How deregulation of prices could transform Pakistan's petroleum sector

Government plans to fully deregulate the petroleum market by 2027

Javed Mirza

Correspondent

Javed Iqbal Mirza is an experienced journalist with over a decade of expertise in business reporting, news analysis, and investigative journalism. His work spans breaking news, editorial pieces, and in-depth interviews.

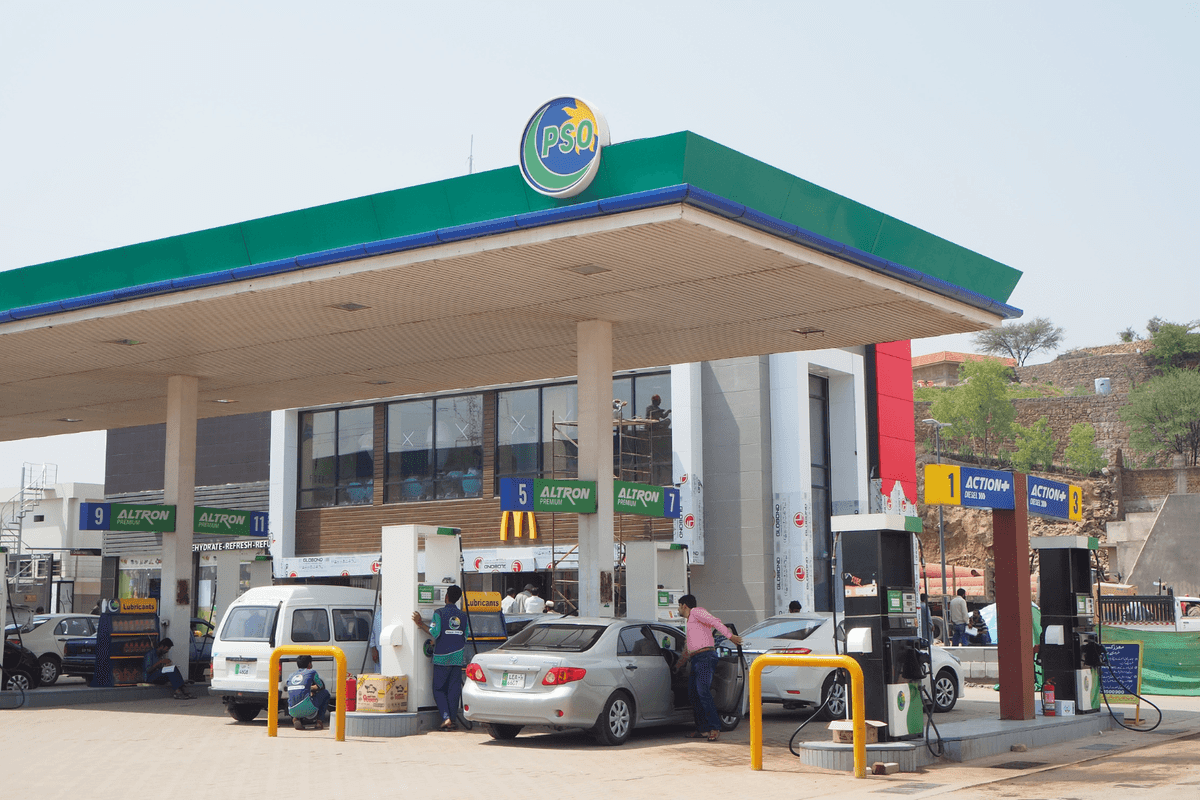

An analysis by Institute of Cost and Management Accountants (ICMA), covering 23 months of petrol price data from November 2022 to September 2024, suggests that deregulating Pakistan’s petroleum sector could lead to reduced prices.

ICMA supports the government’s proposal to deregulate the sector under OGRA’s supervision. Oil Marketing Companies (OMCs) may gradually gain the authority to set petroleum prices independently.

This initiative was previously delayed due to concerns about vulnerable populations.

OGRA has announced that petrol prices would be deregulated in three phases after consulting all stakeholders. The phases are: deregulation of ex-refinery price and OMC margin with oil supply chain management, deregulation of dealers’ margin, and deregulation of Inland Freight Equalization Margin (IFEM).

By 2027, the government plans to fully deregulate the petroleum market, following technical upgrades to oil refineries in 2026.

Limited price-setting role

According to ICMA, regulated petroleum prices widen the fiscal deficit by restraining government revenue. Frequent price changes damage the government’s reputation while deregulation shifts responsibility away from it. More frequent price revisions raise political costs.

Deregulation could help reduce these pressures and show the government’s limited role in price-setting, indicating that prices are determined by the market. Stable oil prices indicate economic stability. Deregulation can improve this by reflecting market conditions.

The analysis shows that deregulation could lower petrol prices, benefiting the economy by reducing cost-push inflation, attracting investment, and lowering unemployment.

Deregulation will lead to competitive pricing driven by market forces and the potential for private sector investment. It can lead to lower prices near refineries and ports, reflect global market conditions, and increase supply from new entrants.

Additionally, deregulation could positively impact the economy by creating new job openings and opportunities to stock fuel products, increasing efficiency and innovation.

Potential risks

However, exchange rate volatility would impact OMC costs, while frequent supply disruptions, and illegal profiteering by refineries and marketing companies pose a risk of hyperinflation and rising costs of essential goods amid inadequate government oversight to prevent cartelization.

Moreover, the loss of control in a vital industry could lead to national security concerns, insufficient infrastructure or storage capacity, and increased unemployment.

ICMA advocates the complete deregulation of the petroleum sector, supported by the forecasting analysis of petrol price deregulation. However, this support depends on the government implementing specific safeguards before moving forward.

Countries like the United States, Canada, the United Kingdom, Australia, New Zealand, and Germany have successfully deregulated oil pricing, allowing market forces to set prices without direct government control. They still maintain regulatory frameworks to ensure fair competition and consumer protection.

It’s vital to involve all stakeholders, such as OMCs, petroleum dealers, and the Oil Companies Advisory Committee (OCAC) in developing a comprehensive deregulation policy. This collaboration will help ensure a smooth transition to achieve more stabilized outcomes.

Comments

See what people are discussing