Pakistan’s 28 textile mills make up 21% of country’s total exports

New data show these companies exported goods worth $6.7 billion

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

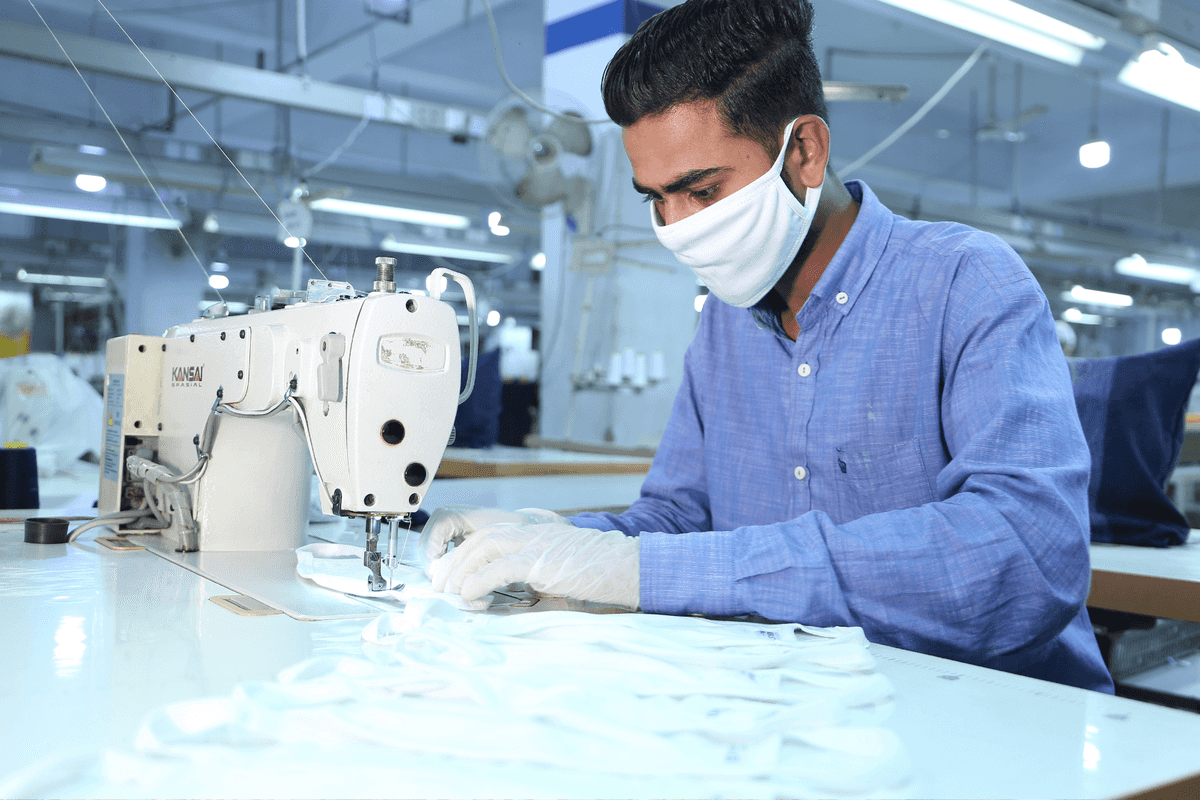

A worker stitches fabric at a textile mill in Pakistan

Shutterstock

The textile sector dominated Pakistan’s exports as 28 companies collectively generated $6.7 billion in exports — around 20.91% of the country's total exports of $32.1 billion in FY25, according to data released by the government.

Pakistan's textile and apparel exports reached $17.89 billion in FY 2024-25, making up 55.83% to total exports

The data shows a concentration of export earnings within a relatively small group of textile manufacturers, with just 10 companies responsible for $3.8 billion in shipments—representing 11.78% of national exports.

Style Textile (Pvt.) Limited was the leading exporter with $616 million in exports, followed by Interloop Limited at $560 million, and Artistic Milliners (Private) Limited at $420 million. Other major exporters include Gul Ahmed Textile Mills Limited ($381 million), Soorty Enterprises (Private) Limited ($373 million), Nishat Mills Limited ($345 million), and Artistic Garment Industries at $286 million.

Yunus Textile Mills Limited, Liberty Mills Limited, and Novatex Limited round out the top 10, with export values of $275 million, $263 million, and $263 million respectively.

Pakistan's textile sector continues to anchor the country's export economy, with these leading companies reflecting strong global demand and operational scale, an analyst told Nukta.

Pakistan's exports grew 4.7% in FY 2024-25, up from $30.7 billion the previous year, though the country continues to face a significant trade deficit of $26.3 billion as imports reached $58.4 billion.

The strong export performance is expected to gain further momentum following Prime Minister Shehbaz Sharif's announcement of measures aimed at easing financing and energy costs for exporters.

The government cut the refinance rate by 300 basis points to 4.5% from 7.5%, providing cheaper access to working capital for export-oriented manufacturers.

In addition, electricity wheeling charges—the cost of transmitting power through the national grid—were reduced by PKR 4.04 per unit to PKR 8.51 from PKR 12.55. The move is intended to lower power transmission costs for industrial and commercial consumers, offering significant relief for energy-intensive textile operations.

With Pakistan's policy rate currently at 10.5%, the refinance rate cut is expected to provide additional support to exporters and encourage investment in the sector. The premier also announced that exporters would receive blue passports valid for two years.

These measures are likely to further strengthen the competitive position of Pakistan's textile exporters, who continue to face challenges from rising energy costs, currency volatility, and shifting global demand patterns.

Impact on the stock market

The export numbers of 28 companies — including both listed and unlisted players — will have a positive impact on the equities market, the analyst added.

Strong export performance supports foreign exchange inflows, earnings stability, and dividend-paying capacity, especially in a volatile macroeconomic environment.

For investors on the Pakistan Stock Exchange, analysts said the rankings reaffirm the structural importance of listed textile exporters such as Interloop, Gul Ahmed, Nishat Mills, Liberty Mills, and Novatex.

Comments

See what people are discussing