Pakistan stocks slightly changed amid budget uncertainty, export worries

Analysts cite IMF-led tax measures, industrial levy as key pressures on market

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

PSX

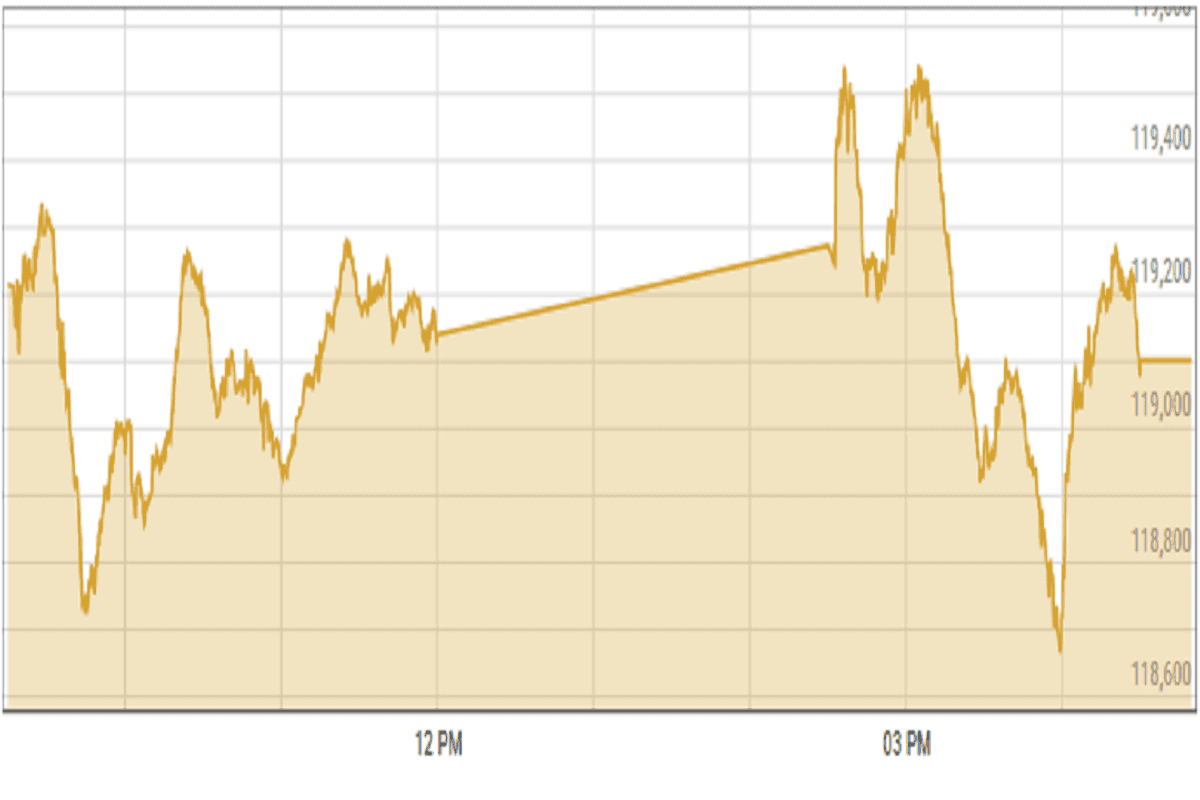

Stocks closed lower Friday amid pre-budget uncertainty and concerns over weak exports, analysts said.

Ahsan Mehanti of Arif Habib Corp said investor concerns over proposed IMF-driven tax measures for exporters and industrialists, along with the National Assembly’s approval of the off-grid (CPPs) Levy Bill, contributed to the decline.

A Topline Securities analyst noted a range-bound session on the last trading day of the week, while Ismail Iqbal Securities said the benchmark index ended lower after a volatile session.

"Investors remained cautious and adjusted portfolios ahead of the FY26 budget, with uncertainty over fiscal measures keeping sentiment mixed," the analyst said.

KSE-100 index shed 0.04% or 50.37 points to close at 119,102.67 points.

Currency

US dollar eased against PKR in the inter-bank market. Pakistani currency gained 09 paisas to close at 281.97. In the open market USD was trading at PKR 284.15.

Indian Stocks

Indian stock markets bounced back on the last trading day of the week, helped by positive news about US-China trade talks.

Stocks in consumer goods, IT, financial services, and banking performed well, while pharma and healthcare stocks remained weak.

Investors felt hopeful after the US and China agreed to keep communication open. However, market gains were limited due to worries about foreign investors pulling out money, rising US Treasury yields, and concerns about the US financial situation.

BSE-100 index gained 0.9% or 233.05 points to close at 26,028.93 points.

DFM General Index gained 0.21% or 11.4 points to close at 5,464.16 points.

Crude Oil

Oil prices fell on Friday. The OPEC+ group is thinking about increasing oil production by 411,000 barrels per day in July. This could lead to too much oil in the market, causing prices to drop even more.

The market is already expecting a surplus, and new data shows that U.S. oil stockpiles have grown again, adding to worries about too much supply.

Brent crude prices decreased by 1.52% to $63.46 per barrel.

Gold Prices

Gold prices increased on Friday and were set for their best week in six weeks. The rise was helped by a weaker US dollar and concerns about the US government's growing debt, which led investors to buy gold as a safe investment.

Analysts noted that President Donald Trump's tax plan is boosting gold prices because some worry it could hurt the US dollar's financial stability. As a result, some investors are moving money from US bonds to gold.

Meanwhile, the dollar fell 0.5% and was on track for its biggest weekly drop since early April. A weaker dollar makes gold cheaper for buyers using other currencies, supporting its price.

International gold prices increased 1.53% to close at $3,347.83 per ounce. In the local market, gold prices increased PKR 3,500 to 351,000 per tola.

Comments

See what people are discussing