Improved economic indicators could lead to 'another policy rate cut'

AKD Securities says lower inflation would support further cuts in interest rate

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

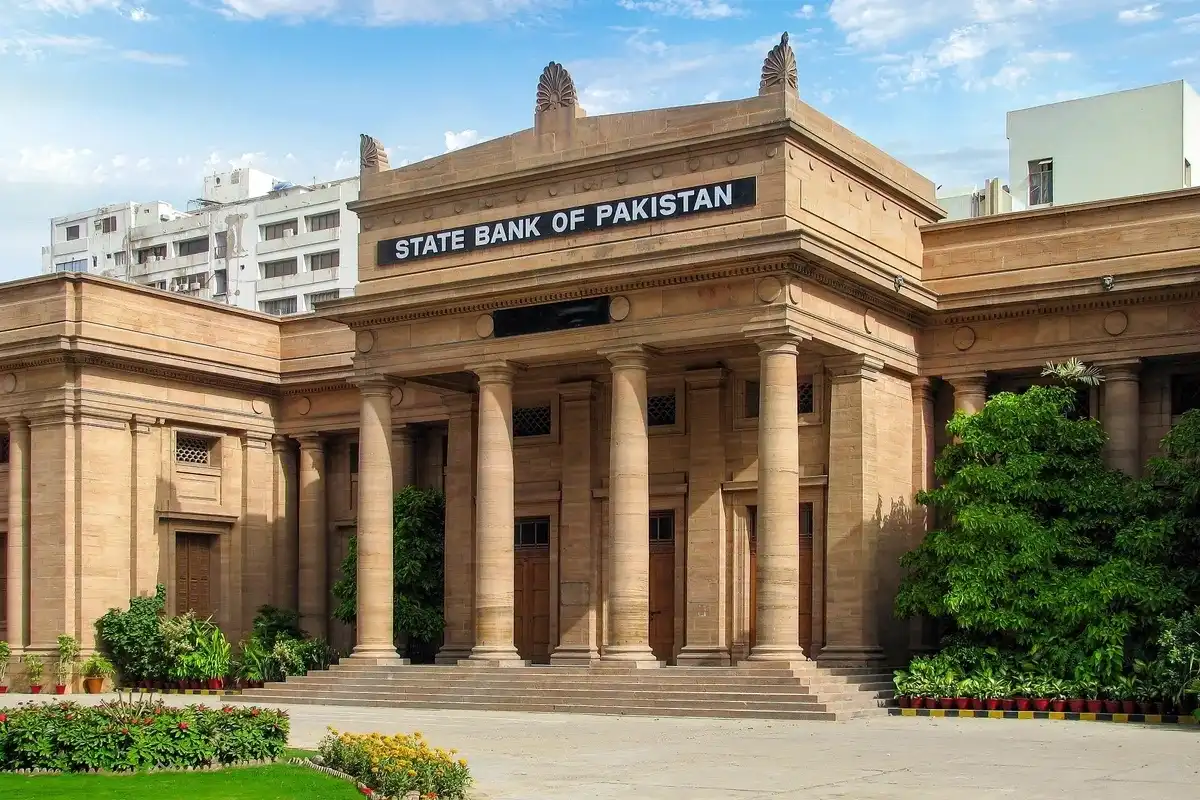

Pakistan’s strong external account position and prudent fiscal management under the International Monetary Fund loan program could result in another interest rate cut, according to a report by AKD Securities.

The brokerage said falling inflation toward the lower end of the State Bank of Pakistan’s target range would support further rate cuts, while robust remittances and improved access to external commercial financing—following recent rating upgrades by S&P and Moody’s—would help finance higher imports as economic activity gains momentum.

“Despite the easing cycle, we expect the SBP to maintain positive real interest rates of around 4% to 5% to prevent another boom-bust cycle,” AKD Securities said.

In December, Pakistan's central bank cut the key policy rate by 50 basis points to 10.5%, bringing the policy rate to the lowest level since March 2022.

Real rates to remain elevated

The report said higher positive real interest rates are likely to become the norm, with forward 12-month real rates projected at 4% to 5%. That level is significantly above Pakistan’s long-term averages, which stand at about 77 basis points over 20 years and negative 4 basis points over the past decade.

AKD Securities expects inflation to average 6.3% in fiscal year 2026 and 4.0% in fiscal 2027, supported by improved food supplies, subdued international oil prices and smaller periodic energy price adjustments. However, it warned that fiscal slippages, global energy shocks and climate-related disruptions remain key risks to the outlook.

Money supply and credit growth

Money supply growth is expected to slow from FY26 but remain in double digits, reflecting lower government borrowing needs amid a narrower fiscal deficit, the report said. At the same time, private sector credit is forecast to expand, led by borrowing from textiles, wholesale and retail trade, chemicals and steel.

Consumer financing is also expected to pick up, particularly in the automobile sector, supported by easing financial conditions, improved sentiment and macroeconomic stability.

External account outlook

AKD Securities said Pakistan’s external account is likely to remain broadly balanced, underpinned by strong remittances and faster growth in services exports amid subdued commodity prices. However, it expects exports to decline in FY26 and food imports to rise following flood-related disruptions to agricultural output.

The current account is forecast to post a surplus of about $99 million in FY26 before turning into a deficit in subsequent years as import growth outpaces gains in remittances and exports. The report projects foreign exchange reserves held by the central bank to approach $25 billion by FY28, alongside a reduction in forward and swap liabilities.

Growth to improve gradually

Economic growth is expected to remain modest but improve steadily, supported by stabilization, lower commodity prices and gains from structural reforms. AKD Securities forecasts gross domestic product growth of 4.0% in FY26 and 4.1% in FY27, driven by stronger performance in agriculture and services and continued industrial expansion.

Inflation outlook and risks

Inflation is expected to remain under control due to relatively tight monetary and fiscal policies and a stable currency, though supply-side disruptions from abnormal monsoons and flooding could push inflation above the central bank’s target range toward the end of FY26.

The report estimates inflation averaged 4.5% in FY25, an eight-year low, down sharply from 23.4% in FY24, reflecting restrained domestic demand and improved supply conditions.

AKD Securities said inflation could remain elevated until June 2026 and may breach the SBP’s upper target band of 7% in the fourth quarter of FY26 due to base effects. It is then expected to fall below the target range in FY27, driven by disinflation in major categories such as food, housing, clothing, restaurants and transport.

Still, the brokerage cautioned that the inflation outlook remains vulnerable to geopolitical tensions, renewed food price pressures, uncertainty over administered energy prices and any additional fiscal measures.

Comments

See what people are discussing