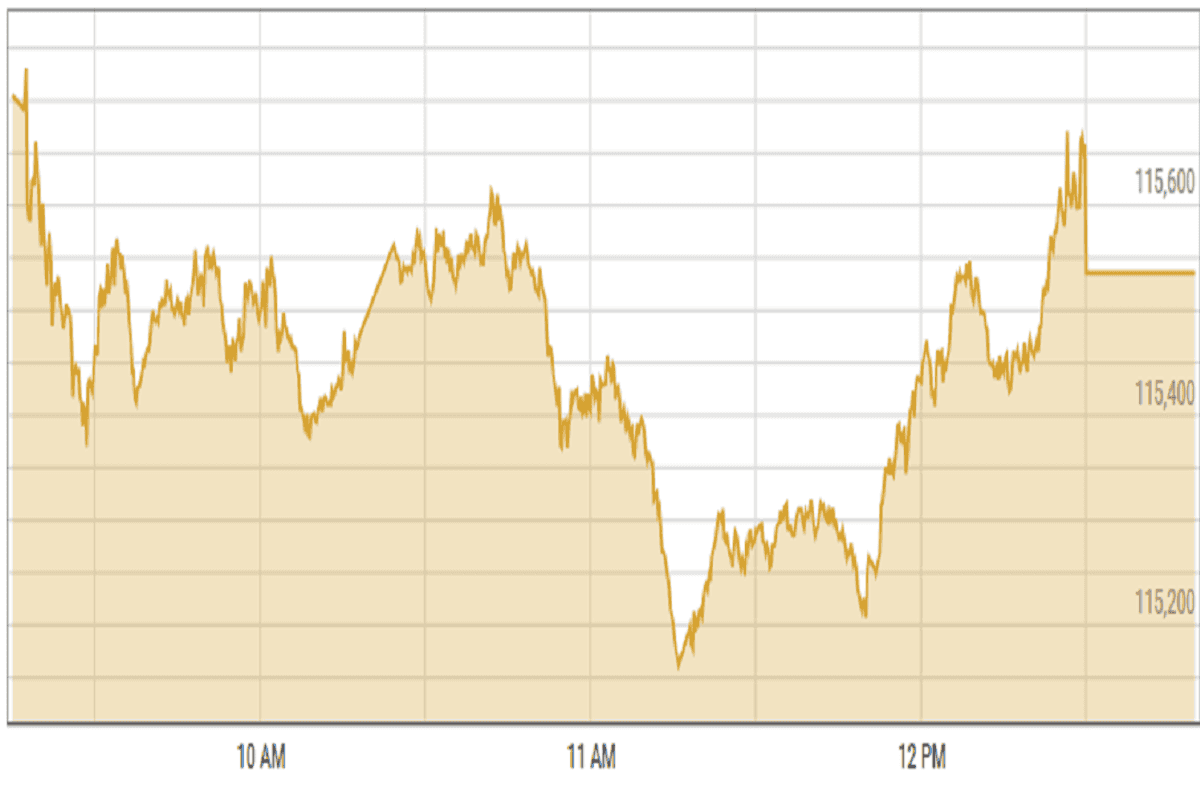

KSE-100 index gained 0.38% or 441.93 points to close at 115,536.17 points.

US dollar steadied against PKR in the inter-bank market. Pakistani currency lost 25 paisas to close at 280.22. In the open market USD was trading at PKR 281.6.

DFM General Index lost 0.96% or 49.61 points to close at 5,135.21 points.

Commodities

Oil prices increased on Friday due to the US tightening sanctions against Iran and ongoing trade tensions.

The White House sanctioned Iran's oil minister and companies involved in transporting crude oil from Iran.

The International Energy Agency stated that global oil supply could exceed demand by about 600,000 barrels per day this year, due to US-led growth and weaker global demand.

Brent crude prices increased by 0.92% to $70.52 per barrel.

Gold prices have soared to an unprecedented $3,000 per ounce as Trump's tariffs have caused a stir among investors and markets.

Investors are gravitating towards gold amidst the growing uncertainty surrounding US tariffs and escalating trade tensions.

Additionally, the potential easing of the US Federal Reserve's monetary policy has further heightened the allure of precious metals.

International gold prices increased by 0.40% reaching $2,991.57 per ounce.

Comments

See what people are discussing