Pakistan stocks close flat on budget caution

Progress on circular debt resolution drew investor interest to energy and gas sectors

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

KSE-100 index gained 0.03%

PSX

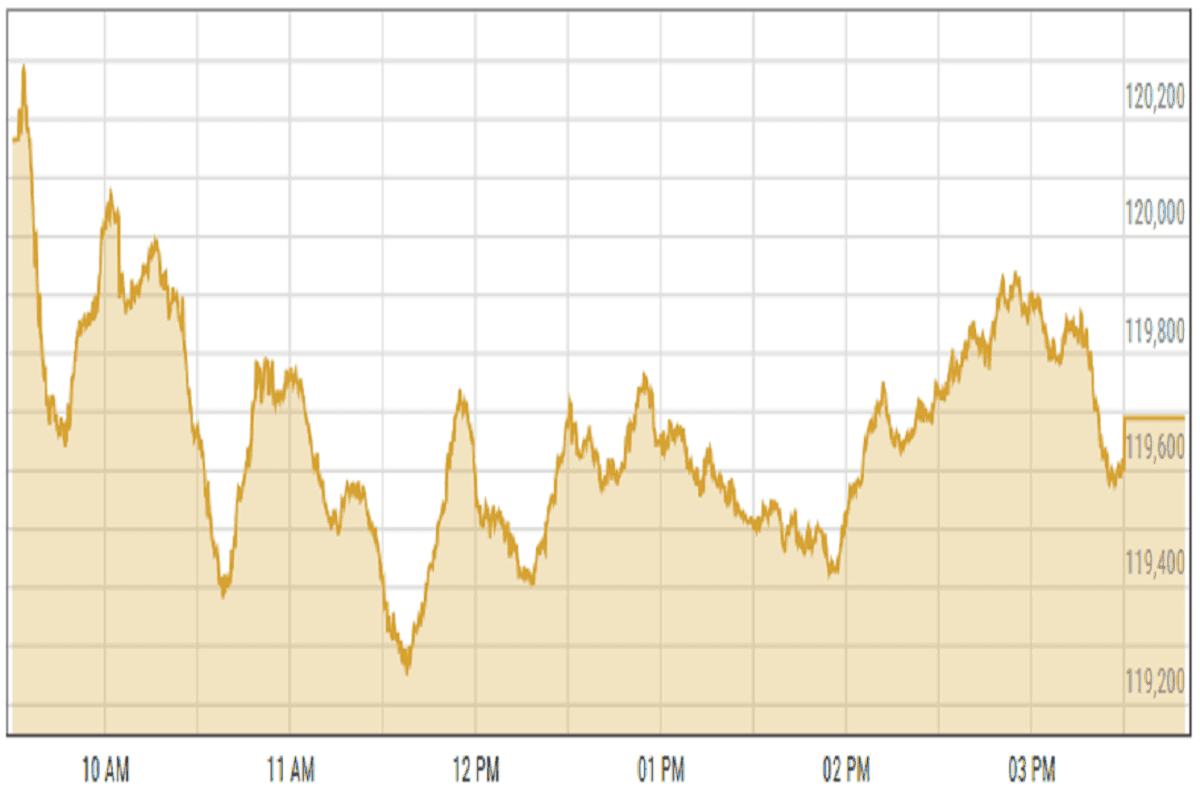

Pakistan stocks ended nearly flat on Tuesday as investors adopted a wait-and-see approach ahead of the upcoming federal budget announcement, analysts said.

"With most known factors already priced in, market participants stayed cautious," said an analyst at Ismail Iqbal Securities.

The benchmark KSE-100 index hovered close to all-time highs but remained in a consolidation phase, according to Topline Securities.

"The steady upward bias was supported by investor optimism following the release of a detailed IMF report, which offered a clearer picture of the country's macroeconomic trajectory and policy direction," the analyst added.

Positive sentiment was further bolstered by progress on resolving the circular debt issue, drawing investor interest to the energy and gas sectors.

Textile composite, oil and gas marketing companies, and power generation and distribution sectors were the top performers, collectively adding 118 points to the index.

KSE-100 index gained 0.03% or 40.49 points to close at 119,689.63 points.

Currency

US dollar steadied against PKR in the inter-bank market. Pakistani currency shed 11 paisas to close at 281.77. In the open market USD was trading at PKR 283.80.

Indian Stocks

The Indian stock market continued its range-bound trend for a second consecutive session on Monday, closing slightly lower as domestic technology stocks bore the brunt of selling pressure.

Defence stocks, which had been on an upward trajectory last week, saw some profit booking.

Meanwhile, textile stocks enjoyed strong buying interest amid an otherwise subdued market, driven by India's newly imposed restrictions on Bangladeshi exports of ready-made garments and other consumer goods through land ports. The measure aims to promote fairness and balance in bilateral trade.

BSE-100 index shed 0.16% or 42.60 points to close at 26,130.95 points.

DFM General Index gained 0.63% or 34.29 points to close at 5,489.70 points.

Crude Oil

Oil prices edged lower on Monday, pressured by Moody’s downgrade of the U.S. sovereign credit rating and economic data from China pointing to a slowdown in industrial output and retail sales.

The credit downgrade raises concerns about the U.S. economic outlook, while China’s figures suggest a challenging path ahead for recovery.

In China, the world's largest crude oil importer, official data showed industrial output growth decelerated in April, though it exceeded economists' expectations.

Last week, Beijing and Washington agreed to roll back most tariffs on each other’s goods, but the temporary truce—alongside Trump's unpredictable trade policies—continues to cloud China’s export-driven economy, which remains subject to 30% tariffs on top of existing duties.

Meanwhile, uncertainty surrounding Iran-U.S. nuclear negotiations is preventing deeper losses in oil prices.

Brent crude prices decreased by 1.36% to $64.52 per barrel.

Gold Prices

Gold prices have gone up due to concerns about the US economy and hopes for lower interest rates. Experts say investors are buying gold as a safe option after Moody’s downgraded the US credit rating, citing rising debt and deficits. Strong demand in the market has also helped push prices higher.

International gold prices decreased 1.62% to close at $ 3,242.08 per ounce. In the local market, gold prices increased PKR 4,000 to 342,500 per tola.

Comments

See what people are discussing