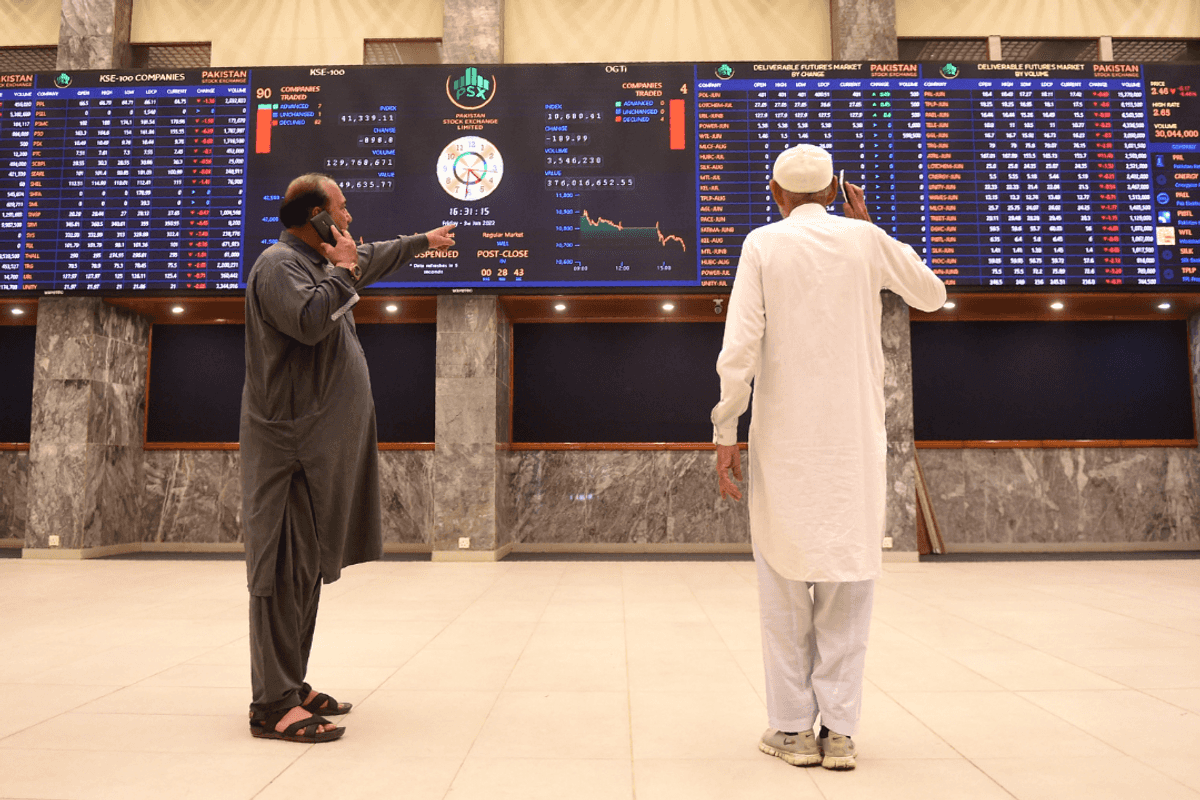

Which sectors and companies at PSX performed the best this year?

Outside the benchmark index, PIA Holding Company Ltd. B was the top-performing stock in the overall market, delivering an extraordinary gain of 2,157% in 2025

Haris Zamir

Business Editor

Experience of almost 33 years where started the journey of financial journalism from Business Recorder in 1992. From 2006 onwards attached with Television Media worked at Sun Tv, Dawn Tv, Geo Tv and Dunya Tv. During the period also worked as a stringer for Bloomberg for seven years and Dow Jones for five years. Also wrote articles for several highly acclaimed periodicals like the Newsline, Pakistan Gulf Economist and Money Matters (The News publications)

Pakistan’s equity market delivered uneven but in many cases spectacular returns in 2025, with vanaspati, financial services and woolen stocks leading sectoral gains, while select small-cap shares posted extraordinary rallies, market data showed.

Vanaspati and allied industries emerged as the best-performing sector of the year, with market capitalization surging 120%.

Investment banks, investment companies and securities firms followed closely, gaining 97%, while the woolen sector rose 88%. In contrast, synthetic and rayon stocks were among the worst performers, posting a 12% decline, while the leather and tanneries sector fell 3% during the year.

Among large-cap sectors, banks, cement and fertilizers dominated performance. Banking stocks saw market capitalization jump 85%, cement stocks gained 81% and fertilizer companies rose 57%.

Analysts said the banking sector remained in the spotlight due to a valuation catch-up, strong net interest income growth and capital gains booked by certain banks.

Cement stocks benefited from improving industry dynamics, while fertilizer sector gains were led primarily by Fauji Fertilizer Company.

The overall market calculations were adjusted to reflect several structural changes during the year, including new listings such as Zarea Limited, Barkat Frisian Agro, Image REIT, Pakistan Credit Rating Agency and Nets International, which entered the market through initial public offerings.

Additional listings followed corporate restructuring, including Engro Holding, DH Partners and Ghani ChemWorld. Adjustments were also made for Agritech’s sector reclassification from chemicals to fertilizers, the delisting of Engro Corp and the issuance of right shares by some companies.

Top-performing companies

Within the KSE-100 index, S.S. Oil Mills Ltd. emerged as the top-performing stock of 2025, with its share price soaring 416%. The rally was driven largely by higher sales after the removal of restrictions on the import of genetically modified seeds and improved availability of GMO seeds in international markets.

The Bank of Punjab followed, with its shares climbing 284% amid a strong turnaround supported by robust net interest income growth and the resumption of dividends. The bank reported a profit of PKR 11.6 billion, or earnings per share of PKR 3.52, in the first nine months of 2025, up 41% year-on-year from PKR 8.2 billion, or EPS of PKR 2.53.

National Bank of Pakistan posted a gain of 280% during the year, underpinned by strong net interest income growth and healthy capital gains on its investment portfolio. The bank’s profitability rose nearly 18-fold year-on-year in the first nine months of 2025, after the previous year’s results were weighed down by the recognition of pension liabilities.

Askari Bank shares advanced 181%, driven by higher earnings, progress toward Shariah conversion and the initiation of quarterly dividends. The bank announced a dividend of PKR 3.25 per share in the first nine months of 2025, compared with no payout in the same period last year.

Kohinoor Textile Mills Ltd. gained 175%, supported by the strong performance of its key subsidiaries, Maple Leaf Cement Company and Maple Leaf Capital. Investor sentiment was further boosted after a group subsidiary announced strategic plans to acquire Pioneer Cement Company, signaling potential future growth and operational synergies.

Outside the benchmark index, PIA Holding Company Ltd. B was the top-performing stock in the overall market, delivering an extraordinary gain of 2,157% in 2025. The company was created by the government to house certain assets and liabilities not directly linked to Pakistan International Airlines’ commercial operations. The stock, converted from PIA’s former Class B shares, is highly illiquid, with a free float of just 2,276 shares, or 0.18%.

Beco Steels posted a return of 704%, reflecting strong investor interest in the steel manufacturer. Bunnys Ltd. climbed 703% after commencing commercial operations of a new bread production line in Islamabad, adding capacity equivalent to 25% of its existing Lahore facility.

Baba Farid Sugar Mills surged 543%, benefiting from investor optimism around its sugar and by-products business, including molasses, filter cake and bagasse.

International Knitwear Ltd. rose 540%, driven by demand for its knitted apparel products.

Comments

See what people are discussing