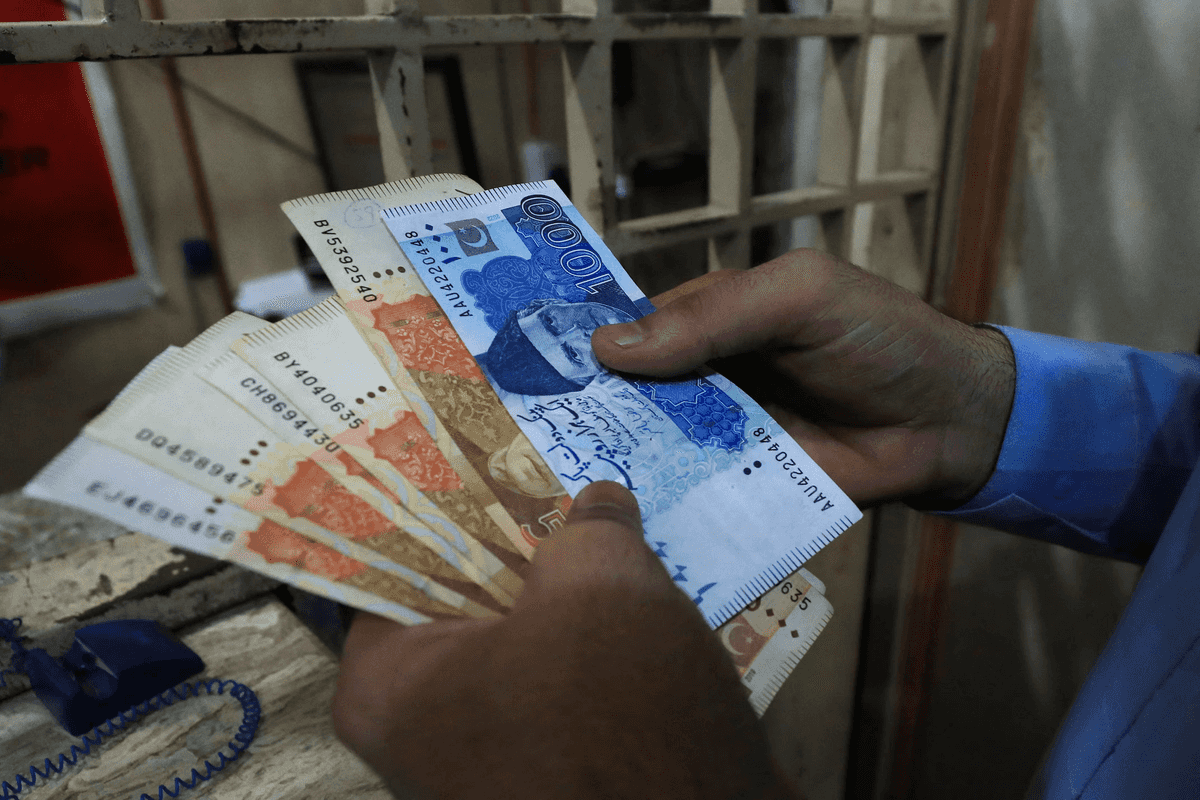

Cash preference stays stubbornly high as Pakistan's currency in circulation hits PKR 10.97T

Analysts say slow deposit growth and informality continue to shape liquidity patterns

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

Currency in circulation in Pakistan climbed to PKR 10.97 trillion as of Nov. 14, marking an 18.9% increase from a year earlier, according to State Bank of Pakistan (SBP) data released Monday.

The figure also rose 0.2% week-on-week and 1.5% from the previous month, underscoring the economy’s growing reliance on physical cash.

Bank deposits reached PKR 28.97 trillion, edging up 0.1% month-on-month and 9.8% year-on-year.

Combined, cash in circulation and deposits pushed Pakistan’s broad money supply (M2) to PKR 39.98 trillion, up 12.2% from last year and 0.5% from October.

What 'currency in circulation' means

Currency in circulation refers to all physical banknotes and coins held by the public, that is, cash outside the banking system.

It excludes the money kept in bank vaults or digital balances.

Higher currency in circulation often indicates stronger demand for cash, limited trust in formal banking or rising informal economic activity.

Analysts said the latest expansion in the money supply reflects a measured increase in liquidity even as the SBP continues its monetary easing cycle.

“Growth remains deposit-driven, while currency in circulation rising 1.5% month-on-month keeps the CiC-to-M2 ratio near 28%, highlighting persistent cash preference and informality,” a leading market observer said.

He said that deposit growth “is improving but still lagging,” suggesting that lower interest rates are transmitting gradually into the banking system.

“Overall, monetary expansion is moderate, not inflationary, and broadly aligned with nominal GDP, signaling a stable liquidity backdrop but continued structural reliance on cash in the economy,” he added.

SBP data also showed government borrowing for budgetary support from the banking system rose sharply to PKR 32.97 trillion, compared with PKR 28.26 trillion a year earlier.

In contrast, private-sector credit slipped to PKR 9.89 trillion from PKR 9.96 trillion, despite an improving economy and more supportive financial conditions.

Comments

See what people are discussing