Pakistan stocks drop as regional tensions unsettle investors

Escalating India-Pakistan friction sparks market selloff, drags key sectors lower

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

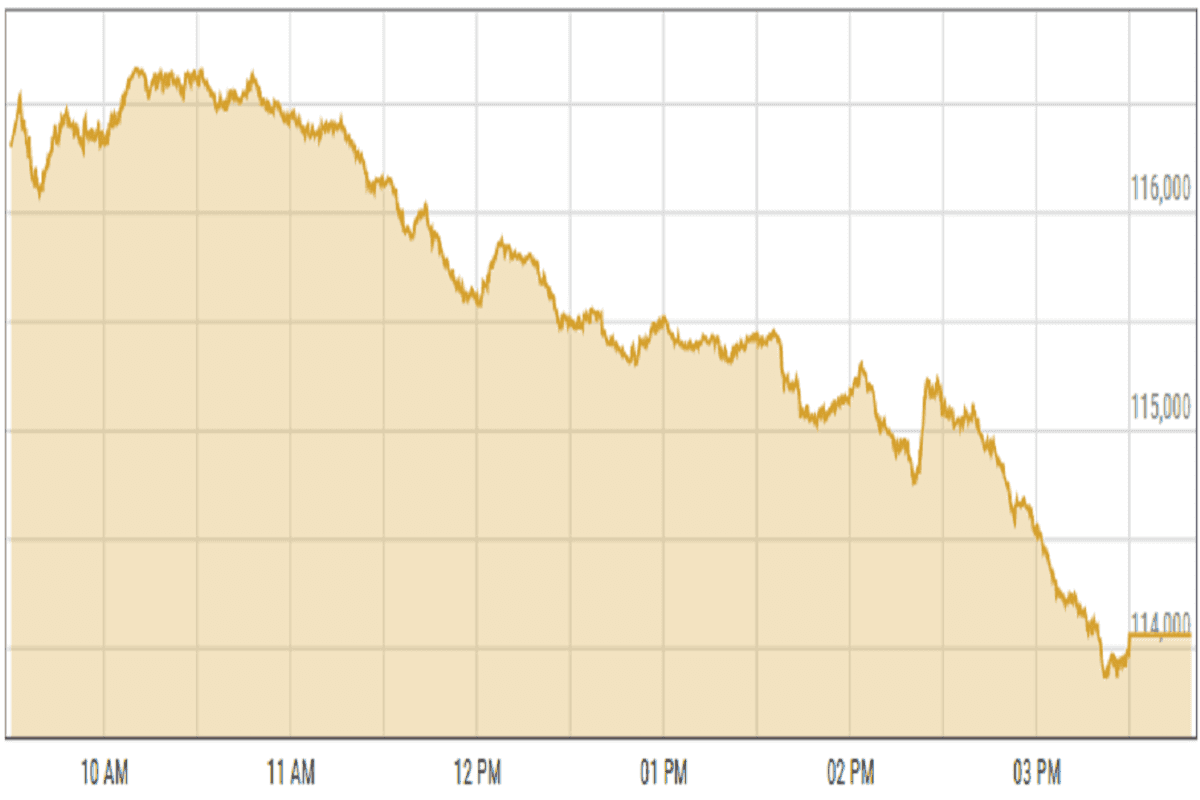

SE-100 index shed -1.22%

PSX

Pakistan’s stock market experienced a sharp reversal Monday as escalating tensions between India and Pakistan rattled investor confidence, analysts said.

The benchmark index opened on a strong note, gaining early momentum, but optimism proved short-lived as selling pressure intensified later in the session, dragging the market into negative territory.

“The market witnessed a classic tug-of-war between bulls and bears,” said an analyst at Topline Securities. “The prevailing negative sentiment was largely driven by geopolitical concerns, which weighed heavily on overall market confidence.”

An analyst at Ismail Iqbal Securities said regional instability remained the primary factor behind the market downturn, pushing the index into the red by the closing bell.

Oil and gas exploration companies, commercial banks, and oil and gas marketing firms were the major laggards, collectively shedding 660 points from the index.

KSE-100 index shed -1.22% or 1,405.45 points to close at 114,063.90 points.

Currency

US dollar steadied against PKR in the inter-bank market. Pakistani currency shed 10 paisas to close at 281.07. In the open market USD was trading at PKR 282.3.

Indian Stocks

The Indian stock market saw good growth on Monday as worries about the trade war eased, foreign investors put in more money, and company earnings matched expectations for the fourth quarter.

However, tensions between India and Pakistan after the Pahalgam attack could still affect the market.

Since the market is going up, more investors might rush to buy stocks. But experts warn that stock prices may change a lot, so investors should be careful when choosing where to invest.

BSE-100 index surged 1.26% or 316.54 points to close at 25,430.81 points.

DFM General Index gained 1.04% or 53.86 points to close at 5,216.47 points.

Crude Oil

Oil prices stayed the same today as investors worried about the uncertainty in trade talks between the US and China. This could affect global economic growth, fuel demand, and the possibility of OPEC+ increasing supply.

Experts say the US-China trade war is the biggest factor influencing oil prices, more than nuclear discussions between the US and Iran or disagreements within the OPEC+ group.

Markets have been unsettled because of mixed messages from US President Donald Trump and China about how much progress is being made to ease the trade war, which could hurt the global economy.

Brent crude prices decreased by 0.46% to $66.56 per barrel.

Gold Prices

Gold prices dipped on Monday as easing tensions between the United States and China diminished demand for traditional safe-haven assets. The precious metal faced additional pressure from a stronger U.S. dollar.

Historically, investors flock to gold during times of geopolitical or economic uncertainty, as well as when interest rates are low. However, recent indications of improved dialogue between Washington and Beijing have alleviated some concerns.

Analysts noted that financial markets, particularly risk assets, are responding more optimistically to the tariff situation compared to earlier in the month.

International gold prices declined 1.23% to close at $ 3,291.59 per ounce. In the local market, gold prices shed PKR 1,600 to 347,100 per tola.

Comments

See what people are discussing