Moody's upgrades ratings for 11 Saudi banks amid stronger operating environment

Moody's upgraded 11 Saudi banks, citing an improved operating environment and enhanced government backing.

Robust credit growth driven by mega-projects is strengthening asset quality and profitability in Saudi banks.

Shutterstock

Moody's Investors Service announced on Thursday an upgrade to the long-term deposit ratings and baseline credit assessments (BCAs) of 11 Saudi banks under its coverage.

The decision follows Moody's recent upgrade of Saudi Arabia’s sovereign credit rating to "Aa3" from "A1" with a stable outlook, reflecting the Kingdom’s improving economic fundamentals.

The rating agency attributed its decision to two primary factors: the strengthening operating environment in Saudi Arabia and the government’s increased capacity to support the banking sector if needed.

The banks that benefited from the upgrade include:

- Saudi National Bank (SNB)

- Al Rajhi Bank

- Riyad Bank

- Saudi Awwal Bank (SAB)

- Banque Saudi Fransi

- Alinma Bank

- Arab National Bank

- Bank Albilad

- The Saudi Investment Bank

- Bank Aljazira

- Gulf International Bank (GIB) – Saudi Arabia

Moody's also revised the outlook on the long-term deposit ratings for all banks from positive to stable, with the exception of Al Rajhi Bank, whose outlook remains stable.

The agency highlighted that Saudi banks are benefiting from improving credit conditions driven by the Kingdom’s ongoing economic diversification efforts. Moody's expects credit growth in the banking sector to remain robust, particularly for high-quality borrowers involved in the execution of mega-projects, which will enhance asset quality and profitability across the system.

Moody's stated that its decision to upgrade the BCAs of SNB, SAB, and GIB reflects improved solvency indicators, bolstered by the positive trends in Saudi Arabia's macroeconomic strength, which the agency upgraded from "Moderate+" to "Strong-". The agency affirmed that these enhancements will support the already solid credit fundamentals of Saudi banks.

The sovereign credit upgrade to "Aa3" indicates a stronger capacity for the Saudi government to support its banking sector. Moody's confirmed that all rated banks benefit from "very high" levels of government support. Additionally, it raised the likelihood of support for Alinma Bank, Bank Albilad, The Saudi Investment Bank, and Bank Aljazira from "high" to "very high."

This reassessment underscores the vital role the banking sector plays in advancing Saudi Arabia’s economic diversification program, which aims to reduce the country’s reliance on oil markets over time. Moody's emphasized that the stability and resilience of the banking system are key to bolstering investor confidence and attracting both domestic and international private investments, a critical element of the government’s Vision 2030 strategy.

This announcement follows Moody’s upgrade of six government-related entities to "Aa3" from "A1," including:

- The Public Investment Fund (PIF)

- Saudi Aramco

- SABIC

- Saudi Electricity Company

- Saudi Power Procurement Company

- Saudi Telecom Company (STC)

Popular

Spotlight

More from Business

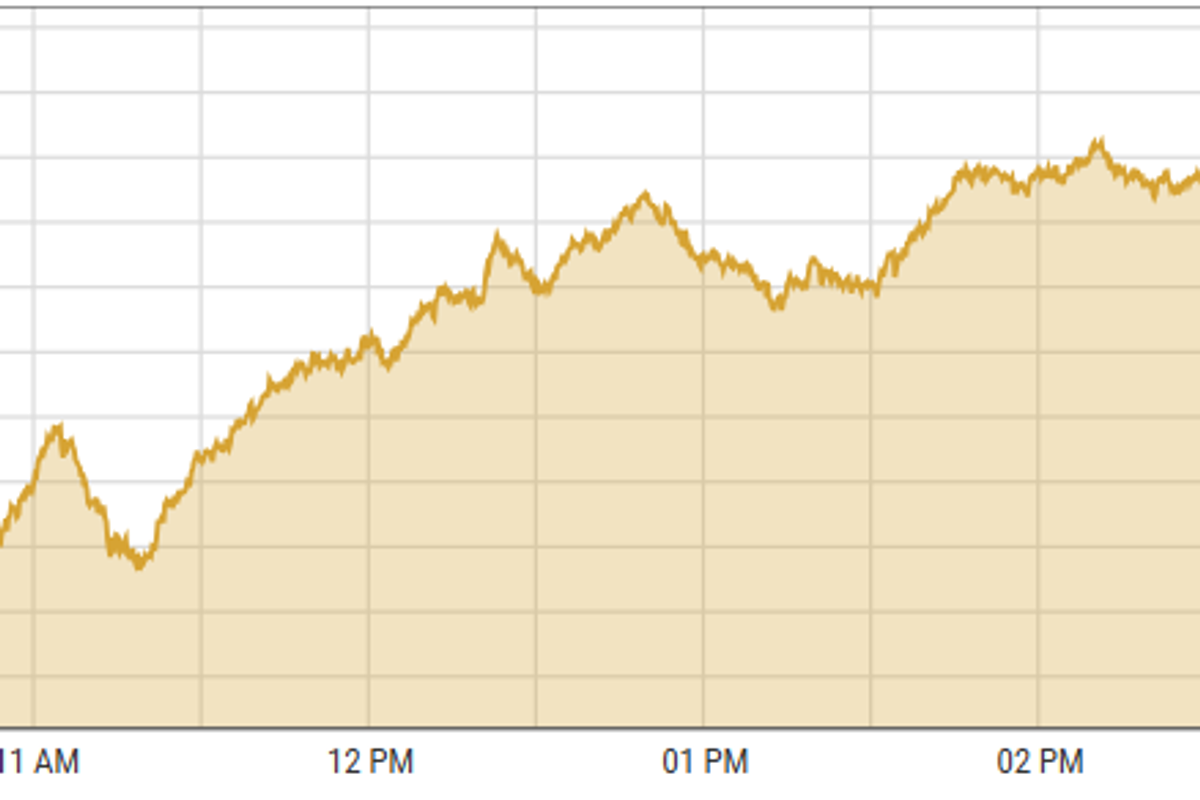

Trading activity at Pakistan Stock Exchange reaches 18-year high

KSE-100 index gained 1.24% to close at 104,559 points

More from World

US lawmakers back Covid Chinese lab leak theory after two-year probe

U.S. federal agencies, the World Health Organization and scientists across the planet have arrived at different conclusions about the most likely origin of Covid-19, and no consensus has emerged

Comments

See what people are discussing