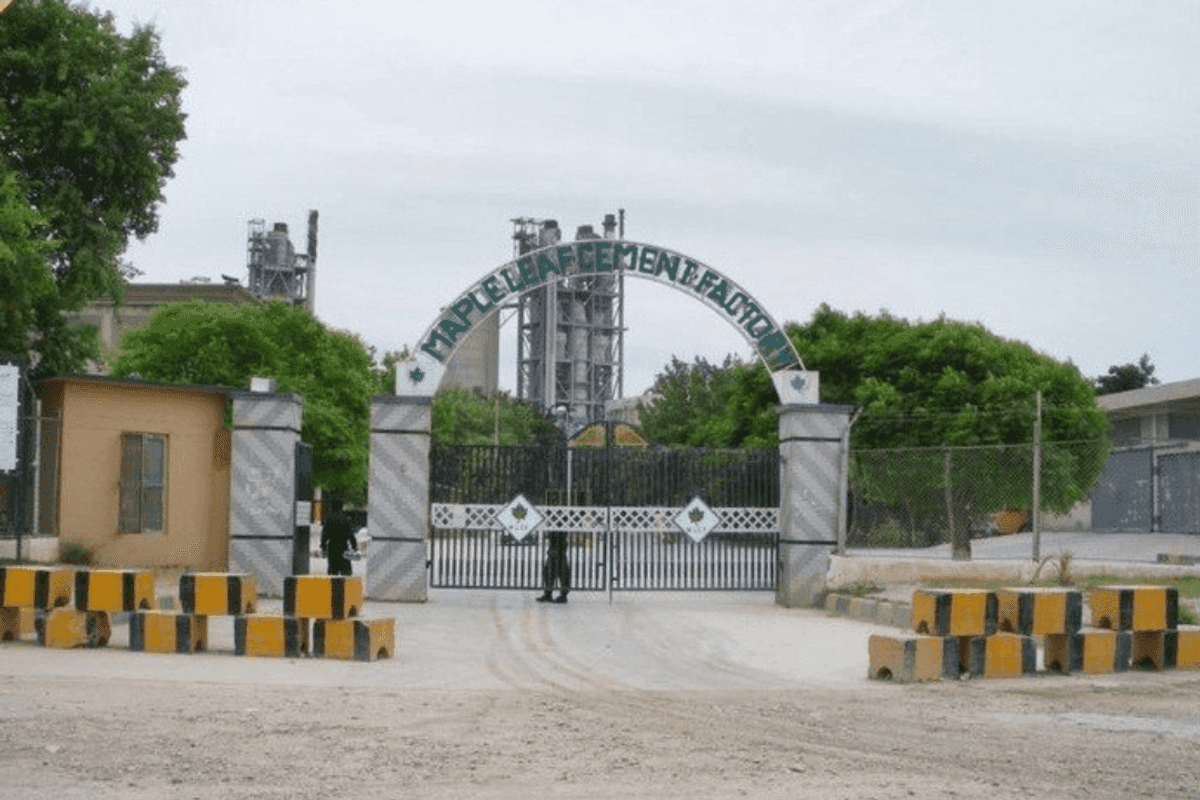

Pakistan regulator okays merger of Maple Leaf Cement and Pioneer Cement

Maple Leaf Cement already holds an 18.6% stake in its competitor

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

The merger will make Maple Leaf Cement the second-largest cement producer in the country’s northern region

Maple Leaf Cement

The Competition Commission of Pakistan (CCP) has approved the proposed acquisition of Pioneer Cement Limited by Maple Leaf Cement Factory Limited (MLCF) after concluding that the transaction will not lead to the creation or strengthening of a dominant position in Pakistan’s cement market.

MLCF is a major cement producer of Pakistan, and the acquisition of Pioneer Cement Limited will make it the second-largest cement producer in the country’s northern region.

MLCF, along with its associated company Maple Leaf Capital Ltd., already holds an 18.6% stake in the company. The Habibullah Group currently controls about 58% of PIOC through multiple entities, with the remainder held by public shareholders.

MLCF produces grey and white cement and Pioneer Cement operating solely in the grey cement market.

The acquisition would expand Maple Leaf’s production capacity from 8 million tons to 13.02 million tons, boosting its regional market share in northern Pakistan from 12% to 19%, according to a research note by Topline Securities.

According to the CCP order, MLCF submitted its pre-merger application in November for the purchase of additional shareholding in Pioneer Cement. Both companies are publicly listed and operate within Pakistan’s cement sector.

Following a review, the CCP assessed the transaction’s competitive implications, focusing on whether increased market concentration could reduce effective competition. The regulator determined that despite being a horizontal merger involving two producers in the same market, the combined market share of the merged entity would remain moderate.

The CCP noted that several large, established cement manufacturers would continue to exert competitive pressure, preventing the merged entity from behaving independently of market forces. It also found no concerns of unilateral or coordinated effects, as multiple sizeable competitors would remain active in the market. Furthermore, the transaction did not include any vertical elements that could create input or distribution constraints.

Overall, the Commission concluded that the market would continue to function competitively post-merger. It authorized the transaction under Section 31(1)(d)(i) of the Competition Act, stating that the acquisition does not substantially lessen competition in the national cement market.

Comments

See what people are discussing